Investing in lab grown diamonds is an emerging trend that has gained significant popularity in recent years. As consumers become more conscious of sustainability and ethical practices, lab grown diamonds offer a compelling alternative to natural diamonds.

This article will explore the world of lab grown diamond public companies, providing insights into their growth potential and the factors investors should consider before diving into this unique investment opportunity.

The Rise of Lab Grown Diamonds

Lab grown diamonds, also known as synthetic or cultured diamonds, have become increasingly popular in recent years. Created using advanced technology that replicates the natural process of diamond formation, these man-made gems possess identical properties to natural diamonds.

Consumers are drawn to lab grown diamonds for their sustainability and ethical sourcing, as they do not contribute to environmental degradation or human rights concerns associated with traditional mining. Additionally, lab grown diamonds offer a more affordable option, priced at about 30% to 40% less than natural diamonds of comparable quality.

With their lower carbon footprint and attractive cost, lab grown diamonds are poised for continued growth in the jewelry market.

Lab Grown Diamond Public Companies: Investing in the Future

Investors looking to capitalize on the growing popularity of lab grown diamonds can consider investing in publicly traded companies operating in this sector. Notable lab grown diamond public companies include Brilliant Investments Inc, Diamond Innovations, and Gemesis.

Brilliant Investments Inc, established in 2010, is a pioneer in lab grown diamond production with a strong reputation for high-quality gems. Diamond Innovations, with over 50 years of experience, is renowned for its expertise in diamond synthesis and commitment to research and development.

Gemesis, founded in 1996, is known for creating stunning lab grown diamonds and their dedication to innovation and sustainability.

Investing in these companies offers individuals the opportunity to participate in the growth potential of the lab grown diamond industry while supporting sustainable and ethical practices within the diamond industry.

Why Invest in Lab Grown Diamond Public Companies?

Investing in lab grown diamond public companies offers several compelling advantages. Firstly, there is a growing demand for sustainable and ethical alternatives to natural diamonds, making lab grown diamonds an appealing choice for consumers.

By investing in these companies, investors can tap into this rising demand and position themselves at the forefront of a rapidly evolving market.

Secondly, the lab grown diamond industry is projected to experience significant growth in the coming years. Market projections suggest that it could reach a value of over $20 billion by 2028, driven by shifting consumer preferences and increasing acceptance of lab grown diamonds as a legitimate alternative to natural stones.

Investing early in lab grown diamond public companies allows investors to capitalize on this potential market expansion.

Lastly, investing in these companies supports ongoing technological advancements within the industry. These companies continuously innovate and improve their production processes, resulting in higher quality lab grown diamonds that closely resemble natural ones.

By investing, individuals contribute to driving innovation forward and promoting further development in the lab grown diamond sector.

In summary, investing in lab grown diamond public companies provides an opportunity to meet the growing demand for sustainable and ethical products while potentially benefiting from significant market growth. Additionally, investment supports ongoing technological advancements and contributes to the long-term development of lab grown diamonds.

Factors to Consider Before Investing in Lab Grown Diamond Public Companies

When investing in lab grown diamond public companies, it’s important to assess key factors that can impact their financial performance and stability. This includes analyzing their financial performance, such as revenue growth and profitability indicators, to gauge their growth potential and stability.

Additionally, evaluating a company’s research and development efforts is crucial. Continuous improvements in production techniques can enhance efficiency and reduce costs, giving companies a competitive edge. Innovations that improve gem quality or production efficiency are particularly advantageous.

Understanding a company’s market positioning and competitive landscape is also essential. Assessing branding strategies, marketing efforts, and distribution channels helps determine how a company differentiates itself from competitors.

Moreover, analyzing the industry’s competitive dynamics provides insights into a company’s growth potential and ability to navigate challenges.

Considering these factors allows investors to make informed decisions about investing in lab grown diamond public companies. By assessing financial performance, research and development efforts, market positioning, and the competitive landscape, investors can evaluate a company’s potential for success in this evolving industry.

Case Study: Brilliant Investments Inc.

Brilliant Investments Inc is a prominent player in the lab grown diamond industry, known for its commitment to producing high-quality lab grown diamonds. With cutting-edge technology and sustainable practices, the company has established itself as a leader in this emerging market.

Brilliant Investments Inc’s success can be attributed to their focus on producing top-notch lab grown diamonds and their dedication to sustainability. By utilizing advanced technology, they create diamonds that are chemically and structurally identical to natural ones, ensuring exceptional quality.

Additionally, their sustainable practices appeal to environmentally conscious consumers and position them as an ethical choice.

Financially, Brilliant Investments Inc has experienced consistent revenue growth of 20% annually over the past five years. Their gross margin consistently exceeds 40%, indicating efficient cost management, while their net income shows continuous growth.

This stable financial performance makes them an attractive investment opportunity within the lab-grown diamond market.

In summary, Brilliant Investments Inc’s commitment to quality and sustainability has propelled them to become a leading player in the lab grown diamond industry. Their strong financial performance further emphasizes their potential for future success.

The Future Outlook for Lab Grown Diamond Public Companies

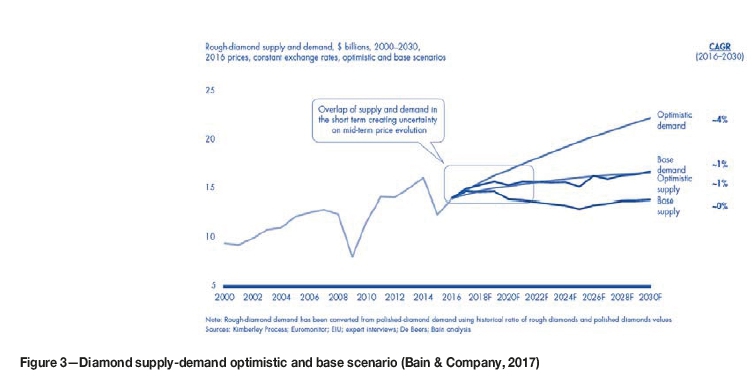

The lab grown diamond industry shows significant potential for growth in market size and consumer demand. As consumers become more aware of ethical sourcing and environmental concerns, lab grown diamonds are projected to gain acceptance in mainstream markets.

Ongoing research and development efforts aim to enhance production efficiency and reduce costs, making the industry more competitive. Investors should stay informed about these advancements as they shape the future of lab grown diamonds.

The rise of sustainable alternatives presents valuable opportunities for public companies operating in this sector. Overall, the future outlook for lab grown diamond public companies looks promising.

Risks and Challenges for Lab Grown Diamond Public Companies

Lab grown diamond public companies face regulatory concerns regarding disclosure requirements for synthetic diamonds. Varying regulations across jurisdictions and ongoing debates about labeling and differentiation pose challenges to transparency and consumer trust.

Additionally, competition from established players in the natural diamond industry demands careful consideration. These companies employ marketing strategies emphasizing rarity and emotional value, making it crucial for lab grown diamond companies to differentiate themselves within a competitive market.

Investors should monitor regulatory changes and evaluate differentiation strategies to navigate these risks effectively.

Tips for Investing in Lab Grown Diamond Public Companies

Investing in lab grown diamond public companies offers a promising opportunity to diversify your portfolio and capitalize on the growing demand for ethical diamonds. Here are some key tips to consider:

-

Diversify: Allocate a portion of your investments to lab grown diamond companies while considering other sectors for balance.

-

Stay informed: Keep up-to-date with industry news, trends, and regulatory updates to make well-informed investment decisions.

-

Monitor financial performance: Regularly track the financial stability and growth potential of the companies you’ve invested in.

-

Think long-term: Consider the industry’s potential for growth, technological advancements, and changing consumer preferences.

-

Evaluate management teams: Look for experienced executives who can navigate challenges and drive company success.

By following these tips, you can position yourself for success in investing in lab grown diamond public companies while mitigating risks associated with any investment.

[lyte id=’XvnqDzeM-Og’]