Investing in precious metals has long been a popular choice for those looking to diversify their portfolios and protect their wealth. While gold and platinum often steal the spotlight, there is another type of silver that holds a special allure for investors – junk silver.

In this article, we will delve into the fascinating world of junk silver, exploring its history, value, collecting and investing strategies, as well as the benefits and risks associated with this unique form of investment.

What is Junk Silver?

Junk silver, despite its seemingly derogatory name, has a fascinating history that dates back to World War II. During this time, governments began debasing their currency by reducing the amount of precious metal content in coins. As a result, older coins made from 90% silver became less desirable due to their lower intrinsic value.

These coins were often referred to as “junk” because they were no longer considered legal tender or used in everyday transactions.

However, over time, collectors and investors recognized that these so-called “junk” coins still held significant value due to their high silver content. This realization sparked the evolution of junk silver from being dismissed as worthless to becoming highly sought-after by those who understood its true worth.

To understand what exactly constitutes junk silver, it’s important to grasp its composition and key characteristics. Junk silver refers specifically to pre-1965 United States dimes, quarters, half dollars, and certain dollar coins that contain 90% silver content.

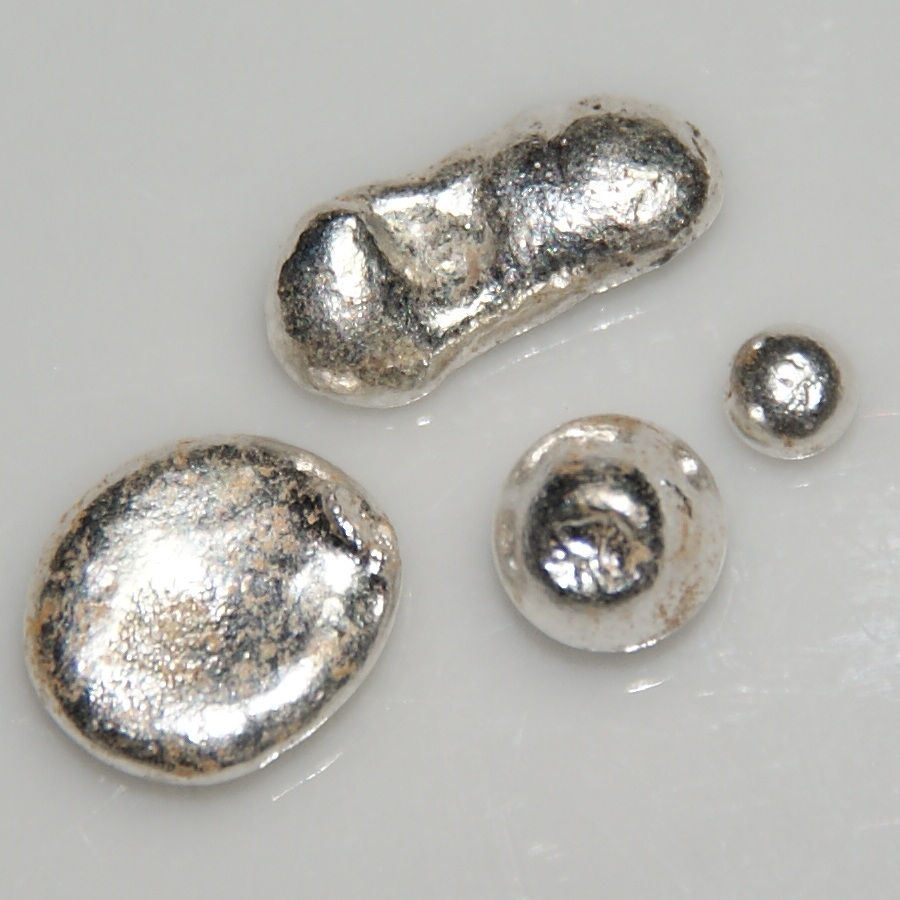

Junk silver coins are composed of 90% pure silver alloyed with copper for added durability. This specific composition gives them a unique weight and appearance compared to other forms of silver. When identifying junk silver coins, there are a few key characteristics to look out for.

Firstly, these coins will typically have a distinct dull-gray appearance due to the copper alloy content. Secondly, they will bear no mint marks as these were discontinued after 1964. Lastly, junk silver coins often feature iconic designs such as the Mercury dime or the Walking Liberty half dollar.

The Value of Junk Silver

Junk silver coins hold value beyond their historical significance and collectability. They contain 90% pure silver, approximately 0.715 ounces per dollar face value. Calculating their melt value involves considering face value, weight, and the current spot price of silver.

Compared to bullion bars or numismatic coins, junk silver offers a lower-cost opportunity to invest in physical precious metals. While numismatic coins may have additional collector’s value due to rarity or condition, they often come with higher premiums.

When investing in junk silver, it’s important to differentiate between numismatic and face values. Numismatic value is influenced by condition, historical attributes, and collector demand. Face value represents the legal tender denomination assigned to the coin.

Understanding the factors influencing numismatic value can help investors make informed decisions about junk silver coins’ worth. These factors include overall condition, unique historical attributes, and collector demand for specific series or variations.

In summary, junk silver holds intrinsic worth derived from its metal content. Differentiating between numismatic and face values allows for better investment decisions. Factors like condition, historical attributes, and collector demand affect the numismatic value of junk silver coins.

Collecting and Investing in Junk Silver Coins

Collecting and investing in junk silver coins can be a rewarding pursuit. To ensure the authenticity of your collection, it’s important to familiarize yourself with common designs and mint marks found on these coins. Popular designs like the Mercury dime and Walking Liberty half dollar hold historical meaning and add value to your collection.

Mint marks indicate the coin’s origin and potential rarity. Building a diverse collection involves exploring different denominations, such as dimes, quarters, half dollars, and certain dollar coins. Strategic purchasing methods can maximize the value of your collection by focusing on specific mint years or designs with historical significance.

With careful selection, you can create a valuable and varied junk silver coin collection.

The Benefits and Risks of Investing in Junk Silver

Investing in junk silver offers advantages like portability and easy storage. Unlike other physical assets, junk silver coins are compact, making them convenient for diversifying investments while maintaining flexibility. They also serve as a hedge against economic uncertainty and inflation. However, there are risks to consider.

The price of silver is subject to market volatility and fluctuations over time. Understanding factors that influence silver prices is crucial for successful investing in junk silver. Additionally, there is a risk of encountering counterfeit or altered coins.

To mitigate this risk, investors should be cautious when purchasing and ensure they’re dealing with trusted sources.

Despite these risks, investing in junk silver can be a beneficial strategy due to its portability, potential protection against economic downturns, and historical value retention. By staying informed and vigilant about market trends and authenticity, investors can make informed decisions in the world of junk silver investment.

Selling Junk Silver Coins

Selling junk silver coins requires careful consideration. Firstly, identify potential buyers and platforms, such as local coin shops and online marketplaces. While local shops offer convenience, online platforms provide wider reach and potentially better prices.

Secondly, factors like current market conditions and the condition/rarity of your coins impact their value. Understanding these aspects helps determine the opportune time to sell and attract potential buyers willing to pay a premium for rare or historically significant coins.

By considering these factors, you can maximize the value of your collection during the selling process.

Conclusion: The Timeless Appeal of Junk Silver

Junk silver coins have transcended their initial “junk” label to become valuable assets sought after by collectors and investors. Their enduring value, historical significance, and tangible nature make them a timeless investment choice.

Investing in junk silver offers a unique opportunity to diversify portfolios and delve into the world of precious metals. Understanding the coins’ history, value, collecting strategies, and associated risks is crucial for success in this captivating realm.

Despite market volatility, junk silver’s intrinsic value remains resilient. Its tangible connection to the past and its physical presence provide stability and security in an ever-changing economic landscape.

[lyte id=’YFeH0ZsLwTY’]