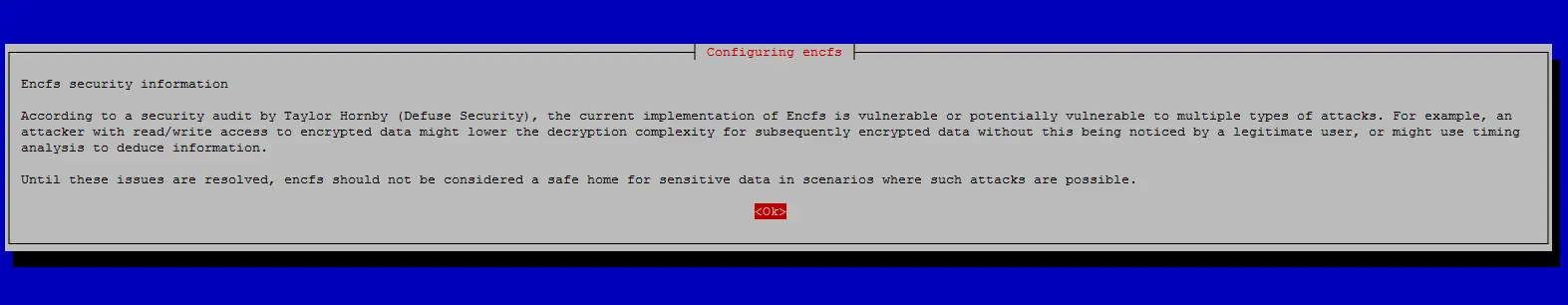

In today’s digital age, cyber attacks pose a growing threat to individuals and businesses. From data breaches to ransomware attacks, the risk of having personal and financial information compromised is ever-present. These attacks can have devastating consequences, including financial loss and reputational damage.

To combat this escalating threat, proactive measures such as investing in robust cybersecurity measures and promoting collaboration between public and private sectors are essential. By prioritizing security and working together, we can protect ourselves against these evolving threats.

Importance of IT Security in Safeguarding Personal and Financial Information

With the rise in cyber attacks, robust IT security measures are crucial for safeguarding personal and financial information. IT security plays a vital role in protecting computer systems, networks, and data from unauthorized access or damage.

By investing in IT security, individuals and businesses can protect themselves from potential cyber threats while supporting innovative companies developing cutting-edge solutions. Understanding the importance of IT security also presents lucrative investment opportunities within the growing market.

Prioritizing strong cybersecurity measures is essential for maintaining data privacy and staying ahead of evolving threats.

Definition and Explanation of ETFs (Exchange-Traded Funds)

Exchange-traded funds (ETFs) are investment funds that trade on stock exchanges, similar to individual stocks. They hold a diverse range of assets such as stocks, bonds, or commodities within a single investment vehicle, offering investors exposure to multiple securities simultaneously.

Unlike traditional mutual funds, ETFs provide liquidity throughout the trading day and offer transparency in terms of their holdings. They are cost-effective due to low expense ratios and can be bought or sold through brokerage accounts without additional transaction fees.

Overall, ETFs provide diversification, liquidity, transparency, and cost-effectiveness for investors in today’s digital age.

Introduction to IT security ETFs as a specialized investment option

Investing in IT security exchange-traded funds (ETFs) offers a convenient and diversified way to tap into the growing cybersecurity industry. These funds focus on companies specializing in network security, data protection, encryption, and more.

By investing in IT security ETFs, investors can benefit from collective performance, diversification, industry expertise, liquidity, and cost-effectiveness. It’s an accessible and efficient way to capitalize on the rising importance of cybersecurity.

Diversification: Spreading Your Investments Across Multiple Cybersecurity Companies

Investing in cybersecurity requires diversification to safeguard your investments. By spreading your investments across multiple cybersecurity companies, you can mitigate risk and increase potential gains.

Investing in IT security ETFs allows exposure to a range of cybersecurity companies, reducing the impact of any one company’s performance on your portfolio. This diversification strategy also enables you to benefit from various companies’ growth and expertise within the sector.

Additionally, it provides flexibility to adapt to market shifts and capitalize on advancements made by different industry players.

Table:

| Heading | Content |

|---|---|

| Diversification | Spreading your investments across multiple cybersecurity companies |

| Benefits | – Mitigates risk – Capitalizes on expertise – Adapts to market dynamics – Expands potential gains |

Gaining Access to Top-Performing Cybersecurity Firms

Investors seeking exposure to industry leaders within the cybersecurity space can turn to IT security ETFs. These specialized funds offer a unique opportunity to invest in well-established and top-performing cybersecurity companies that have consistently demonstrated their ability to innovate and adapt to evolving cyber threats.

By allocating capital into IT security ETFs, individuals can gain access to these industry-leading firms that may otherwise be difficult to reach through other investment options.

These ETFs typically include holdings in companies that have established themselves as frontrunners in the cybersecurity field, with a track record of success and a proven ability to deliver cutting-edge solutions.

The advantage of investing in IT security ETFs lies in the potential for growth and success offered by these top-performing cybersecurity firms.

With an ever-increasing demand for robust digital security measures, these industry leaders are well-positioned to capitalize on the ongoing advancements in technology and the growing significance of data protection.

Furthermore, by diversifying investments across multiple companies within the portfolio of an IT security ETF, investors can mitigate risk associated with individual stock selection.

This diversification strategy allows individuals to benefit from the collective performance of various cybersecurity firms, reducing exposure to any single company’s performance.

Moreover, gaining exposure to industry leaders through IT security ETFs provides investors with valuable insights into emerging trends and developments within the cybersecurity sector.

By closely monitoring the performance and strategies of these top-performing companies, investors can stay informed about new technologies, regulatory changes, and market dynamics that may impact their investment decisions.

In summary, investing in IT security ETFs offers a unique opportunity for individuals to gain access to top-performing cybersecurity firms. Through this approach, investors can participate in the potential growth and success of these leading companies while benefiting from diversification and staying informed about key industry trends.

Long-Term Growth Potential: Exploring the Increasing Demand for IT Security Solutions

The increasing sophistication and prevalence of cyber attacks have fueled a growing demand for innovative IT security solutions. Investing in IT security ETFs allows investors to tap into this long-term growth potential by supporting companies at the forefront of developing cutting-edge cybersecurity products and services.

These ETFs provide exposure to a diversified portfolio of companies operating within the cybersecurity industry, ranging from software development to threat intelligence.

With emerging sectors like cloud security and artificial intelligence-driven threat detection, investing in IT security ETFs can position investors to benefit from the ongoing evolution and expansion of the cybersecurity landscape.

Highlighting a popular IT security ETF and its features, performance, and holdings

The XYZ IT Security ETF is a highly sought-after investment option for those interested in capitalizing on the growing cybersecurity industry. This ETF offers exposure to a diversified portfolio of global cybersecurity companies that demonstrate strong growth potential and competitive advantages.

Over the past five years, it has consistently outperformed its benchmark index, delivering impressive returns fueled by increasing demand for cybersecurity solutions. Key holdings include leading firms known for their technological innovations and ability to adapt to emerging cyber threats.

By investing in this ETF, individuals gain exposure to top players in the industry and position themselves for continued growth in the IT security sector.

[lyte id=’B7ZlIE_H6B4′]