In the ever-evolving landscape of investing, one industry that has been gaining significant attention is clean energy. As the world shifts towards sustainability and reducing carbon emissions, the demand for clean energy sources has skyrocketed.

One key player in this sector is lithium, a vital component in rechargeable batteries used in electric vehicles and renewable energy storage systems. Acme Lithium is a company that has emerged as a potential investment opportunity in this growing market.

The Rise of Lithium: Exploring the Global Demand for Clean Energy

The clean energy sector has witnessed remarkable growth, driven by climate change awareness and the need for sustainable solutions. Lithium-ion batteries have become essential due to their efficient storage of renewable energy. As governments and industries invest heavily in renewables, lithium demand is expected to surge.

Acme Lithium is poised to capitalize on the booming lithium market. With a focus on high-quality products and sustainability, investing in Acme offers a chance to be part of the clean energy revolution while potentially reaping financial rewards.

Unveiling Acme Lithium: A Look into the Company’s Background and History

Acme Lithium, a leading supplier of high-grade lithium products globally, has a remarkable history rooted in sustainability and responsible practices. Through strategic partnerships and expansion efforts, the company has achieved significant milestones, positioning itself as a key player in the market.

Investors can gain valuable insights into Acme’s potential for future growth by examining its track record of success and commitment to environmental stewardship.

Evaluating Market Trends: Understanding the Future Outlook for Lithium Investments

To make informed investment decisions in the lithium market, it is crucial to evaluate market trends and understand its future outlook. By analyzing supply and demand dynamics, technological advancements, and government policies, investors can gain valuable insights into the potential growth trajectory of lithium investments.

The demand for lithium is expected to soar due to the global shift towards cleaner energy sources and the increasing adoption of electric vehicles (EVs) and renewable energy solutions. Technological advancements in battery chemistry and manufacturing processes further enhance the performance and efficiency of lithium-ion batteries.

Additionally, government policies promoting sustainability and clean energy initiatives have a direct impact on the demand for lithium batteries.

In summary, evaluating market trends allows investors to gauge the future prospects of lithium investments. Analyzing supply and demand dynamics, technological advancements, and government policies provides valuable insights for making informed investment decisions in this rapidly growing industry.

Assessing Acme Lithium’s Profitability and Stability

When evaluating the investment potential of a company, one crucial aspect to consider is its financial performance. In the case of Acme Lithium, a thorough examination of its profitability and stability is essential.

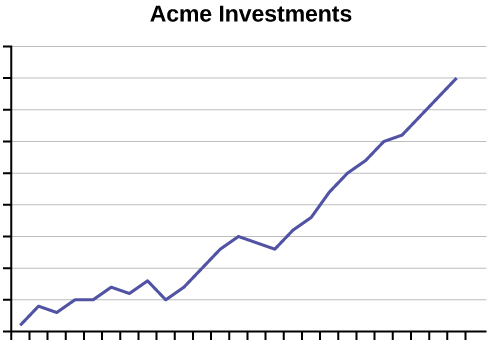

By analyzing Acme Lithium’s financial statements, including revenue trends, profit margins, and cash flow, investors can gain valuable insights into the company’s long-term prospects.

Financial statements serve as a window into a company’s financial health. They provide detailed information on factors such as revenue growth over time, which indicates the company’s ability to generate income consistently. Additionally, profit margins reveal how efficiently Acme Lithium manages its costs and generates profits from its operations.

A high-profit margin suggests that the company has effective cost management strategies in place.

Moreover, assessing key financial indicators further enhances our understanding of Acme Lithium’s financial strength. Return on investment (ROI) is a metric that measures how effectively the company generates profits from investments made by shareholders.

A higher ROI signifies better profitability and highlights Acme Lithium’s ability to deliver returns to its investors.

Another important indicator is the debt-to-equity ratio, which reveals the proportion of debt used to finance the company’s operations compared to shareholder equity. A lower debt-to-equity ratio indicates that Acme Lithium relies less on borrowed funds, indicating greater stability and reduced financial risk.

By examining these key indicators alongside comprehensive financial statements analysis, investors can obtain a holistic view of Acme Lithium’s financial situation. This knowledge allows for informed decision-making regarding investments in the clean energy sector.

Competitive Advantage: What Sets Acme Lithium Apart from Other Industry Players?

Acme Lithium stands out in the competitive lithium production market due to its commitment to sustainability, technological advancements, and strategic partnerships. The company’s sustainable practices reduce its ecological footprint, while ongoing research and development efforts ensure operational efficiency and superior product quality.

Patents and partnerships provide exclusive access to innovative extraction techniques and valuable market insights. These unique selling points establish Acme Lithium as a leader with a clear competitive advantage in the industry.

Risks and Challenges: Addressing Potential Obstacles in Investing in Acme Lithium

Investing in the lithium sector, including Acme Lithium, comes with inherent risks. Regulatory changes and environmental regulations can impact operations and profitability. Fluctuations in commodity prices also pose challenges. Investors must consider industry-wide risks such as competition, management issues, and supply chain disruptions.

Evaluating Acme Lithium’s ability to mitigate these risks is crucial for informed investment decisions.

Expert Opinions: Insights from Investment Gurus on Acme Lithium’s Potential

In this section, we explore the valuable insights provided by investment gurus regarding Acme Lithium’s investment prospects. By examining their perspectives, readers can gain a broader understanding of the key factors that experts consider when evaluating lithium investments.

Renowned investors and analysts have shared their thoughts on investing in lithium companies, shedding light on Acme Lithium’s position in the market. These expert opinions provide guidance for investors looking to make informed decisions.

Factors like market demand, competitive landscape, technological advancements, and sustainability practices are crucial considerations for investment experts when assessing lithium investments. By analyzing these factors, experts gauge a company’s growth potential and differentiation from competitors.

Understanding these expert opinions and key evaluation factors provides valuable insights into Acme Lithium’s investment potential. Investors can make more informed decisions by aligning their strategies with industry trends and expert perspectives in the lithium sector.

Investor Tips: How to Make Informed Decisions When Investing in Acme Lithium

Investing in Acme Lithium requires careful research and analysis. Look beyond financial performance and consider industry trends, market dynamics, and relevant news. Diversify your portfolio to manage risk effectively. Explore different strategies for diversification across sectors or asset classes.

Assess Acme Lithium’s risk profile by analyzing its financial health. Making well-informed investment decisions involves thorough research and thoughtful consideration of all factors involved in the dynamic world of lithium investing.

[lyte id=’7jp5FmqCsxw’]