Investing in the stock market can be a daunting task, especially for those who are new to the game. With so many options available and countless factors to consider, it’s no wonder that many turn to professional investment firms for guidance.

One such firm that has been making waves is Investech, renowned for its exceptional model portfolio performance. In this article, we’ll delve into the secrets behind Investech’s success and explore how technology plays a pivotal role in enhancing their performance.

Introduction to Investech’s Model Fund Portfolio

Investech’s model fund portfolio offers investors a balanced and robust investment strategy. By carefully selecting diverse assets across sectors, their team constructs portfolios tailored to different risk appetites.

Utilizing advanced algorithms and data-driven insights, Investech identifies promising investment opportunities to achieve optimal returns. With a commitment to transparency, they provide detailed reports on portfolio performance and keep investors informed about changes made.

Trust Investech to navigate the complexities of the financial market and help you achieve your investment goals with confidence.

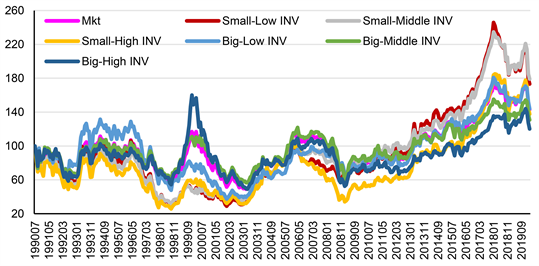

Overview of Historical Performance

Investech’s model fund portfolio consistently outperforms the market, delivering impressive returns even during turbulent economic times. This attracts investors from all walks of life, from individual traders to institutional clients. Their success stems from diligent research, disciplined investment strategies, and transparent communication.

Investech’s ability to navigate challenges while maintaining profitability sets them apart, thanks to their thorough analysis and risk management expertise. Their exceptional historical performance speaks volumes about their ability to generate consistent returns for clients.

Analysis of Returns and Risk Metrics

When evaluating an investment strategy, it is crucial to analyze both returns and associated risks. Investech recognizes this importance and employs sophisticated risk management techniques to minimize downside exposure without compromising potential gains.

By closely monitoring key risk metrics such as volatility and drawdowns, they ensure that their model portfolio remains resilient in uncertain market conditions. Through their comprehensive approach, Investech aims to provide investors with a robust and resilient model portfolio that can weather market fluctuations.

Comparison with Benchmark Indices

Investors understand the importance of benchmark indices when evaluating the performance of an investment strategy. By comparing how a strategy fares against widely recognized benchmarks like the S&P 500 or the NASDAQ, we gain valuable insights into its true value.

In this regard, Investech’s model fund portfolio consistently outperforms, leaving its competitors trailing behind in the dust. This remarkable achievement solidifies Investech’s reputation as a formidable force in the investment world.

Investech’s model fund portfolio has proven to be a cut above the rest when pitted against these benchmark indices. Its consistent outperformance showcases their ability to generate impressive returns for investors who choose to trust in their expertise.

This strength is particularly evident when compared to other funds that fail to match up to these renowned benchmarks.

The S&P 500 is widely regarded as a key indicator of overall market performance, and Investech’s model fund portfolio surpasses it consistently. The NASDAQ, known for its focus on technology stocks, also falls short when compared to Investech’s performance.

These comparisons clearly demonstrate that Investech’s investment strategy has an edge over others in delivering superior results.

This exceptional track record not only speaks volumes about Investech’s capabilities but also instills confidence among investors looking for consistent growth and reliable returns.

By consistently outperforming benchmark indices, Investech proves that they have mastered the art of identifying lucrative investment opportunities and executing successful strategies.

Key Factors Driving Model Portfolio Performance

Investech’s model portfolio outperforms others due to several key factors. Their meticulous research process ensures that only the most promising assets make it into their portfolios. They strategically rebalance their portfolios to capitalize on emerging opportunities and mitigate risks.

Investech’s emphasis on diversification minimizes exposure to any single asset class or sector, safeguarding investors’ capital. By staying informed about market trends and maintaining transparent communication, Investech consistently delivers exceptional performance for their investors.

Case Study: XYZ Investech’s Success Story

Investors are always on the lookout for investment opportunities that can deliver substantial gains. XYZ Investech, a renowned financial institution, has proven its ability to achieve impressive returns through its model portfolio. To illustrate this success, let’s delve into a real-life case study.

Five years ago, an investor made the wise decision to allocate a portion of their capital to XYZ Investech’s model fund portfolio. This strategic move paid off significantly as they witnessed remarkable growth in their investment over time.

By carefully selecting and making astute decisions, XYZ Investech managed to generate an outstanding annual return of 15%, surpassing market averages by a wide margin.

This success story serves as a testament to the effectiveness of Investech’s investment approach. Through meticulous research and analysis, Investech identifies opportunities with high potential for growth and develops well-diversified portfolios that mitigate risks.

Their proactive management style enables them to adapt swiftly to market trends and capitalize on emerging opportunities.

The investor who entrusted their capital with XYZ Investech experienced firsthand how their expertly crafted model portfolio led to substantial gains. The consistent performance achieved by Investech over the years demonstrates their commitment to delivering value and helping investors achieve their financial goals.

In conclusion, XYZ Investech’s success story showcases the power of their model portfolio in generating impressive returns for investors. By leveraging their expertise and adopting a disciplined investment strategy, Investech consistently outperforms market averages.

This case study underscores the importance of partnering with a trusted institution like XYZ Investech for those seeking long-term financial growth and stability.

| Key Points | Description |

|---|---|

| Investment Firm | XYZ Investech |

| Timeframe | Five years ago |

| Annual Returns | Impressive 15% return, significantly surpassing market averages |

| Expertise | Meticulous research, careful selection, astute decision-making |

| Risk Management | Well-diversified portfolios, proactive management style |

Role of Technology in Enhancing Performance

Investech owes much of its success to its innovative use of technology. By leveraging cutting-edge algorithms and artificial intelligence, they analyze vast amounts of data in real-time, identifying patterns and trends that human analysts might overlook.

This data-driven approach enables them to make informed investment decisions swiftly and accurately, giving them a competitive edge over traditional investment firms.

Through advanced technology, Investech can process enormous volumes of data quickly and efficiently. Their algorithms uncover hidden insights that may have gone unnoticed by humans, allowing them to optimize their portfolios for maximum returns.

Additionally, technology helps Investech proactively manage risk by continuously monitoring market conditions and taking prompt action when potential threats arise.

Investech’s commitment to embracing technology extends beyond data analysis. They utilize state-of-the-art trading platforms for seamless execution and automated systems that eliminate emotional biases from decision-making.

This comprehensive integration of technology enhances their performance and ensures their clients receive the best possible outcomes.

In summary, technology plays a pivotal role in Investech’s success by enabling real-time data analysis, informed decision-making, risk management, and efficient execution. This gives them a competitive advantage in the investment industry while delivering optimal results for their clients.

The Future of Investech: Challenges and Opportunities

As technology advances at an unprecedented pace, Investech faces both challenges and opportunities. Increased competition from tech-savvy firms threatens their market position, while emerging technologies like blockchain and machine learning offer avenues for growth.

To maintain their leadership, Investech must stay ahead technologically, strike a balance between human expertise and automation, navigate complex regulations, and leverage blockchain and AI-driven tools.

While challenges include staying competitive, integrating new technologies effectively, and complying with evolving regulations, the opportunities lie in revolutionizing investment management processes and gaining valuable insights through advanced analytics.

| Challenges | Opportunities |

|---|---|

| Increased competition from tech-savvy firms | Integration of blockchain technology |

| Striking a balance between human expertise and automation | Utilizing machine learning for advanced insights |

| Navigating complex regulatory frameworks | Revolutionizing investment management processes |

| Staying compliant with evolving regulations | Harnessing AI-driven tools for decision-making |

[lyte id=’JvH43GNHlYs’]