Lithium, once considered an obscure element, has now emerged as a game-changer in the world of investing. As industries increasingly rely on lithium for its exceptional properties, investors are eyeing this valuable resource as a lucrative opportunity.

In this article, we will explore the growing importance of lithium across various sectors and delve into the factors driving its stock price up. Whether you are an experienced investor or just starting to learn about investing, this article will provide you with in-depth insights and new information about the infinite lithium stock price.

Exploring the Growing Importance of Lithium in Various Industries

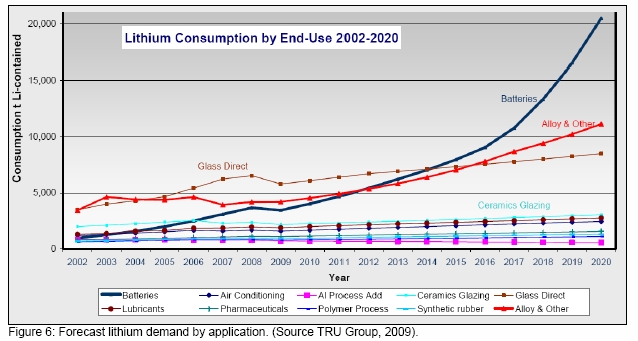

Lithium’s versatility and unique characteristics have made it indispensable across multiple industries. It is widely used in electric vehicles (EVs), where lithium-ion batteries power engines efficiently and sustainably. Additionally, renewable energy sources like solar and wind heavily rely on lithium batteries for efficient energy storage.

As countries strive to reduce carbon footprints, the demand for lithium is set to skyrocket. It also finds applications in consumer electronics and pharmaceuticals. The growing importance of lithium in these industries highlights its crucial role in shaping our future towards sustainability and cleaner energy alternatives.

How the Demand for Lithium is Driving Its Stock Price Up

The surging demand for lithium has driven its stock price to new heights. Companies like Infinite Lithium Corporation (INF.AX) have strategically positioned themselves within the market, making them attractive investment options.

Infinite Lithium Corporation recognizes the industry’s potential and actively explores high-quality lithium deposits globally. By meeting the growing demand and positioning themselves favorably, they ensure potential revenue growth and profitability.

The popularity of lithium-ion batteries in devices like electric vehicles and renewable energy storage systems fuels the demand for lithium. Additionally, global efforts towards sustainability and energy independence contribute to its increased consumption.

As the demand for lithium continues to rise, companies like Infinite Lithium Corporation are well-positioned to benefit from this electrifying trend.

Understanding Infinite Lithium Corporation (INF.AX): An Opportunity Worth Exploring

Infinite Lithium Corporation (INF.AX) is a leading player in the lithium sector, focusing on exploring and developing high-quality lithium deposits worldwide. With a mission to meet the growing demand from industries like EVs and renewable energy, the company offers investors an opportunity to participate in the booming lithium market.

By analyzing key financial metrics such as market capitalization, revenue growth, and profitability, investors can make informed decisions about the potential of Infinite Lithium Corporation as an investment option.

Key Statistics of Infinite Lithium Corporation (INF.AX)

To understand where Infinite Lithium Corporation stands within the lithium industry, it’s important to compare its key statistics with other prominent players. This analysis allows investors to gauge the company’s competitiveness and growth potential.

Market capitalization is a crucial factor to consider, as it reflects the company’s overall value in the market. Examining revenue growth helps assess its ability to generate income and expand operations. Profitability indicators such as net profit margin and return on equity offer insights into how efficiently the company generates profits.

Debt levels are also critical in evaluating financial health. Analyzing metrics like debt-to-equity ratio and interest coverage ratio provides an indication of debt management. Operational efficiency metrics shed light on resource utilization and cost management.

By examining these key statistics and comparing them with industry peers, investors can make informed decisions about their investments in Infinite Lithium Corporation and the lithium sector as a whole.

Executive Leadership at Infinite Lithium Corporation (INF.AX)

The success of Infinite Lithium Corporation relies heavily on the expertise and leadership qualities of its executives. Led by [CEO Name], a seasoned industry veteran, the executive team brings a wealth of knowledge and strategic vision to navigate the dynamic lithium industry.

Supporting roles such as CFO, COO, and CSO ensure sound financial strategies, operational efficiency, and sustainability practices are integrated throughout the company. With this strong leadership in place, investors can have confidence in the company’s growth potential and strategic decision-making.

Financial Analysis of Infinite Lithium Corporation (INF.AX)

Analyzing the financial statements of Infinite Lithium Corporation provides valuable insights into its revenue growth, profit margins, and overall financial stability. Positive revenue growth indicates market expansion and increased sales, while higher profit margins reflect better cost management and profitability.

Evaluating financial ratios helps assess liquidity, solvency, and efficiency. Additionally, analyzing the cash flow statement reveals how cash moves within the company. This comprehensive analysis informs investors’ decisions about investing in Infinite Lithium Corporation.

Factors Influencing Infinite Lithium Stock Price

The stock price of Infinite Lithium Corporation is influenced by global trends and political/regulatory factors shaping the lithium market.

The electric vehicle revolution is driving the demand for lithium-ion batteries as governments worldwide push for a transition from fossil fuel-powered vehicles to EVs. Additionally, the rise of renewable energy sources like solar and wind power requires efficient energy storage solutions, where lithium batteries play a vital role.

Political stability, government regulations, and environmental policies impact both supply chain dynamics and pricing in the lithium market. Investors must consider these factors when assessing risks and rewards associated with investing in Infinite Lithium Corporation.

Changes in regulations or instability can disrupt supply chains, while sustainable practices can create opportunities for environmentally responsible investments.

In summary, global trends such as the electric vehicle revolution and renewable energy adoption, along with political stability and regulatory policies, significantly influence the stock price of Infinite Lithium Corporation.

Risks Associated with Investing in Infinite Lithium Stocks

Investing in Infinite Lithium stocks offers potential returns, but it’s important to consider the associated risks. Market volatility and macroeconomic factors can lead to unpredictable stock prices. Environmental concerns arise from lithium mining’s impact on ecosystems and water supplies.

Geopolitical risks, such as political instability, can disrupt the supply chain. Technological advancements may also affect demand for lithium. Evaluating these risks is crucial when investing in Infinite Lithium stocks.

[lyte id=’GuTio_-pEgM’]