Investing in clean energy has become increasingly popular as the world strives to reduce its reliance on fossil fuels and combat climate change. One area within the clean energy sector that is gaining significant attention is hydrogen storage.

Hydrogen storage stocks hold immense potential for investors looking to capitalize on the clean energy revolution.

The Rise of Clean Energy and the Importance of Hydrogen Storage

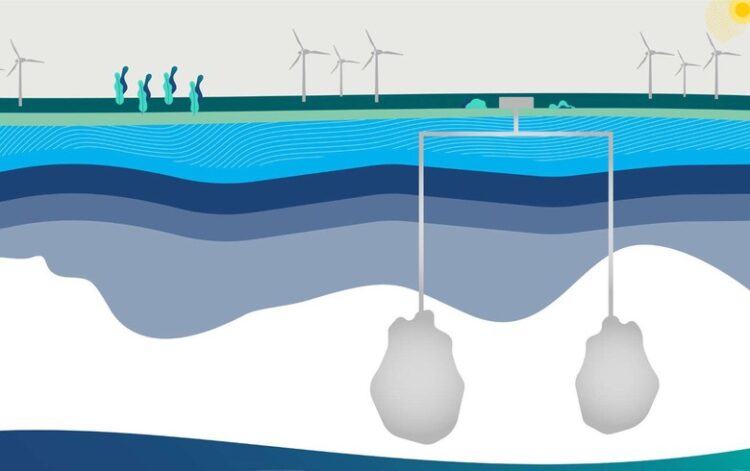

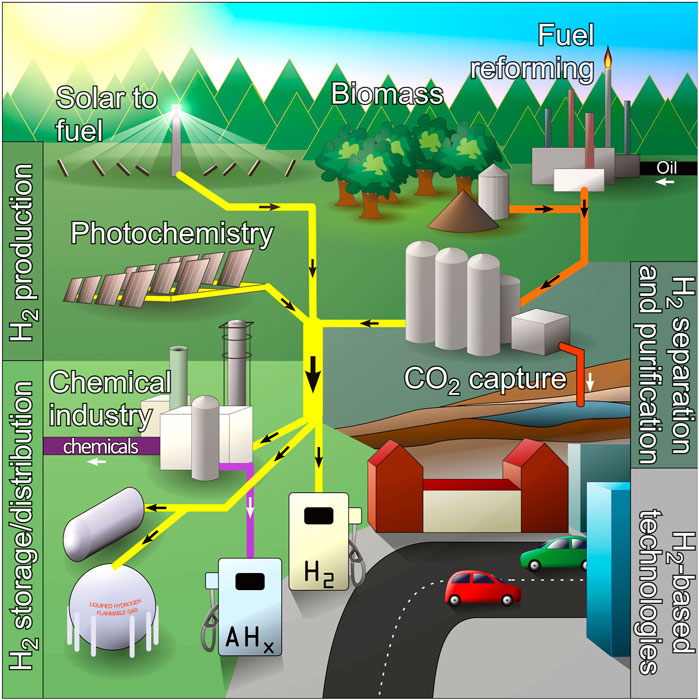

Governments worldwide are pushing towards carbon neutrality, driving the adoption of renewable energy sources like wind and solar power. However, these sources are intermittent, requiring efficient methods to store excess energy generated during peak times.

Hydrogen storage offers a solution by converting surplus renewable energy into hydrogen through electrolysis. This hydrogen can be stored and used later when renewable sources are not available. By storing excess renewable energy as hydrogen, we create a reliable clean fuel source that can power various applications.

Hydrogen’s high energy density and versatility make it an attractive alternative to fossil fuels in transportation, electricity generation, heating systems, and industrial processes. Furthermore, hydrogen storage enables grid flexibility and balances supply and demand for long-term energy storage solutions.

In summary, the rise of clean energy is closely tied to the importance of hydrogen storage. It allows us to tap into the full potential of renewable energy by efficiently storing and utilizing excess power. Embracing hydrogen storage technologies is key in achieving our carbon neutrality goals and building a sustainable future.

Exploring the potential for investing in hydrogen storage stocks

Investing in hydrogen storage stocks offers a unique opportunity to both profit financially and contribute to a cleaner future. These stocks provide exposure to companies leading the way in developing innovative solutions for storing and utilizing hydrogen.

By investing in these stocks, individuals can support technology advancements that promote greater adoption of renewable energy sources. Additionally, with increasing government support for clean energy initiatives and regulations promoting decarbonization, there is a favorable market environment for hydrogen storage stocks.

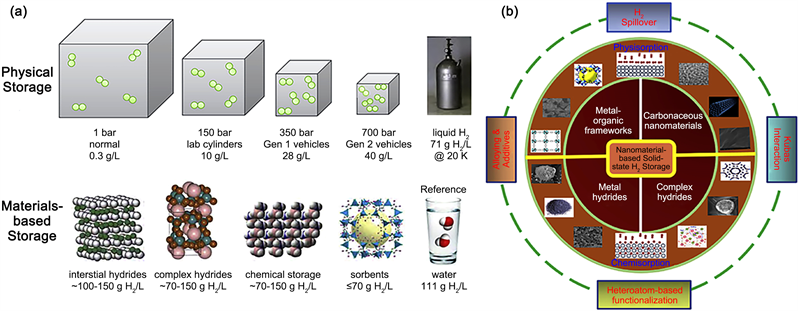

Understanding the various methods used for storing hydrogen is essential when assessing the investment potential of these stocks. Methods such as compression, liquefaction, and solid-state storage each have their advantages and limitations, influencing the growth prospects of companies specializing in these areas.

Compression involves storing gaseous hydrogen at high pressures, while liquefaction cools it to a liquid state for higher volume storage. Solid-state storage utilizes materials that chemically bind or absorb hydrogen gas. Keeping an eye on companies excelling in these methods can lead to promising investment opportunities.

Overall, investing in hydrogen storage stocks not only brings financial benefits but also supports advancements in clean energy technology. With government backing and an increasing focus on decarbonization, the outlook for these stocks remains positive.

By understanding different storage methods and identifying companies at the forefront of innovation, investors can make informed decisions and contribute to shaping a sustainable future.

Different Methods of Hydrogen Storage

Hydrogen can be stored using different methods, each with its own advantages and challenges.

-

Compressed gas storage involves compressing gaseous hydrogen into high-pressure tanks or cylinders. It is widely used but requires a lot of energy for compression and faces challenges in storage volume and transportation.

-

Liquid hydrogen storage involves cooling hydrogen to extremely low temperatures to convert it into a liquid state. It offers higher energy density but requires specialized cryogenic equipment and insulation.

-

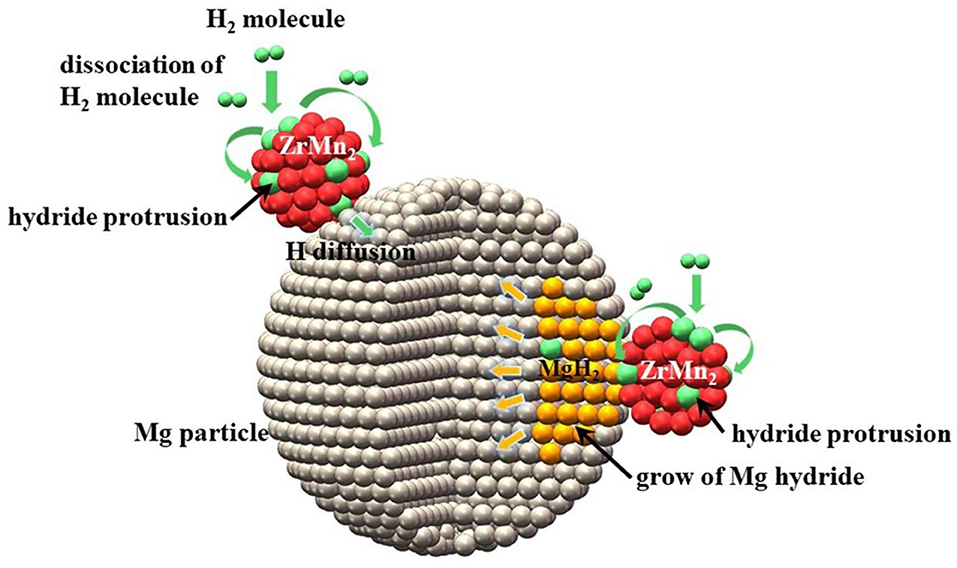

Solid-state storage uses materials that can absorb and release hydrogen atoms, such as hydrides or metal-organic frameworks (MOFs). This method offers improved safety, lower pressure requirements, and increased storage capacity, but further research is needed for commercial use.

These methods play a crucial role in the development of efficient hydrogen energy systems. Continued research will enhance their efficiency and accessibility, making hydrogen a reliable alternative energy source for the future.

Pros and Cons of Each Method

The different methods of hydrogen storage have their own advantages and limitations.

Compressed gas storage is mature and relatively affordable, but requires significant infrastructure development for large-scale implementation.

Liquid hydrogen storage offers higher energy density, but faces challenges in handling and transportation due to extremely low temperatures.

Solid-state storage shows promise in terms of safety and increased capacity, but is still in the early stages of development, requiring more research before widespread adoption.

When evaluating companies in the hydrogen storage industry, it’s important to consider these factors to assess their viability and long-term prospects.

Major Players in the Hydrogen Storage Industry

Two prominent players in developing innovative hydrogen storage solutions are:

-

Company A: Specializing in compressed gas storage, they provide cost-effective solutions with a focus on improving efficiency through infrastructure development.

-

Company B: Leading the way in solid-state storage research, they are exploring advanced materials and technologies to enhance capacity and safety.

These companies are shaping the future of clean energy storage, contributing to a more sustainable hydrogen economy.

Company A: Pioneering Advancements in Compressed Gas Storage Technology

Company A is at the forefront of revolutionizing compressed gas storage through their groundbreaking advancements in technology. By developing innovative approaches that address the limitations associated with traditional methods, they have paved the way for significant progress in this field.

One of the key achievements of Company A’s technology is its ability to enable higher-pressure capabilities without compromising on safety or efficiency. Through their research and development efforts, they have successfully tackled the challenges posed by storing hydrogen, ensuring its safe handling and efficient utilization.

In recent years, Company A has made remarkable strides in tank design, materials, and safety features. Their continuous focus on improvement has allowed them to overcome previous limitations and develop storage solutions that are scalable and adaptable to various applications.

This versatility positions them as a leading contender in capturing a substantial share of the hydrogen storage market.

Through their dedication to innovation and commitment to excellence, Company A has solidified their reputation as pioneers in compressed gas storage technology. With a strong emphasis on research and development, they continue to push boundaries and transform the industry landscape.

Company B: Leading the way in liquid hydrogen storage solutions

Company B is at the forefront of liquid hydrogen storage solutions, leveraging their expertise in cryogenic systems to create innovative storage tanks. These tanks maximize energy density while minimizing heat loss, setting new standards in the industry.

With a strong track record and successful partnerships with major automakers and aerospace companies, Company B has proven their ability to provide reliable and efficient liquid hydrogen storage solutions. Their continuous focus on improvement positions them for future growth.

Investors interested in hydrogen storage stocks should closely monitor key players like Company B for valuable investment opportunities. Consider factors such as financial stability, research and development efforts, partnerships, regulatory changes, and market demand when evaluating opportunities within the industry.

In summary, Company B leads the way in liquid hydrogen storage solutions through their cutting-edge technology and commitment to excellence. Investors should keep a close eye on their advancements for potential investment prospects.

Evaluating Financial Health and Stability

To minimize investment risks, evaluate the financial health and stability of companies before investing. Review balance sheets, cash flow statements, and profitability metrics to assess their ability to generate sustainable revenue streams. Consider investment ratings from reputable agencies and analyst recommendations.

Comparing companies within the industry can help identify those with a competitive advantage. By conducting comprehensive due diligence, investors can make informed decisions and increase the likelihood of favorable returns.

| Key Factors for Evaluating Financial Health and Stability |

|---|

| Balance sheet |

| Cash flow statement |

| Profitability metrics |

| Investment ratings |

| Analyst recommendations |

| Industry comparisons |

Technological Advancements and Breakthroughs

Staying updated on technological advancements within the hydrogen storage industry is crucial for investors. These advancements can have a significant impact on stock performance and give companies a competitive edge.

Monitoring patents, partnerships, and acquisitions in the industry can indicate which companies are leading in technological developments. New innovations that improve efficiency, reduce costs, or enhance safety are key factors to watch out for.

By staying informed about emerging trends and breakthroughs, stakeholders can make well-informed decisions and capitalize on growth opportunities.

[lyte id=’PQf2KRoZJl0′]