Investing in uranium exchange-traded funds (ETFs) can be a lucrative opportunity for those looking to diversify their investment portfolio and tap into the growing demand for nuclear energy.

In this comprehensive guide, we will explore the potential of uranium as an investment, delve into the world of ETFs, and provide you with step-by-step instructions on how to invest in uranium ETFs.

Understanding Uranium and its Potential as an Investment

Uranium, a naturally occurring element widely used in the production of nuclear energy, holds great investment potential. With its unique properties and crucial role in generating electricity, uranium is in high demand across industries.

As a heavy metal with atomic number 92, uranium’s radioactive nature allows it to generate heat through nuclear fission. This drives the operation of nuclear power plants, providing clean and efficient electricity while minimizing carbon emissions.

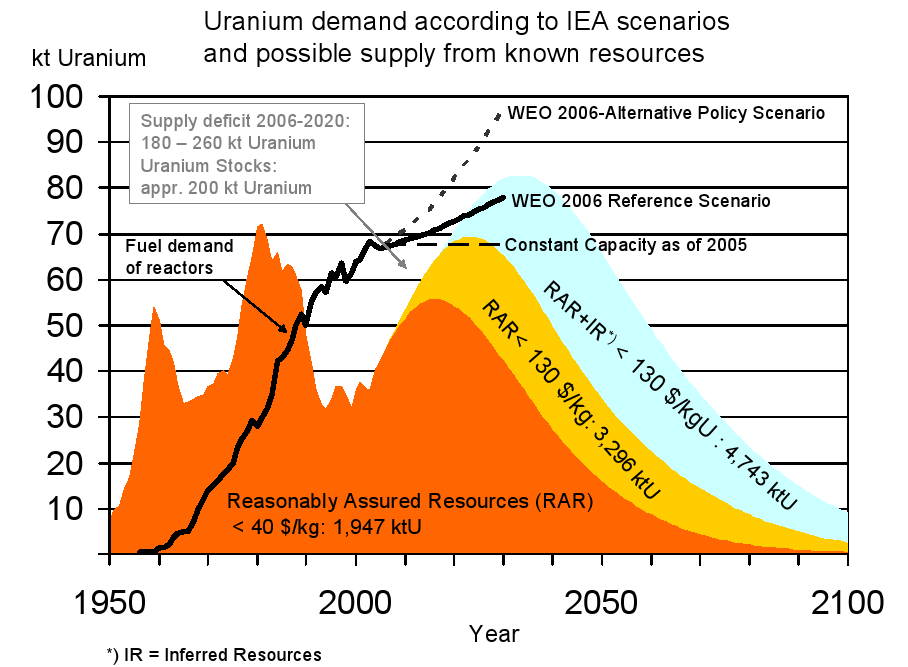

The global demand for reliable and sustainable energy sources continues to rise, making nuclear power an attractive solution. Investing in uranium allows one to tap into this growing industry as countries invest in nuclear infrastructure.

To succeed in uranium investments, it’s important to stay informed about market trends, government policies, and technological advancements within the industry. By understanding these factors and conducting thorough research, investors can make informed decisions that may lead to substantial returns.

In summary, recognizing uranium’s unique properties and its role in generating electricity through nuclear power plants is key to understanding its investment potential. With increasing global energy needs and advancements in the sector, investing in uranium offers promising opportunities for those well-informed about the market.

Introduction to ETFs (Exchange-Traded Funds)

ETFs, or Exchange-Traded Funds, have become increasingly popular among investors. These funds trade on stock exchanges like individual stocks and offer exposure to a diversified portfolio of assets such as stocks, bonds, or commodities.

Investing in ETFs provides several advantages over individual stocks or mutual funds, including diversification benefits and access to niche markets with growth potential. Additionally, ETFs offer flexibility, liquidity, and generally have lower expense ratios compared to actively managed mutual funds.

Overall, ETFs are a compelling investment option for diversification and targeted sector exposure.

Why Invest in Uranium ETFs?

Diversification advantages of ETFs

Investing in uranium ETFs offers diversification advantages that help manage investment risk effectively. By spreading your investments across multiple companies within the uranium sector, you reduce the impact of any specific company’s risks on your portfolio.

Reducing exposure to individual company-specific risks

Companies in the uranium sector face various challenges. By investing in a uranium ETF, you minimize your exposure to these company-specific risks and ensure a more balanced overall portfolio.

Access to a niche market with growth potential

Compared to other industries, there are limited publicly traded uranium companies available for direct investment. Investing in a uranium ETF provides access to a broader range of companies operating within this niche market.

Additionally, as global demand for nuclear energy increases, the uranium sector is expected to experience significant growth.

In summary, investing in uranium ETFs allows for risk diversification and provides access to a niche market with growth potential. By spreading investments across multiple companies and taking advantage of the increasing demand for nuclear energy, investors can potentially enhance their portfolios.

Researching and Selecting the Right Uranium ETF

When it comes to investing in a uranium ETF, thorough research and careful selection are necessary. Start by evaluating the underlying index or benchmark to understand which companies are included and how they are weighted. Consider historical performance and tracking error to gauge an ETF’s ability to replicate its index effectively.

Analyze expense ratios, management fees, brokerage commissions, and bid-ask spreads to minimize costs and maximize investment gains. By taking these factors into account, investors can make informed decisions that align with their objectives and optimize their chances for favorable returns.

Choosing a Reputable Brokerage Account for Uranium ETF Investments

When investing in uranium ETFs, selecting a reputable brokerage account is crucial. Traditional brokerages offer personalized services but come with higher fees, while online brokerages provide convenience and lower costs.

Consider factors such as trading fees, account minimums, research tools, customer service quality, and ease of use when choosing a brokerage account that aligns with your investment needs. Thoroughly researching and comparing different brokerages will help you make an informed decision.

Making Your First Investment in Uranium ETFs

Getting started with uranium ETF investments is a straightforward process that can diversify your portfolio and potentially yield profitable returns. To begin, open a brokerage account by providing necessary identification and address proof.

Once your account is set up, place orders for uranium ETF shares using different types of orders such as market, limit, or stop orders. Specify your investment amount and desired price based on thorough research.

Regularly monitor the performance of your investment, conduct portfolio reviews, and consider setting performance benchmarks to track progress. With careful planning and informed decision-making, you can navigate the world of uranium ETFs successfully.

Risks and Considerations When Investing in Uranium ETFs

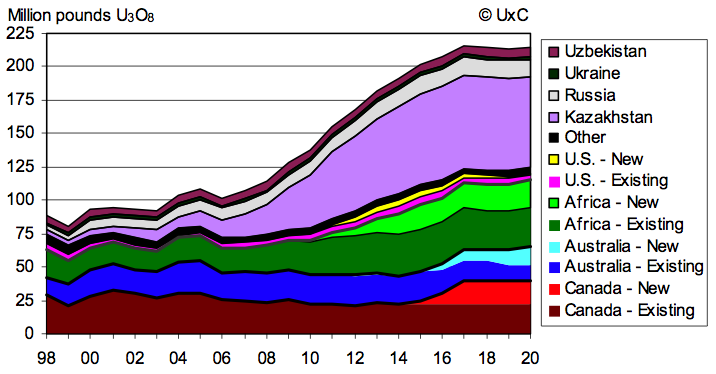

Investing in uranium exchange-traded funds (ETFs) can offer opportunities but comes with risks to consider. The uranium market is known for its volatility, influenced by factors such as global economic conditions, supply-demand dynamics, and geopolitical events.

Changes in government policies or regulations regarding nuclear energy can impact uranium prices and the performance of uranium ETFs. Environmental risks associated with uranium mining operations should also be monitored. Understanding these risks and staying informed will help investors make more informed decisions when investing in uranium ETFs.

Tax Implications of Investing in Uranium ETFs

Investing in uranium ETFs comes with important tax implications. When investing through an IRA, tax advantages like tax-deferred growth or tax-free withdrawals can be enjoyed. However, taxable accounts require reporting capital gains or losses on annual tax returns.

Different uranium ETFs may have varying taxation rules, so thorough research is necessary. Consulting with a financial advisor or tax professional is recommended for personalized guidance on optimizing investment strategies and complying with tax regulations.

[lyte id=’SSqiGKtLiYQ’]