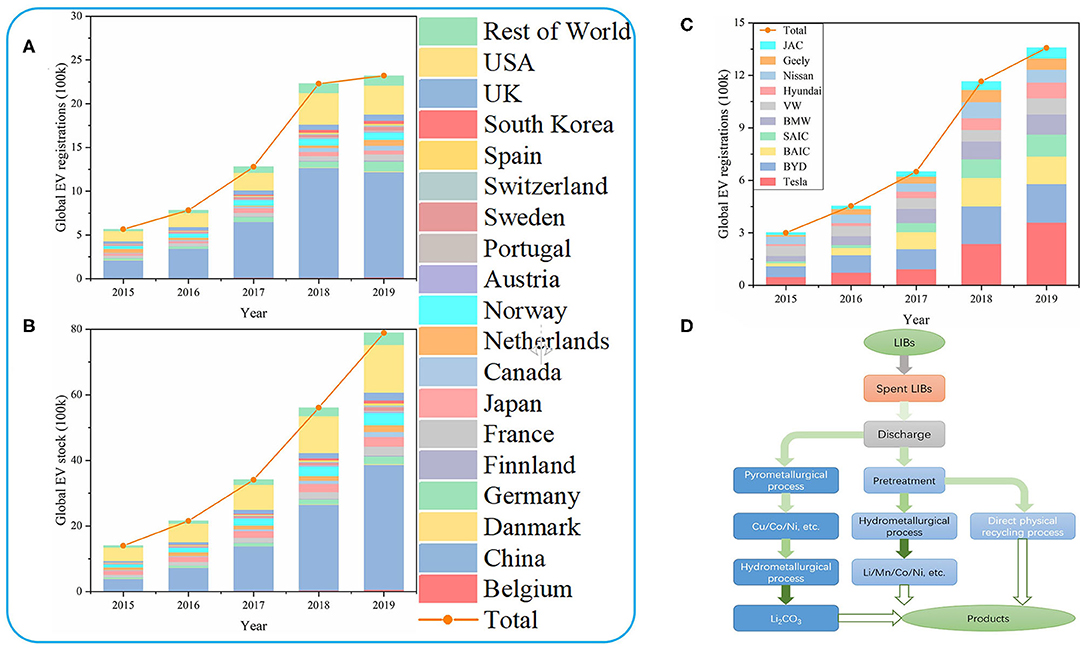

The surge in popularity of electric vehicles (EVs) is driven by their environmental benefits and cost savings. This has led to a soaring demand for EV batteries, making investing in EV battery stocks an attractive opportunity. EVs reduce emissions and combat climate change, with governments implementing stricter regulations.

High-quality batteries are essential for longer driving ranges and faster charging times. EV batteries also play a crucial role in energy storage systems, supporting renewable energy sources. Companies like Tesla, Panasonic, LG Chem, Samsung SDI, and BYD are at the forefront of battery innovation.

Investing in EV battery stocks allows participation in the ongoing electrification revolution while potentially gaining financial rewards.

Best Electric Vehicle Battery Stocks in 2023

Investing in electric vehicle (EV) battery stocks is gaining popularity as the demand for sustainable transportation rises. BYD, known for innovative technology and strong financial performance, is a leader in the EV market.

Albemarle specializes in lithium production and is well-positioned to benefit from the growing demand for lithium-ion batteries. Panasonic, with a century-long history and strong market position, successfully expands into the EV battery market.

These stocks offer promising investment opportunities for those seeking long-term growth and sustainability.

Quantum Glass Battery Stocks Investment Opportunities

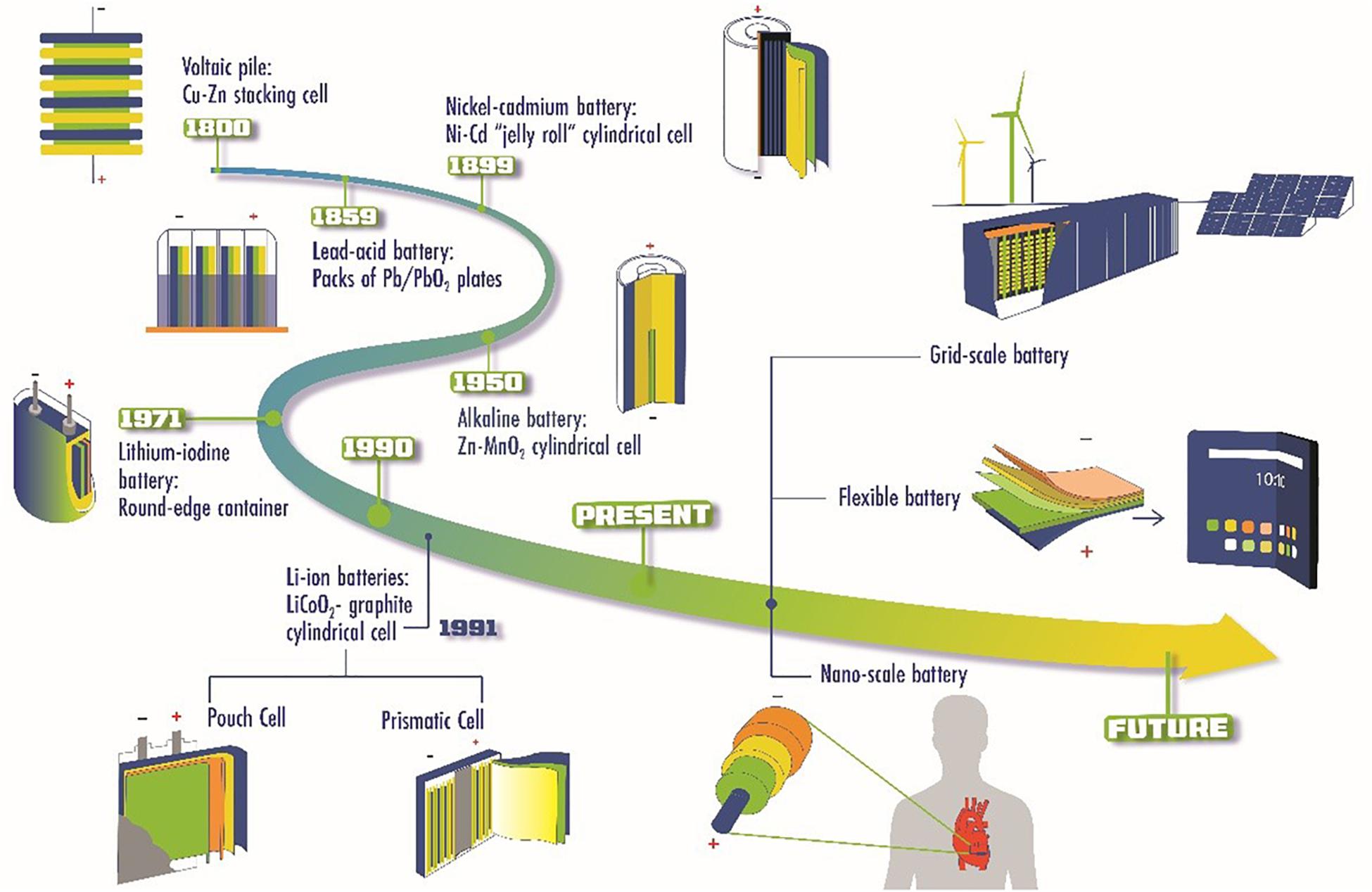

The emergence of Quantum Glass Batteries presents a remarkable opportunity for investors looking to capitalize on the ever-growing electric vehicle (EV) industry.

These innovative batteries have the potential to revolutionize the energy storage landscape, offering higher energy density, longer lifespan, and faster charging capabilities compared to traditional lithium-ion batteries.

Investing in Quantum Glass Battery stocks allows investors to position themselves at the forefront of technological advancements in the EV industry. As this groundbreaking technology gains traction and becomes more widely adopted, companies involved in its development and production are likely to experience significant returns on investment.

The growth prospects for Quantum Glass Battery stocks are highly promising. The increasing demand for electric vehicles and the urgent need for more efficient energy storage solutions create a favorable environment for companies specializing in this cutting-edge battery technology.

By recognizing the immense potential of Quantum Glass Batteries early on, investors may stand to benefit greatly as this disruptive technology continues to reshape the market.

To fully understand the investment opportunities in Quantum Glass Battery stocks, it is essential to analyze market trends and evaluate key players in the industry. This can be done by examining financial data, assessing research and development efforts, and gaining insights into partnerships or collaborations within the field.

Conducting thorough due diligence will enable investors to make informed decisions about which companies are poised for success in this rapidly evolving sector.

Investing in Lithium Stocks for EV Batteries

Lithium stocks have become an attractive investment option for those looking to capitalize on the growing demand for electric vehicles (EVs). With its high energy density and lightweight nature, lithium plays a vital role in EV batteries.

Companies like Albemarle, Livent Corporation, and SQM have established themselves as key players in the lithium market, with strong financial performance records and robust growth prospects.

As governments worldwide implement stricter regulations on vehicle emissions, the demand for efficient and reliable EV batteries continues to rise, making investing in lithium stocks a promising opportunity.

Risks Associated with Investing in EV Battery Stocks

Investing in EV battery stocks comes with inherent risks. The stock market’s volatility can lead to unpredictable fluctuations in stock prices, impacting the value of investments. Regulatory risks and government policies also play a significant role.

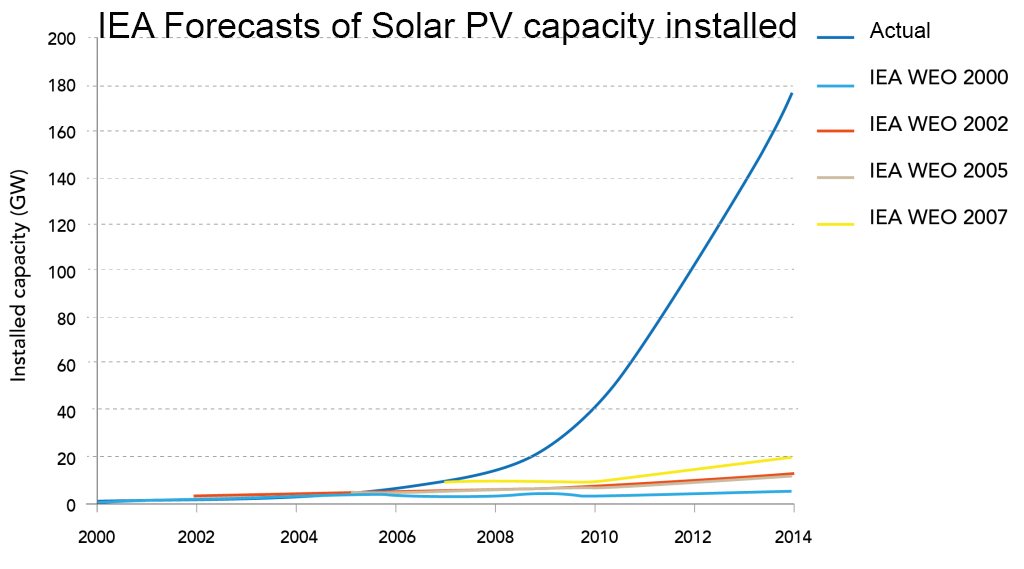

Changes in regulations or subsidies can influence the demand for electric vehicles and impact the performance of EV battery stocks. Technological advancements and geopolitical factors further add complexity to the investment landscape.

Disruptions or shortages in critical materials and environmental concerns surrounding battery production can affect stock performance. Careful research, diversification, and staying informed are crucial when considering investments in this sector.

Strategies for Successful Investing in EV Battery Stocks

Investing in EV battery stocks requires effective strategies to maximize returns and manage risks. Diversify your portfolio by investing in multiple companies within the industry. This spreads risk and increases chances of benefiting from overall market growth.

Consider long-term vs short-term investment strategies based on your financial goals and risk tolerance. Long-term investments focus on sustained growth, while short-term investments capitalize on immediate market trends. By implementing these strategies, you can position yourself for success in the growing electric vehicle battery market.

Fully Charged: Growth Prospects for EV Battery Stocks

The electric vehicle (EV) industry is booming as more consumers embrace sustainable transportation. This surge in demand directly impacts the need for efficient and reliable EV batteries, creating exciting growth prospects for EV battery stocks.

Investors can capitalize on this projected growth by staying informed about technological advancements, industry trends, and top-performing companies like BYD, Albemarle, and Panasonic. Emerging technologies such as Quantum Glass Batteries also offer potential investment opportunities.

However, it’s important to be aware of the associated risks and adopt appropriate investment strategies. Factors like regulatory changes and competition can impact stock performance. By conducting thorough research and staying informed, investors can position themselves for success in this rapidly evolving market.

[lyte id=’W0pdRM5rfYE’]