Investing in the stock market can be a rewarding venture, but it requires careful analysis and decision-making. One strategy that many investors employ is finding undervalued companies. These are stocks that are trading at a price lower than their intrinsic value, offering the potential for significant returns in the long run.

In this article, we will explore what undervalued stocks are, why they occur, and how you can find them to make informed investment decisions.

What Are Undervalued Stocks?

Undervalued stocks are those that trade below their true worth or intrinsic value. These stocks present an opportunity for investors to acquire shares at a discounted price and potentially profit when their value eventually catches up with their true worth.

Market prices can deviate from a company’s actual value due to factors like market sentiment or temporary setbacks. Investors who identify undervalued stocks conduct thorough research and analysis to assess the company’s earnings potential and overall performance.

It is important to approach undervalued stocks with caution and ensure that the underlying fundamentals align with growth potential.

Why Stocks Become Undervalued

Stocks can be undervalued due to market sentiment, investor behavior, or company-specific factors. Market sentiment plays a crucial role as fear or pessimism among investors can lead to selling pressure and drive prices below their fair value.

Investor behavior, such as herd mentality or irrational exuberance, can cause certain stocks to be overlooked. Company-specific factors like poor financial performance or negative news events also contribute to undervaluation. Recognizing these opportunities allows savvy investors to capitalize on the potential for future success.

How to Find Undervalued Stocks

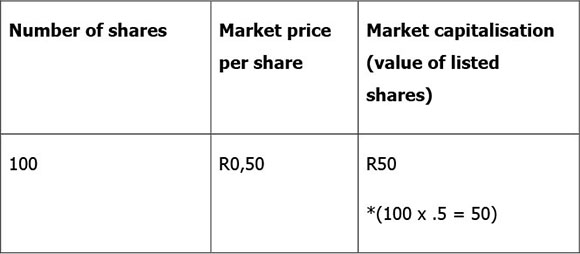

To find undervalued stocks, thorough research and analysis are crucial. Start by examining the company’s price-to-earnings (P/E) ratio and market capitalization (market cap). A low P/E ratio compared to peers or historical averages may indicate undervaluation.

Additionally, assess the company’s financial statements for signs of healthy financials and evaluate its competitive position within the industry. Stay updated on relevant news and developments that can impact stock prices. By implementing these strategies, investors can uncover hidden gems with potential for growth.

Remember to approach investing with a long-term perspective and consider diversification for risk management.

Conclusion

[lyte id=’5PgWtd-4CMo’]