In recent years, electric vehicles (EVs) have taken the world by storm. With their environmental benefits and technological advancements, EVs have not only revolutionized transportation but also created a lucrative opportunity for investors.

This article will delve into the growing popularity of EV stocks, explore the hottest players in the market, discuss investment strategies for success, and highlight key metrics for evaluating EV stocks.

Whether you’re a seasoned investor or just starting out, this article will provide you with valuable insights to navigate the exciting world of EV investing.

The Rise of EV Stocks: A New Era in Investing

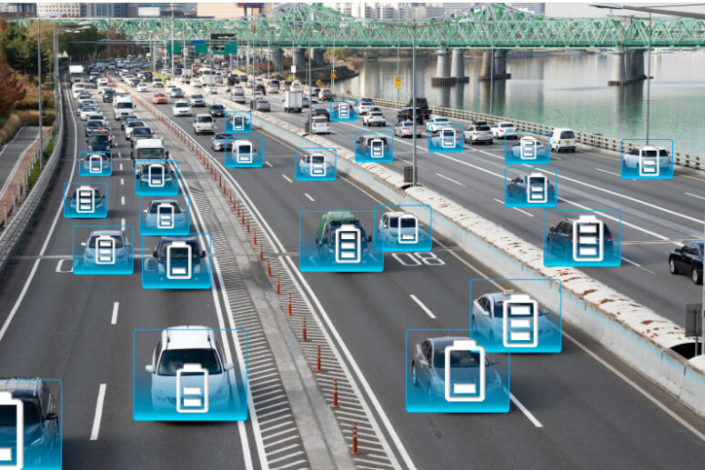

Electric vehicle (EV) stocks have emerged as a dominant force in the stock market, signaling a new era in investing. As governments worldwide push for greener transportation solutions and consumers demand sustainable options, the popularity of companies at the forefront of electric vehicle technology has skyrocketed.

This surge in interest is driven by stricter emission regulations, increasing demand for electric vehicles, and interconnections with various industries such as battery manufacturers and renewable energy companies.

Investing in EV stocks presents an incredible opportunity for both short-term gains and long-term growth, thanks to the sustained growth of the electric vehicle market.

Exploring the Hottest EV Stocks in the Market

The electric vehicle (EV) market is booming, and three stocks stand out: Tesla, NIO, and Xpeng.

Tesla revolutionized the EV industry with its innovative vehicles like Model S, 3, X, and Y. Their charging infrastructure and visionary leadership under Elon Musk have propelled their success. As a market leader, Tesla’s financial performance and expansion plans remain promising.

NIO has made significant strides in China’s EV market with its battery swapping technology and luxurious SUVs like ES8, ES6, and EC6. With government support and international aspirations, NIO is poised to become a global player.

Xpeng’s G3 SUV and P7 sedan offer impressive range and ADAS features while focusing on autonomous driving capabilities through their XPILOT system. With strong financial backing from Alibaba Group Holding Ltd., Xpeng shows potential for long-term growth.

Investing Strategies for Success in the EV Market

Diversification is crucial in the EV market to manage risk and maximize returns. By investing in a mix of established players and promising startups, you can create a well-rounded portfolio. Additionally, consider different time horizons for investment – short-term trading for quick gains and long-term holding for sustained growth.

Implementing a risk management strategy with stop-loss orders and staying informed about industry developments will safeguard your investments. By following these strategies, you can position yourself for success in the dynamic EV market.

Key Metrics for Evaluating EV Stocks

Investing in the electric vehicle (EV) market requires analyzing key financial indicators. Revenue growth, profit margins, and cash flow are crucial metrics to assess a company’s financial health. Monitoring technological advancements and staying informed about regulatory changes is also essential for investors.

By evaluating these metrics and staying updated on industry trends, investors can make informed decisions in the dynamic EV sector.

Seizing Opportunities in the Hot EV Market

Investing in electric vehicle (EV) stocks is a hot topic in the investment world, with immense potential for growth. The EV market is booming, driven by technological advancements and environmental concerns. However, it’s important to be aware of the risks involved.

The potential gains from investing in EV stocks are significant. As more countries embrace cleaner energy sources, the demand for electric vehicles is set to soar. This presents a unique opportunity for investors to capitalize on this trend and potentially achieve substantial financial rewards.

But investing in EV stocks also comes with risks. Stock prices can be volatile due to regulatory changes, technological advancements, and competition within the industry. Thorough research and staying informed about market trends are crucial to making well-informed investment decisions.

Diversification is key in this fast-paced market. Spreading investments across different companies within the industry or even diversifying into other sectors can help mitigate risk and increase chances of success.

Staying informed is vital as well. Keeping up-to-date with industry news and developments allows investors to navigate the rapidly evolving landscape of EV technology and regulations.

[lyte id=’T5S7jjsK_6o’]

.JPG/120px-Metropolitan_Railway_electric_stock_trailer_carriage%2C_1904_(02).JPG)