Investing in the stock market can be exciting and profitable, but it requires careful analysis and prediction of stock prices. One stock gaining attention is HNHAF, a company operating in the [industry] sector. With rising stock prices, investors from around the world are taking notice.

In this article, we’ll explore the factors influencing HNHAF stock prices and techniques used to predict their future movement.

HNHAF stands for [Company Name], a leading player in the [industry] industry. Known for innovation and high-quality products/services, they have a strong track record that attracts investors. Market trends, economic indicators, industry performance, and company-specific developments impact HNHAF stocks.

By analyzing these factors, investors gain insights into potential future movements.

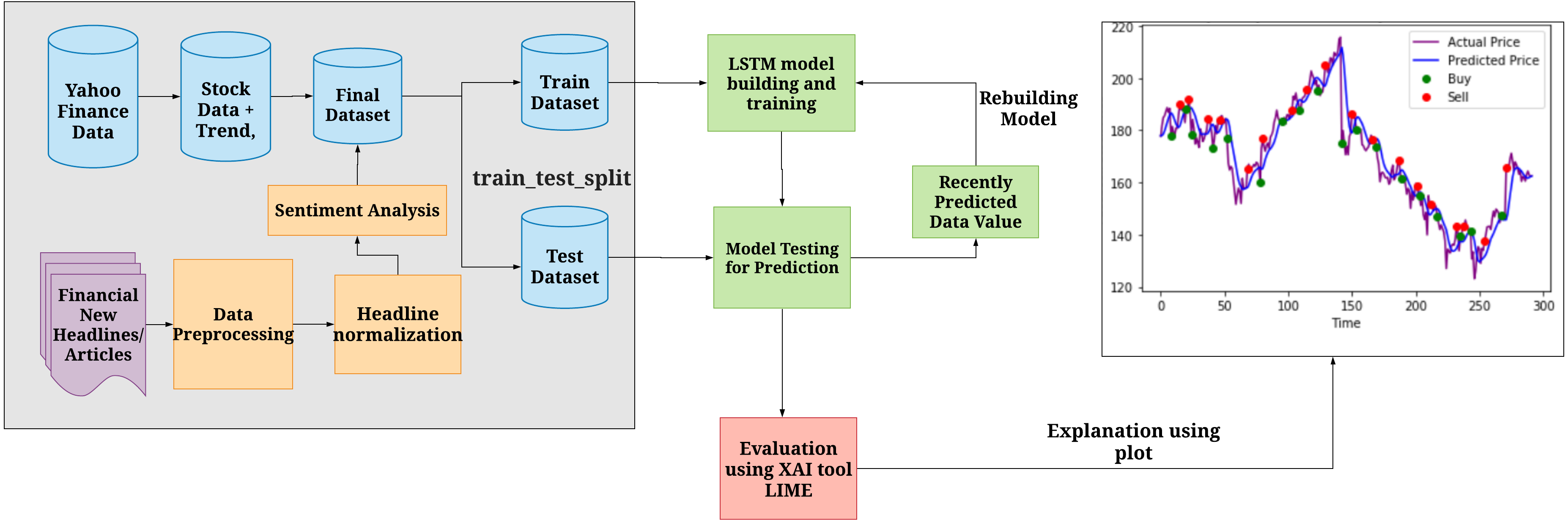

To make informed predictions about HNHAF stock prices, investors use fundamental analysis to evaluate financial statements and market trends. Technical analysis examines historical price patterns and trading volumes. Sentiment analysis gauges public opinion through social media and news articles.

Combining these approaches with thorough research enhances prediction accuracy.

Overview of the Recent Performance and Popularity of HNHAF Stocks

When considering potential investment opportunities, it is important to examine the recent performance and popularity of stocks. In this case, we will focus on HNHAF stocks, which have gained significant attention from investors in recent years.

HNHAF has consistently demonstrated impressive growth and profitability over the past few years. Through their innovative products and strong financial performance, they have captured the attention of investors seeking promising opportunities in the market. This success has translated into a surge in popularity for HNHAF stocks.

One of the main factors contributing to the increased popularity of HNHAF stocks is their significant price appreciation. Investors are attracted to these stocks due to the potential for high returns on their investments. As more market participants recognize the value and growth potential of HNHAF, demand for its stocks continues to rise.

Positive sentiment surrounding HNHAF’s future prospects and industry trends has also fueled its popularity among investors. The company’s ability to adapt to changing market dynamics and capitalize on emerging trends has instilled confidence in shareholders. This positive outlook further enhances investor interest in HNHAF stocks.

In summary, HNHAF stocks have experienced remarkable performance and widespread popularity among investors due to their consistent growth, financial strength, innovative products, and positive market sentiment. Understanding these factors can help investors make informed decisions when considering investing in HNHAF or similar companies.

| Key Points |

|---|

| – HNHAF has shown impressive growth and profitability |

| – Innovative products contribute to its strong financial performance |

| – Significant price appreciation makes it an attractive choice for high returns |

| – Positive sentiment about future prospects enhances investor interest |

What is stock price prediction?

Stock price prediction involves the analysis and forecasting of future movements in a company’s stock prices. By examining historical data, market trends, and other relevant factors, investors can gain valuable insights to guide their investment decisions.

This process entails analyzing various variables and utilizing different techniques to estimate potential changes in stock prices.

The primary goal of stock price prediction is to provide investors with the necessary information to make informed decisions. Accurately predicting whether a stock’s price will rise or fall enables investors to strategically buy or sell shares at opportune times. By doing so, they can maximize their profits and minimize potential losses.

To predict stock prices, analysts examine historical patterns and trends in the financial markets. They consider factors such as company performance, industry conditions, economic indicators, and investor sentiment.

Advanced statistical models and machine learning algorithms are often employed to analyze large datasets and identify patterns that may influence future stock prices.

It is important to note that while stock price prediction can provide valuable insights, it is not foolproof. The financial markets are complex and influenced by numerous unpredictable factors. Therefore, predictions should be used as one tool among many when making investment decisions.

Importance of Stock Price Prediction for Investors

Accurate stock price prediction is essential for investors as it allows them to make informed decisions and effectively manage their portfolios. By accurately forecasting stock prices, investors can identify investment opportunities, mitigate risks, and optimize portfolio management.

Identifying investment opportunities: Stock price prediction helps investors spot undervalued stocks with growth potential before the market catches up. This allows them to capitalize on opportunities and maximize returns.

Mitigating risks: Predicting stock price movements enables investors to anticipate market downturns and take necessary precautions. They can set stop-loss orders or diversify their portfolios to protect their investments.

Optimizing portfolio management: Accurate predictions allow investors to adjust their portfolio allocation based on expected returns and risks. They can strategically buy or sell stocks to rebalance portfolios and maximize overall returns.

Considering these advantages, it is crucial to explore the factors that affect HNHAF stock prices.

Factors Affecting HNHAF Stock Prices

To understand HNHAF stock prices, it is important to consider various influencing factors:

-

Industry Trends: Performance of HNHAF’s industry affects its stock price. Factors like emerging technologies or regulatory changes impact financial performance and share prices.

-

Company Performance: Evaluating HNHAF’s financial health, including revenue growth and profitability, helps understand stock price dynamics.

-

Macroeconomic Factors: Broader economic indicators like inflation rates or interest rates influence HNHAF’s stock prices.

-

Market Sentiment: Investor perception, influenced by media coverage or analyst reports, impacts demand for HNHAF shares.

-

Competitive Landscape: Market share, innovation capabilities, and strategic partnerships play a role in determining investor perceptions of HNHAF’s long-term prospects and valuation.

Considering these factors alongside accurate predictions empowers investors to navigate the complexities of the stock market effectively.

Economic Factors Influencing HNHAF Stock Prices

HNHAF stock prices are influenced by various economic factors, both globally and within the industry. Global economic trends such as interest rates, inflation rates, GDP growth, and geopolitical events directly impact investor sentiment towards HNHAF.

Industry-specific factors like technological advancements, regulatory changes, competitive landscape dynamics, and consumer demand also play a crucial role in determining the company’s financial health and investor perception. Understanding these economic factors is essential for making informed investment decisions in HNHAF stocks.

Company-specific factors influencing HNHAF stock prices

Investors keenly observe various company-specific factors that can significantly impact the stock prices of HNHAF. One crucial aspect is the financial performance and earnings reports of the company. Investors closely monitor metrics such as revenue growth, profitability ratios, debt levels, and cash flow.

Positive financial results and strong earnings reports have the potential to drive up the stock price of HNHAF. Conversely, poor performance may lead to a decline in stock prices as investors become concerned about the company’s stability and future prospects.

Another influential factor is noteworthy events like product launches, partnerships, or acquisitions by HNHAF. These significant developments can have a profound impact on the company’s stock prices. When HNHAF introduces new products into the market, it signals growth potential and market expansion.

Likewise, strategic partnerships or acquisitions can boost investor confidence in the company’s ability to navigate competitive landscapes effectively. As a result, these events attract investors’ attention and contribute to driving up the stock price of HNHAF.

It is essential for potential investors to consider these company-specific factors when evaluating whether to invest in HNHAF. By closely monitoring its financial performance as well as keeping an eye on significant events like product launches or partnerships, investors can make informed decisions about buying or selling HNHAF stocks.

Now that we have explored the key factors influencing HNHAF stock prices let’s delve into some traditional approaches used for predicting stock prices accurately.

Traditional Approaches for Stock Price Prediction

Fundamental Analysis for Predicting HNHAF Stock Prices

To predict HNHAF stock prices, investors rely on fundamental analysis. This involves evaluating the company’s financial statements and ratios, as well as assessing industry trends and competition.

By analyzing key financial indicators and understanding the broader market landscape, investors can gain valuable insights into the potential performance of HNHAF stock. Ultimately, this comprehensive approach helps investors make informed decisions and accurate predictions about HNHAF’s stock price movements.

Technical Analysis for Predicting HNHAF Stock Prices

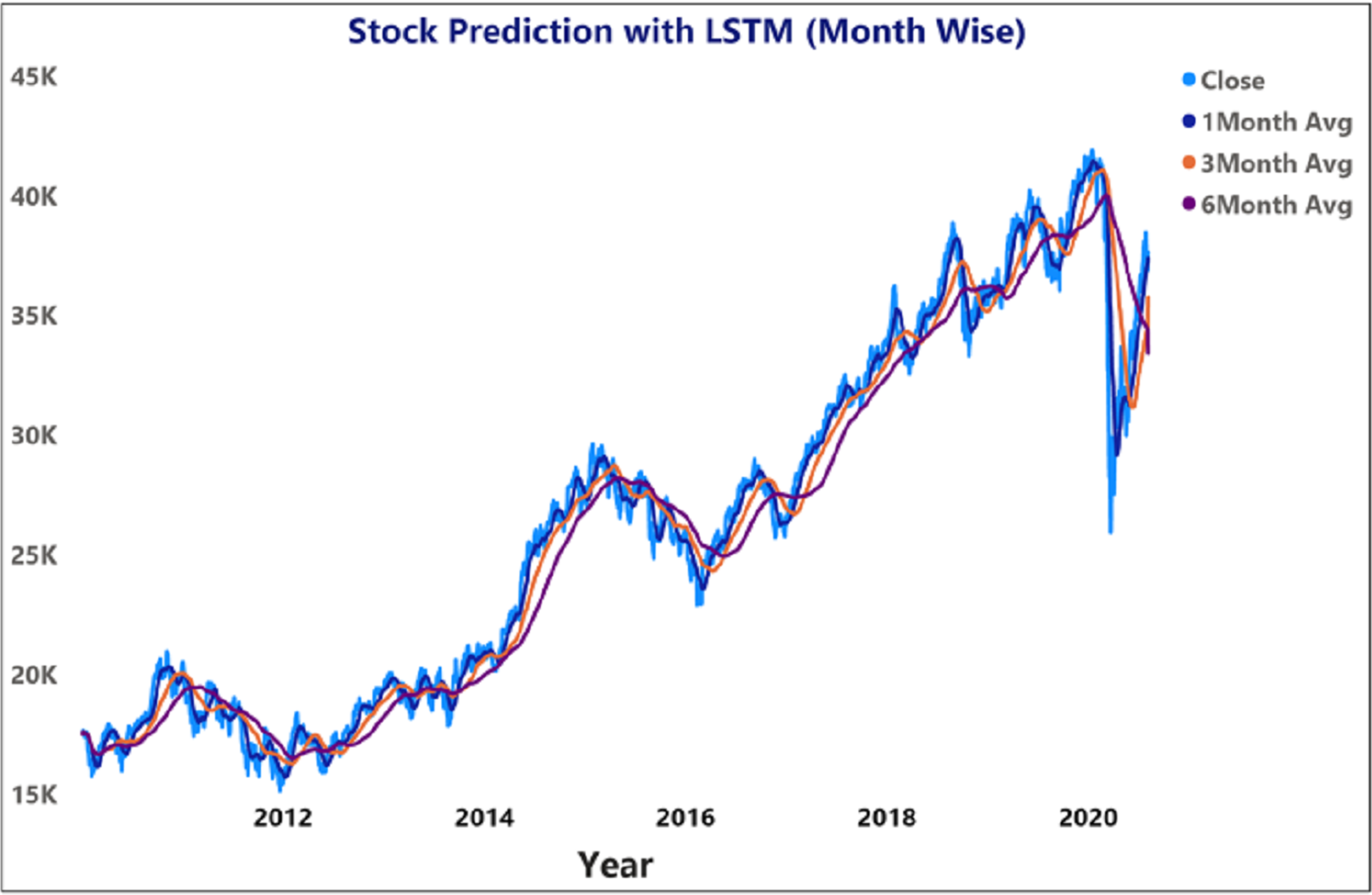

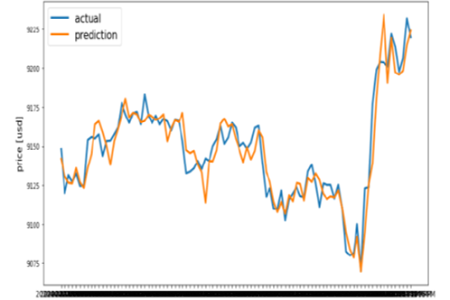

Analyzing historical price patterns and trends is key to technical analysis for predicting HNHAF stock prices. By studying past price data using techniques like charting and trend lines, investors can identify patterns that may help predict future movements.

Additionally, traders use technical indicators such as moving averages and relative strength index (RSI) to generate buy or sell signals. Emerging trends in stock price prediction include the integration of artificial intelligence (AI) and machine learning algorithms, sentiment analysis, and the use of big data analytics.

By staying updated with these trends, investors can make more informed decisions when it comes to predicting HNHAF’s stock prices.

[lyte id=’C9z6BYobCRg’]