Gold’s timeless beauty and scarcity have captivated humanity for centuries. Beyond aesthetics, gold is recognized as a reliable store of value throughout history. In times of economic uncertainty, political instability, or inflationary pressures, investors turn to gold as a safe haven asset.

Its limited supply, ability to hedge against inflation, and diversification benefits make gold an enduring investment option.

Brief History of Gold’s Role as a Store of Value

Gold has been a trusted store of value for thousands of years. Ancient civilizations like Egypt and Rome recognized its worth and used it as a medium of exchange. During times of crisis, people would trade their paper money for gold to protect their wealth.

In more recent history, the gold standard provided stability to the global economy, with many countries pegging their currencies to gold. Even after its abandonment, central banks still hold significant reserves of gold as a means of diversifying their currency holdings.

Gold’s enduring appeal lies in its timeless beauty and ability to preserve wealth throughout history.

Exploring why investors are drawn to gold in uncertain times

During periods of economic uncertainty and market volatility, investors are often drawn to gold. One key reason is its negative correlation with other assets – when stock markets decline or currencies depreciate, the price of gold tends to rise. This inverse relationship allows investors to diversify their portfolios and mitigate risk.

Gold is also seen as a hedge against inflation, preserving purchasing power in times of monetary expansion. Its tangible nature and universal appeal further contribute to its allure as a stable investment option during uncertain times.

Definition and Explanation of an Exchange-Traded Fund (ETF)

An Exchange-Traded Fund (ETF) is an investment fund that trades on stock exchanges like individual company stocks. It provides investors with exposure to a diversified portfolio of assets such as stocks, bonds, or commodities.

The main advantages of ETFs are their lower costs compared to traditional mutual funds and the ability to achieve instant diversification without buying individual securities. ETFs track specific market indices or sectors and can be bought and sold throughout the day at market prices, offering flexibility and liquidity.

Transparency is another key feature, as ETFs disclose their holdings daily, allowing investors to make informed decisions based on their investment goals. The popularity of ETFs has been steadily growing due to these attractive features for both retail and institutional investors seeking cost-effective diversification in their portfolios.

Introducing the Concept of a Gold Exploration ETF

A Gold Exploration ETF focuses on companies involved in exploring and developing gold mines. These companies conduct geological surveys, drilling, sampling, and analysis to identify potential gold deposits.

Investing in this type of ETF provides exposure to multiple companies in the gold exploration industry, spreading risk across various projects and increasing the likelihood of benefiting from successful discoveries.

It offers convenience, diversification, lower transaction costs, and indirect participation in the potential upside of gold discoveries. Overall, a Gold Exploration ETF is an enticing investment option for those interested in the gold mining industry without assuming significant risks associated with individual companies.

Investing in a Gold Exploration ETF offers several advantages for investors seeking exposure to the gold mining sector. First, it provides instant diversification by including multiple companies involved in gold exploration, reducing the impact of individual company performance on overall portfolio returns.

Additionally, as an exchange-traded fund, shares can be bought or sold throughout the trading day at market prices, ensuring liquidity and flexibility. Compared to investing in individual gold exploration companies, a Gold Exploration ETF offers cost efficiency due to its diversified nature and avoids high transaction costs or management fees.

Finally, these funds are managed by experienced professionals who actively monitor and rebalance holdings, ensuring they remain well-positioned to capture potential opportunities within the sector.

In the next section, we will explore the process of gold exploration and shed light on the methods used to uncover hidden treasures beneath the Earth’s surface.

Understanding Gold Exploration: Seeking Hidden Treasures

Understanding the Process and Methods of Gold Exploration

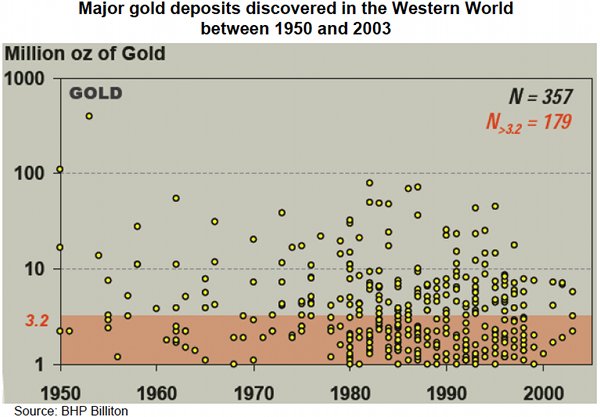

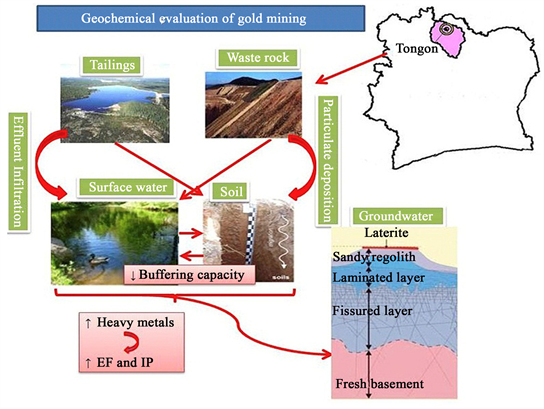

Gold exploration involves a systematic approach to identify areas with potential gold deposits. It begins with geological surveys to narrow down regions with favorable conditions. Promising sites are then drilled to extract core samples for analysis. These samples undergo testing to determine gold content and economic viability.

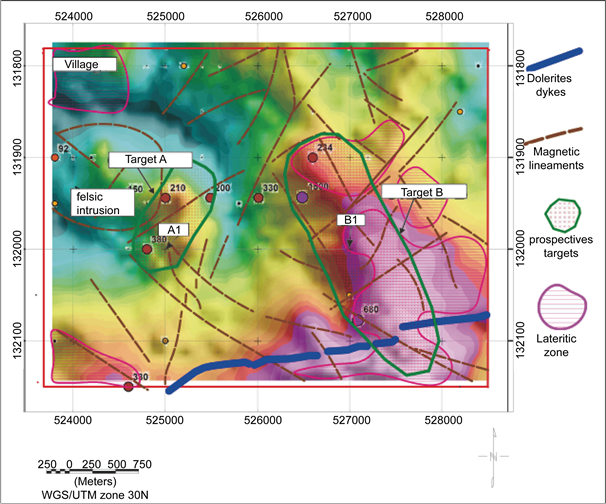

Positive results may lead to further exploration efforts, including additional drilling and sampling to understand deposit size and grade. Geophysical surveys help refine understanding of the deposit’s characteristics. By following this process, companies increase their chances of discovering economically viable gold deposits.

Geological Surveys and Assessments for Potential Discovery Sites

Geological surveys are essential in identifying areas with high mineral potential, including gold deposits. Geologists utilize techniques such as studying rock formations, mineral alteration patterns, soil geochemistry, and geophysical anomalies to pinpoint regions worth investigating.

Advanced technologies like satellite imagery provide valuable information about surface features and terrain characteristics that aid in identifying prospective areas for further exploration.

Additionally, airborne geophysical surveys using magnetic or electromagnetic sensors help detect subsurface anomalies that may indicate the presence of mineral deposits.

By combining these survey methods with research on historical mining activities and known occurrences, geologists can prioritize areas with the highest likelihood of containing economically viable gold deposits.

In summary, geological surveys play a crucial role in discovering potential gold sites. Techniques such as analyzing rock formations and utilizing advanced technologies like satellite imagery and airborne surveys guide exploration efforts to target areas with higher chances of success.

[lyte id=’H_jFbGoEvtQ’]