Investing in genome sequencing companies has become an exciting opportunity for those looking to capitalize on the cutting-edge field of genomics. As advancements in technology continue to drive the genomic revolution, these companies hold immense potential for growth and innovation.

In this article, we will delve into the significance of genome sequencing, explore prominent companies in the industry, analyze market performance and investment opportunities, discuss risks and challenges associated with genome sequencing stocks, highlight investment strategies, and provide case studies of successful investments.

Join us as we unravel the world of genome sequencing companies and discover the vast possibilities they offer for investors interested in both learning about genomics and making sound financial decisions.

Understanding the Genomic Revolution

The genomic revolution has transformed our understanding of genetics, thanks to advancements in genome sequencing. This process enables scientists to decode the genetic makeup of organisms by determining the order of nucleotides within DNA molecules.

Genome sequencing has profound implications for human health, as it helps identify genetic variations responsible for inherited disorders and enables personalized medicine. Additionally, it aids in biodiversity conservation by tracking population dynamics and unveiling evolutionary relationships between species.

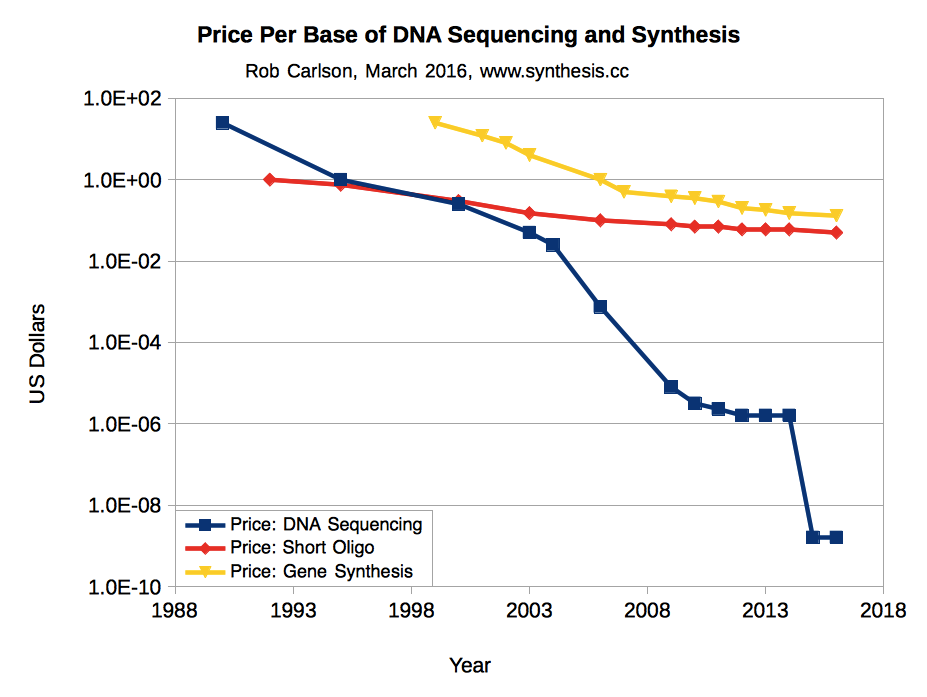

Companies have played a crucial role in advancing genomics through investments in technology and research. Their contributions have accelerated progress, improved sequencing capabilities, and reduced costs associated with data analysis.

As we continue to explore the genomic revolution, we can expect even more breakthroughs that will shape the future of medicine, biology, and our understanding of life itself.

Exploring Prominent Genome Sequencing Companies

In the field of genomics, two prominent companies are leading the way in revolutionizing precision medicine and genetic research.

Company A has made significant breakthroughs in personalized medicine by leveraging genomic data analysis. They offer key products and services that enable healthcare providers to tailor treatments based on an individual’s unique genetic makeup.

Collaborations with healthcare providers further enhance clinical decision-making processes, resulting in improved patient outcomes.

Company B has a rich history of contributing to our understanding of complex diseases through extensive genomic research. Their work has provided invaluable insights into the underlying genetic mechanisms of various conditions.

Additionally, they have developed advanced sequencing technologies that have revolutionized the field, making genome sequencing more accessible, affordable, and efficient.

These prominent genome sequencing companies are driving innovation and shaping the future of genomics, bringing us closer to a more personalized approach to healthcare.

Analyzing Market Performance and Investment Opportunities

The genomics industry is experiencing rapid growth, making it an attractive market for investors. Recent trends show increased demand for genetic testing and personalized treatments, presenting significant investment opportunities.

When evaluating investments in this sector, it is crucial to review key financial performance indicators such as revenue growth and profitability. Comparing these metrics across companies provides valuable insights into their market position and future earnings potential.

By analyzing growth potential, market projections, and financial performance, investors can make informed decisions within the dynamic genomics industry.

Risks and Challenges Associated with Genome Sequencing Stocks

Genome sequencing stocks face regulatory hurdles and ethical concerns, including compliance with data privacy laws and the responsible usage of genetic information. The competitive landscape is dynamic, with mergers, acquisitions, and partnerships shaping the industry.

Additionally, emerging technologies like CRISPR gene editing pose competition to traditional sequencing methods. Investors must navigate these challenges to maximize their investments in genome sequencing stocks.

| Category | Risks/Challenges |

|---|---|

| A.Regulatory hurdles and ethical considerations | 1.Compliance with data privacy laws and regulations 2.Ethical concerns surrounding genetic information usage |

| B.Competitive landscape and industry consolidation | 1.Impact of mergers, acquisitions, and partnerships 2.Competition from emerging technologies |

In summary, genome sequencing stocks face challenges related to regulations, ethics, competition, and technological advancements. Investors need to carefully assess these risks in order to make informed investment decisions.

Investment Strategies for Genome Sequencing Stocks

Before investing in genome sequencing stocks, it’s important to consider key factors that can impact your investment outcomes. Conduct a thorough market analysis to assess growth prospects and understand the demand for genomic sequencing services.

Evaluate companies’ financial stability and competitive advantage to determine their long-term viability. Diversify your portfolio by spreading investments across different genomics companies or related sectors like pharmaceuticals or biotechnology.

Balancing risk through diversification and considering investments in related sectors can help manage risks effectively while tapping into potential growth opportunities in the genomics industry.

Case Studies: Successful Investments in Genome Sequencing Stocks

Investing in genome sequencing stocks has emerged as a promising opportunity in recent years. Two case studies provide valuable insights into successful investments in this field.

Company X has experienced impressive growth in the genome sequencing sector. By investing in cutting-edge technology and research capabilities, they have positioned themselves as a leader. They have also identified niche areas within the market and capitalized on high-growth opportunities.

Investor Y has achieved remarkable results through a well-thought-out portfolio strategy focused on genome sequencing stocks. Their recommendations include diversifying investments, staying informed about scientific breakthroughs and regulations, and maintaining a long-term perspective.

These case studies highlight the importance of thorough research and analysis when considering investments in genome sequencing stocks.

The Future of Genome Sequencing Companies Stocks

[lyte id=’2_9cEPa2lo8′]