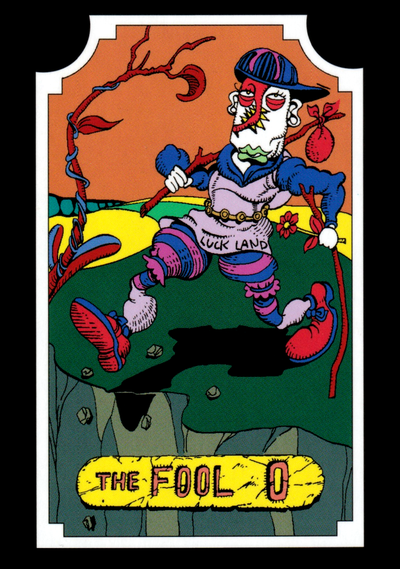

Credit cards can be a useful tool for managing your finances and building credit. However, not all credit cards are created equal. In the world of investing, there is a specific type of credit card known as “fool credit cards” that come with their own set of risks and considerations.

In this article, we will delve into the potential pitfalls of fool credit cards and explore alternative options.

So, if you’re interested in learning more about investing and making informed decisions when it comes to credit cards, keep reading!

Understanding the Risks of Fool Credit Cards

Fool credit cards carry risks that consumers should consider. The potential for overspending and accumulating debt is a major concern, as these cards often have high spending limits. To avoid this trap, establish a budget and stick to it, avoiding impulsive purchases.

Fool credit cards also come with higher interest rates compared to traditional ones. Be aware of the Annual Percentage Rate (APR) and consider alternative options with lower rates. Additionally, fool credit cards may have limited acceptance and potential usage restrictions.

Research their acceptance in different locations and understand any limitations imposed by the issuer. By understanding these risks, consumers can make informed decisions about their financial well-being.

Assessing Your Financial Readiness for Fool Credit Cards

Before considering a fool credit card, it’s crucial to assess your financial readiness. Evaluate your income, expenses, and savings to determine if you have the stability to manage credit card payments effectively.

Consider whether you can comfortably handle additional credit obligations and if you’re already struggling with existing financial commitments. If you’re not yet ready or uncomfortable with the associated risks, focus on building a strong foundation first.

Establish an emergency fund to cover unexpected expenses and prioritize paying off existing debts or loans. By doing so, you’ll position yourself for better financial stability and potentially more favorable borrowing terms in the future. Remember to make informed decisions that align with your current circumstances and goals.

Exploring Alternative Credit Card Options

When it comes to credit cards, there are alternatives worth considering if you’re not comfortable with the risks associated with fool credit cards. Two popular options include traditional credit cards with rewards programs and secured credit cards for building or rebuilding credit.

Traditional credit cards with rewards programs provide attractive benefits while still giving you access to necessary funds. Research popular providers that align with your financial goals and compare their benefits and features to those of fool credit cards.

Secured credit cards require a security deposit upfront and can be helpful for individuals looking to build or rebuild their credit history. They offer a safer alternative to fool credit cards, but responsible usage is still crucial for maximum benefits.

By exploring these alternative options thoroughly, weighing their benefits, features, and risks, you can choose the option that best suits your financial needs and goals. Remember to prioritize responsible usage and consider seeking professional advice if needed.

Tips for Responsible Credit Card Usage in General

Responsible credit card usage is key, regardless of the type of card you have. Here are some important tips to keep in mind:

- Know your spending limits and set a budget to avoid falling into debt traps.

- Track your expenses diligently and stay within your means.

- Resist unnecessary purchases that don’t align with your financial goals.

- Pay your credit card bills on time and in full each month to maintain good credit health.

- Consider setting up reminders or automatic payments to avoid late fees and damage to your credit score.

- Prioritize paying off any outstanding balances to minimize high interest charges.

By following these tips, you can use your credit card responsibly, maintain control over your finances, and build a strong credit history.

Common Misconceptions about Fool Credit Cards

To make informed decisions about credit cards, it’s important to address common misconceptions surrounding fool credit cards. One misconception is the promise of lucrative cashback rewards. However, it’s crucial to understand the limitations and requirements associated with these rewards.

Some programs may have specific spending categories or maximum limits on cashback earnings.

Another misconception is the earning potential of cashback rewards. Before deciding solely based on potential earnings, evaluate whether the rewards align with your spending habits and financial goals.

Building credit with fool credit cards requires responsible credit habits. Simply having a card is not enough; consistent payments, low utilization rates, and overall responsible financial behavior are essential.

Making an Informed Decision on Fool Credit Cards

When considering fool credit cards, it’s crucial to weigh the risks and benefits before making a decision. Consider your financial goals, preferences, and readiness. Explore alternatives like traditional rewards or secured credit cards with better terms.

Use any credit card responsibly by setting a budget, tracking expenses, paying bills on time, and prioritizing debt repayment. By understanding the risks and exploring other options available, you can make a wise decision that aligns with your financial wellbeing.

[lyte id=’VST-tCsVgQQ’]