Investing in the stock market is a popular way to grow wealth and take advantage of emerging industries. One sector that has been capturing investors’ attention is electric vehicles (EVs). With increasing concerns about climate change and the need for sustainable transportation solutions, the demand for EVs has skyrocketed in recent years.

This article will explore why investing in EV stocks can be a smart move and provide insights into some top EV stock picks for investors.

The Rise of Electric Vehicles (EVs)

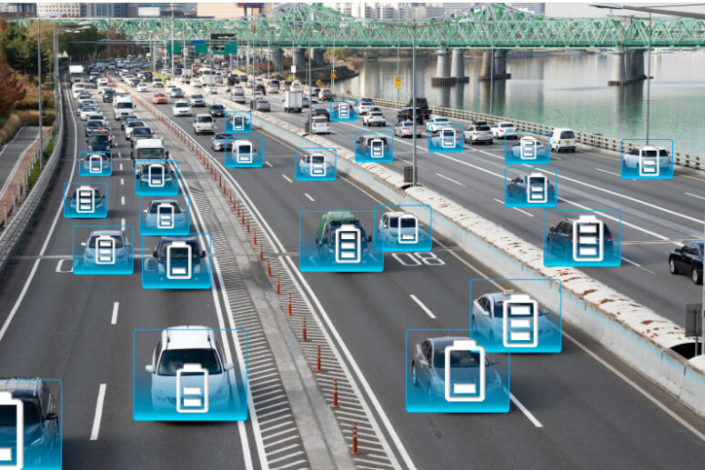

The world is experiencing a significant shift in transportation as electric vehicles (EVs) gain popularity. This rise can be attributed to factors like environmental consciousness, technological advancements, government policies, cost reduction, and increasing charging infrastructure.

Consumers are opting for EVs due to their eco-friendly nature, producing zero emissions and reducing air pollution. Technological advancements in battery technology have improved EV performance and range. Government policies incentivize adoption through tax credits and subsidies.

Cost reductions make EVs more affordable, while expanding charging infrastructure addresses range anxiety concerns.

In summary, the rise of electric vehicles is driven by environmental awareness, technological progress, supportive policies, cost reduction, and improved charging infrastructure. As these trends continue to evolve, we can expect greater adoption of EVs and a significant impact on transportation worldwide.

Investing in EV Stocks: An Opportunity Worth Considering

Investing in electric vehicle (EV) stocks offers a smart move for several reasons. Firstly, the electric vehicle industry is experiencing rapid growth, presenting investors with the potential for significant returns.

Secondly, electric vehicles have the power to disrupt the traditional automotive industry, benefiting companies at the forefront of this transition. Lastly, investing in EV stocks aligns portfolios with sustainable and socially responsible initiatives, as governments and consumers increasingly favor environmentally friendly solutions.

The potential growth and profitability of the EV industry are attracting investors from various sectors. Research suggests that the global electric vehicle market is projected to reach $802.81 billion by 2027, growing at a compound annual growth rate of 22.6%.

As battery technology improves and costs decline, EV manufacturers’ profit margins are expected to increase further. Additionally, advancements in charging infrastructure and autonomous driving technology contribute to the industry’s growth potential.

Top EV Stock Picks for Investors

As the demand for electric vehicles (EVs) continues to soar, investors are seeking opportunities in this growing market. Here are some top EV stock picks to consider:

-

Company A: This industry leader has a strong track record of innovation and market success. Known for cutting-edge EVs and advancements in battery technology, Company A is well-positioned for future growth.

-

Company B: With a focus on quality and innovation, Company B has formed strategic partnerships with key stakeholders in the EV ecosystem. These alliances strengthen its market position and enhance its ability to deliver comprehensive solutions.

-

Company C: Standing out through unique selling points, Company C captures a specific segment of consumers seeking distinct benefits. Its differentiation strategy positions it well for market share.

When considering these stock picks, evaluate each company’s financial stability and growth potential based on key indicators such as revenue growth and profitability ratios. Additionally, stay aware of risks such as increased competition and regulatory uncertainties that can impact the performance of these companies.

Investing in EV stocks presents exciting opportunities, but it’s crucial to navigate the risks associated with this rapidly evolving sector. In the following sections, we will explore important factors to consider when choosing EV stocks and delve into the specific risks involved in investing in this dynamic industry.

Factors to Consider When Choosing EV Stocks for Investment

Investing in electric vehicle (EV) stocks requires careful consideration of market trends, management teams, and financial indicators. Monitoring government policies, technological advancements, and consumer demand helps identify companies with growth potential.

Evaluating a company’s management team and corporate strategy provides insights into their long-term success. Analyzing revenue growth, profit margins, and cash flow generation helps assess a company’s financial health. By considering these factors, investors can make informed decisions when choosing EV stocks for their portfolios.

In the next sections, we will discuss the risks associated with investing in EV stocks and provide tips for successful investing in this dynamic sector.

Risks Associated with Investing in EV Stocks

Investing in electric vehicle (EV) stocks comes with its fair share of risks. The evolving nature of the industry brings intense competition, requiring investors to evaluate a company’s competitive positioning.

Technological advancements can render existing solutions obsolete, making it essential to assess a company’s commitment to research and development. Regulatory changes impact consumer demand and company profitability, necessitating awareness of global developments.

Market volatility caused by factors like supply chain disruptions or global events is also a risk factor. Successful investing in the EV sector requires careful analysis and staying informed about industry trends.

Tips for Successful Investing in the EV Sector

Investing in the electric vehicle (EV) sector requires a strategic approach to maximize potential returns. Here are three essential tips for successful investing in this dynamic industry:

-

Diversify your portfolio: Spreading investments across different companies within the EV industry helps mitigate risks associated with individual stocks and allows you to take advantage of potential growth opportunities.

-

Stay updated on industry news and trends: Keeping abreast of the latest industry news, technological advancements, and market trends enables you to make well-informed investment decisions. Follow reputable sources, attend conferences, and engage with online communities to gain valuable insights.

-

Regularly review and reassess your investment strategy: The EV sector is constantly evolving, so it’s essential to regularly review and adjust your investment strategy. Monitor financial performance, market dynamics, and emerging trends to ensure your investments align with changing conditions.

By incorporating these tips into your investment approach, you can position yourself to capitalize on the promising growth of the electric vehicle market.

Conclusion

[lyte id=’7yFkZM2w54Q’]