The electric vehicle (EV) industry is experiencing tremendous growth as the world shifts towards sustainable transportation. With increasing concerns about climate change and environmental sustainability, there is a rising demand for electric vehicles.

In this article, we will explore the factors driving the growth of the EV industry and why investing in EV stocks can be a smart financial move.

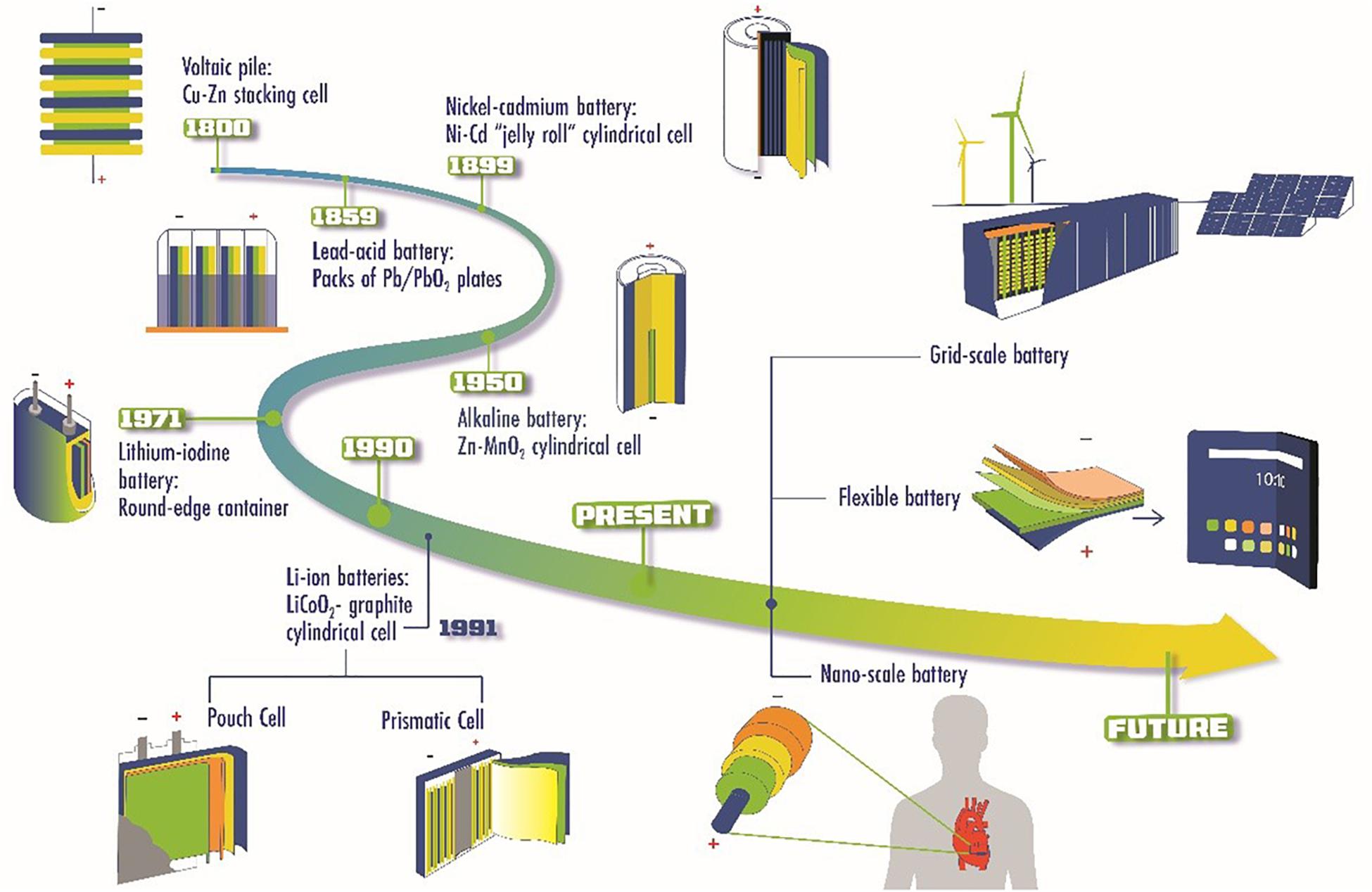

Advancements in technology have made electric vehicles a viable alternative to traditional cars. Improved battery technology and charging infrastructure have contributed to their mainstream acceptance. Governments worldwide are supporting this shift through tax credits and subsidies.

The reduction in greenhouse gas emissions is another key driver of the EV industry’s growth. As governments aim to meet carbon reduction targets, they encourage the adoption of cleaner transportation options. Electric vehicles produce zero tailpipe emissions, making them attractive to environmentally-conscious consumers.

Electric vehicles also offer advantages over conventional cars. They have lower operating costs due to fewer moving parts and no need for regular maintenance associated with traditional engines. Range anxiety has been addressed through longer ranges on a single charge and expanding charging infrastructure networks.

Investing in EV stocks presents an opportunity for financial gain as demand for electric vehicles continues to rise. Companies involved in EV production and technology development are experiencing significant growth. However, thorough research and market analysis are crucial before making investment decisions.

The future of the electric vehicle industry looks promising as sustainability becomes a top priority globally. By understanding its growth factors and potential financial benefits, individuals can position themselves for success while contributing to a greener future.

Factors Driving the Growth of EVs

The growth of the electric vehicle (EV) industry is propelled by several key factors. Environmental concerns and global climate change have fostered strong public support for cleaner alternatives to traditional gasoline-powered vehicles. Government regulations, such as tax credits and stricter emission standards, have accelerated EV adoption.

Technological advancements, including improved battery technology and autonomous driving capabilities, have made electric vehicles more attractive. The expanding charging infrastructure network and changing consumer preferences towards greener transportation also contribute to the rise of EVs.

Overall, these factors are driving the remarkable growth witnessed in the EV industry, making them a promising and sustainable mode of transportation for the future.

Understanding the Potential for Profitable Investments in the EV Industry

The EV industry is booming, presenting a lucrative opportunity for investors. With governments pushing for electrification and consumers embracing eco-friendly transportation, there is a high demand for electric vehicles.

This demand, coupled with advancements in EV technology and infrastructure development, offers significant growth potential for companies operating in this industry.

Governments worldwide are implementing policies and incentives to drive the adoption of electric vehicles, creating a favorable regulatory environment. Consumer preferences are also shifting towards cleaner alternatives, increasing the sales of electric vehicles globally.

Technological advancements, particularly in battery technology, have addressed concerns about range anxiety and charging times. Additionally, infrastructure development focuses on establishing charging networks that alleviate range anxiety and boost consumer confidence.

Investing in the EV industry provides opportunities across various sectors, from automakers to battery production, charging infrastructure, and renewable energy solutions. The stage is set for exponential growth within this market as governments support electrification efforts and consumers embrace sustainable mobility options.

Explaining why investing in EV stocks can be a smart financial move

Investing in EV stocks can be a wise financial decision for several reasons. The demand for electric vehicles is on the rise as consumers recognize the benefits of lower fuel costs, reduced maintenance expenses, and a smaller carbon footprint.

Leading manufacturers like Tesla, NIO, and General Motors have established themselves as key players in the industry with innovative technology and strong market positions.

Additionally, governments worldwide are committed to reducing carbon emissions and transitioning to cleaner transportation solutions, ensuring sustained demand for electric vehicles. By investing in this growing industry early on, investors can tap into substantial long-term growth potential while supporting a greener future.

Highlighting Key Players in the EV Market and Their Stock Performance

The EV market has seen remarkable growth, attracting investors seeking opportunities in this thriving industry. Let’s explore the key players in the EV market and analyze their stock performance, focusing on their dominance and potential.

Tesla Inc., a global leader in the EV industry, has consistently delivered impressive stock performance. From its IPO in 2010 to present day, Tesla’s stock price has soared, reflecting investor confidence. Tesla’s innovative technology, manufacturing capabilities, and global expansion plans have played a significant role in its success.

NIO Inc., one of China’s prominent electric vehicle manufacturers, is gaining traction both domestically and internationally. NIO’s stock performance reflects growing investor confidence in the company’s potential.

Notably, NIO’s unique business model and battery swapping technology address concerns surrounding range anxiety, making it an attractive option for investors.

General Motors Company (GM), a renowned automotive manufacturer, is committed to electrification. GM’s stock performance demonstrates investor recognition of its efforts to transition towards electric vehicles.

Leveraging its strong legacy and strategic partnerships with major tech companies, GM aims to secure its position in the evolving EV landscape.

Investing in EVs offers exciting opportunities due to their growth potential and sustainability. By analyzing key players like Tesla Inc., NIO Inc., and General Motors Company, we gain insights into the current state of the EV market and assess their stock performance.

These companies showcase dominance within their markets while driving innovation for a greener future.

Highlighting Lesser-known but Promising Players in the EV Industry

In addition to well-known brands like Tesla and NIO, there are several lesser-known yet promising players making waves in the electric vehicle (EV) industry. One such player is Xpeng Inc., which has experienced rapid growth in China’s competitive market.

With a focus on innovation and autonomous driving capabilities, Xpeng is carving out a niche within the EV industry. Similarly, Rivian Automotive LLC stands out with strategic partnerships and plans for electric trucks and SUVs.

When investing in the EV stock market, thorough research, diversification, and consideration of long-term growth potential are key. While there are risks associated with this sector, staying informed and conducting due diligence can lead to exciting opportunities within the EV industry’s sustainable future.

| Key Factors for Investment |

|---|

| Thorough research |

| Diversify investments |

| Consider long-term growth potential |

| Acknowledge risks and challenges |

[lyte id=’gv9CFkbz590′]