Investing in the stock market has always been a popular choice for those looking to grow their wealth. Over the years, investors have witnessed the rise and fall of various industries, each with its own unique set of opportunities and challenges. One such industry that has been gaining significant attention is energy ventures stock.

Introduction to the Topic

Energy ventures stock refers to investments made in companies involved in the exploration, development, and production of energy resources. This includes traditional oil and gas producers as well as emerging renewable energy start-ups.

With growing concerns about climate change and the need for sustainable energy solutions, investing in energy ventures has become an attractive option. It allows investors to align their financial goals with their ethical values while capitalizing on the demand for clean energy alternatives.

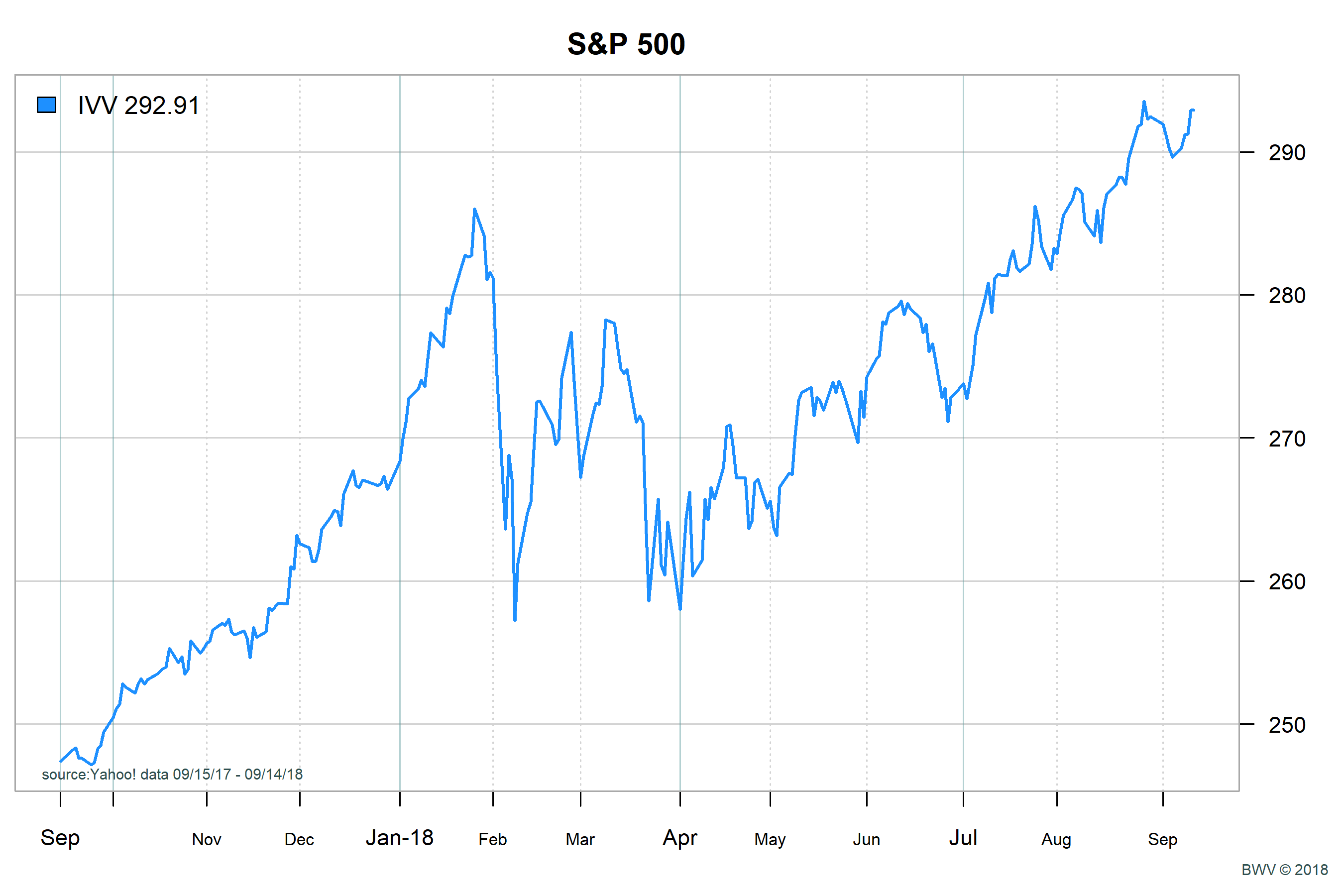

However, it is important to consider potential risks such as market volatility and regulatory changes before making investment decisions.

Explanation of the Growing Popularity of Energy Ventures Stock

Investing in energy ventures stock has become increasingly popular due to several key factors. Firstly, the rising global demand for energy presents a lucrative opportunity for companies operating in this sector to capitalize on growth and generate high returns on investment.

Additionally, advancements in technology have made renewable energy solutions more viable and profitable, attracting investors looking to participate in the transition towards sustainable options. Government incentives and policies supporting clean energy initiatives further enhance the appeal of investing in energy ventures stock.

Overall, these factors contribute to the growing popularity of this investment choice.

Examples of Successful Energy Venture Companies

When considering the potential of energy ventures stock, two notable examples stand out: Tesla Inc. and NextEra Energy Inc. Tesla, known for its electric vehicles and clean energy products, has seen tremendous growth over the years under visionary leadership.

NextEra Energy is a leading renewable energy company that consistently delivers strong financial performance. These companies demonstrate how successful energy venture companies can thrive by embracing sustainability and innovative approaches to clean energy.

Understanding Energy Ventures Stock

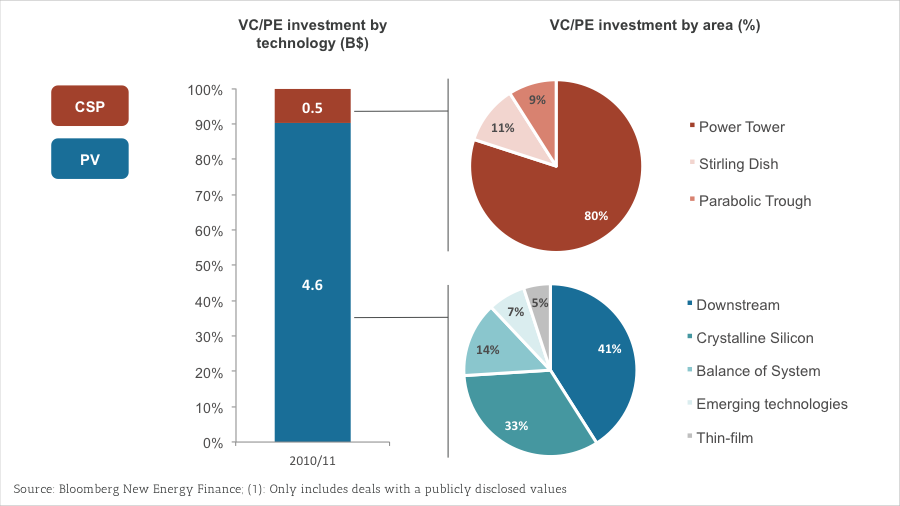

Investing in energy ventures involves supporting businesses within the energy sector that focus on renewable or alternative sources of power. This can include companies specializing in renewable energy production or developing cutting-edge technologies for storing and distributing clean energy.

By investing in these ventures, individuals align their financial goals with environmental values, while driving innovation and contributing to a more sustainable future.

Definition and Explanation of Energy Ventures Stock

Energy ventures stock represents ownership in companies involved in the energy sector, including traditional fossil fuel producers and renewable energy companies focused on wind, solar, or hydroelectric power generation.

By investing in these stocks, individuals become shareholders and have the potential to benefit financially from the company’s success. Investing in energy ventures stock offers the opportunity for capital appreciation and dividends, while also supporting sustainable forms of energy generation.

However, thorough research and monitoring are essential due to market trends and external factors that can impact performance.

How Energy Ventures Differ from Traditional Stocks

Energy ventures stocks, while operating within the broader stock market, exhibit distinct characteristics compared to traditional stocks.

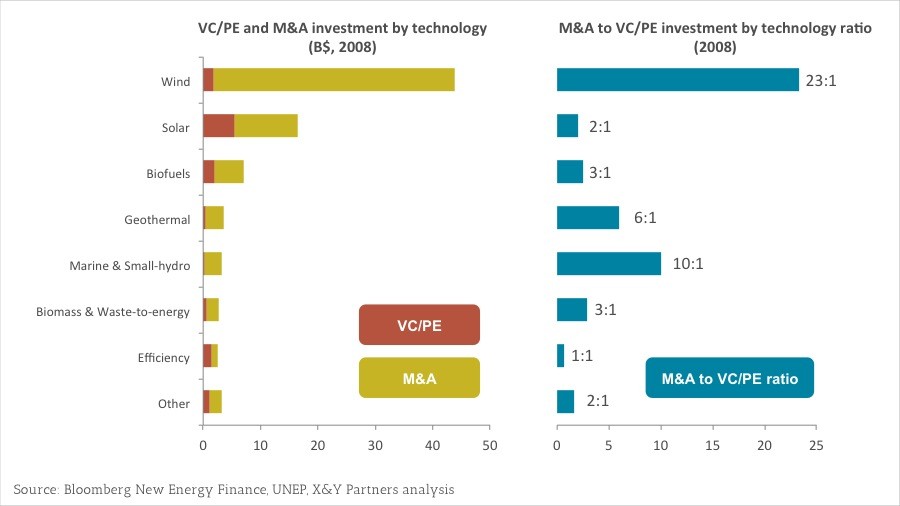

Traditional stocks rely on established industries driven by consumer demand and market competition, whereas energy ventures are influenced by global energy trends, government policies, and technological advancements. Fluctuating prices of oil, gas, and renewable energy sources greatly impact these investments.

Additionally, the risk profile associated with energy ventures is higher due to exposure to geopolitical events and climate change policies. Understanding these differences is crucial for informed investment decisions in this sector.

Benefits and Risks Associated with Investing in Energy Ventures

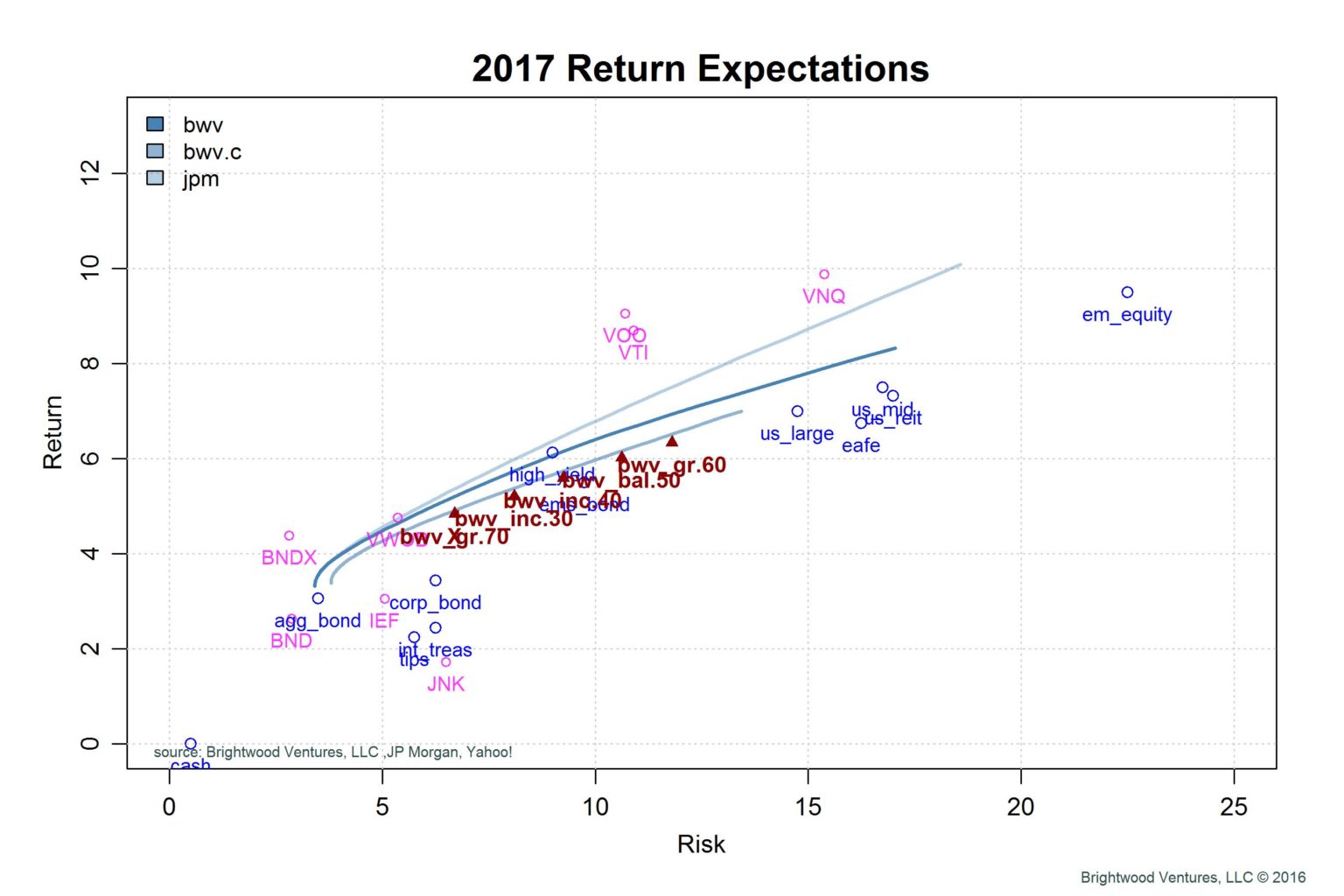

Investing in energy ventures offers the potential for long-term growth and high returns. It aligns with sustainable values by supporting renewable energy solutions. However, this sector can be volatile due to fluctuating commodity prices and regulatory changes. Technological advancements and environmental concerns also pose risks.

Thorough research, diversification, and understanding market trends are crucial for informed investment decisions in this sector.

Factors Impacting Energy Ventures Stock Performance

Several factors influence the performance of energy ventures stocks. Economic conditions and global energy demand play a significant role in determining market dynamics. Additionally, government policies related to climate change and renewable energy targets can greatly affect investor sentiment towards this sector.

Geopolitical events also have an impact on stock prices as they can disrupt production or distribution channels. By monitoring these factors, investors can make informed decisions within the energy ventures market.

Market Trends and Industry Dynamics Affecting Energy Ventures

The energy industry is evolving rapidly, driven by market trends and changes in industry dynamics. One significant trend is the increasing global adoption of renewable energy sources. This shift has impacted the industry, with companies embracing innovative technologies gaining a competitive edge.

Embracing renewables not only aligns with sustainability goals but also presents opportunities for growth. Other factors influencing energy ventures include geopolitical events, regulatory changes, technological advancements, and consumer behavior.

Understanding and adapting to these dynamics are crucial for investors looking to navigate this ever-changing landscape successfully.

[lyte id=’AumdPJRJeiU’]