Investing in the right stocks can be a daunting task, especially when you’re looking for companies that offer unique opportunities. One such hidden gem in the investment world is EI Ventures. With its focus on emotional intelligence and its mission to revolutionize the way we invest, EI Ventures has captured the attention of savvy investors.

In this article, we will explore the rise of EI Ventures, its investment activities, funding, valuation, stock price analysis, key factors influencing its stock price, expert opinions, investor sentiment, strategies for investing in EI Ventures’ stock, and ultimately determine whether investing in Emotional Intelligence Ventures is worth it.

The Rise of EI Ventures: A Hidden Gem

EI Ventures is not your typical investment firm. It goes beyond financial metrics and focuses on emotional intelligence as a key driver for success. By selecting companies that prioritize emotional intelligence, EI Ventures identifies businesses with long-term growth potential.

Founded by seasoned investors, EI Ventures recognized the untapped potential of emotional intelligence in the business world. Their unique investment strategy and commitment to emotional well-being have led to remarkable growth for companies across various industries.

As a hidden gem in the industry, EI Ventures highlights the growing importance of emotional intelligence in business. It serves as an inspiration for other investment firms to consider the impact of emotions on performance and recognize its potential for sustainable growth.

In summary, EI Ventures stands out as an innovative force that uncovers hidden gems through its focus on emotional intelligence. With its success stories and commitment to long-term growth, EI Ventures continues to make its mark in the investment landscape.

Emotional Intelligence Ventures Investments Activity

EI Ventures, a leading investment firm, focuses on selecting investments based on emotional intelligence practices, leadership qualities, and growth potential. By prioritizing companies that integrate emotional intelligence into their operations, EI Ventures taps into an overlooked market.

Notable investments include a tech startup that developed an AI-powered chatbot for mental health support. Through leveraging emotional intelligence algorithms, personalized and empathetic responses led to significant user growth and revenue.

EI Ventures continues to shape the investment landscape by recognizing the value of emotionally intelligent businesses across various industries.

Funding, Valuation, and Revenue Growth of EI Ventures

EI Ventures has experienced remarkable growth in funding, valuation, and revenue by leveraging its unique investment approach centered around emotional intelligence. The company has attracted substantial funding from institutional investors and individual backers who recognize the power of emotional intelligence.

This influx of capital has contributed to the steady rise in EI Ventures’ valuation over time.

Demand for investments focused on emotional intelligence has surged as more companies acknowledge its importance. This increased demand has led to significant revenue growth for EI Ventures. Their rigorous evaluation process ensures investments in companies with strong financial performance potential, further driving overall success.

By combining substantial funding, valuation growth, and revenue expansion, EI Ventures has positioned itself as a prominent player in the investment landscape. Their focus on emotional intelligence sets them apart and allows them to capitalize on emerging market opportunities.

As recognition for their unique approach grows, so does the number of funding opportunities available to EI Ventures. This ongoing support enables them to continue driving positive change by investing in emotionally intelligent companies poised for long-term success.

Stock Price Analysis and Performance of EI Ventures

To evaluate the performance of EI Ventures’ stock price, various analysis techniques are employed. These include fundamental analysis, which assesses the company’s financial health and future prospects, and technical analysis, which examines historical price patterns and trends.

EI Ventures’ stock price has shown both upward trends during positive news periods and downward trends during market uncertainty. However, overall, the company has experienced growth due to strategic investments and recognition within the investment community.

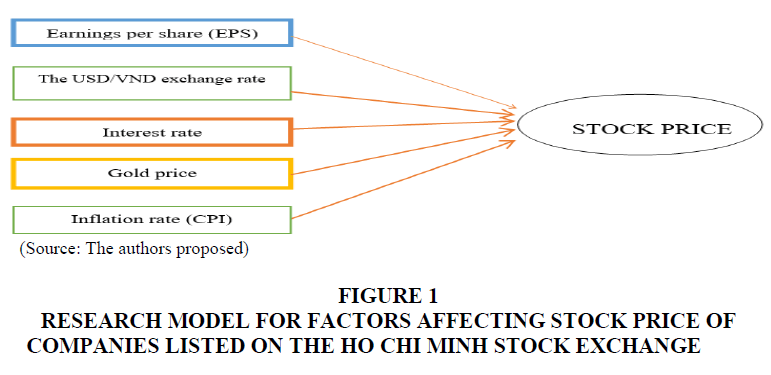

Key Factors Influencing EI Ventures’ Stock Price

Emotional intelligence, along with other key factors, influences the stock price of EI Ventures. As investors recognize the value of emotional intelligence in business success, demand for stocks like EI Ventures increases, positively impacting its stock price.

Additionally, positive market sentiment towards emotional intelligence ventures and a focus on long-term growth contribute to the overall performance and stability of EI Ventures’ stock price.

Other factors that influence the stock price of EI Ventures include financial performance indicators, industry trends, the competitive landscape, economic conditions, and investor sentiment.

Strong financial performance, differentiation from competitors through unique approaches, favorable economic conditions, and positive investor sentiment all play a role in determining the stock price movement of EI Ventures.

By considering these factors collectively, investors can gain a better understanding of how emotional intelligence and other elements shape the dynamics of EI Ventures’ stock price.

Expert Opinions on EI Ventures’ Stock Price Prospects

Experts and analysts anticipate a bright future for EI Ventures, citing its unique investment strategy and focus on emotional intelligence. As companies increasingly value emotional well-being, there is a growing demand for investments in firms like EI Ventures.

Investing in emotionally intelligent ventures offers significant growth opportunities in an interconnected world where empathy and adaptability are vital. However, experts caution about potential risks such as market volatility and industry competition, urging investors to carefully evaluate these factors before making investment decisions.

Overall, the consensus is that EI Ventures shows promise but requires prudent assessment of associated risks.

| Prospects | Insights |

|---|---|

| Promising future ahead | Unique investment strategy and focus on emotional intelligence |

| Increasing demand for emotionally intelligent investments | Recognition of importance of emotional well-being |

| Significant growth opportunities | Thriving in an interconnected world |

| Potential risks and challenges | Market volatility and competition within the industry |

Investor Sentiment: What Are Investors Saying?

Investors are optimistic about emotional intelligence ventures like EI Ventures. They appreciate the unique investment approach and recognize the potential for long-term growth in companies that prioritize emotional intelligence.

Social media, forums, and expert interviews reveal a positive sentiment towards EI Ventures, with investors discussing its potential for significant returns and positive societal impact. This optimism is driven by the company’s innovative strategy and recognition of the importance of emotional intelligence in business success.

Overall, investor sentiment remains high, highlighting the appeal of EI Ventures in an emotionally aware world.

Strategies for Investing in Emotional Intelligence Ventures’ Stock

Investing in Emotional Intelligence (EI) Ventures’ stock offers various strategies tailored to different risk appetites. For patient investors, a long-term approach within a diversified portfolio can capture the potential growth of emotionally intelligent ventures.

On the other hand, active traders can leverage short-term trading opportunities by monitoring market trends and capitalizing on price fluctuations. These strategies require thorough research and analysis to align with individual investment goals.

Table: Comparison of Long-Term Investment and Short-Term Trading Strategies

| | Long-Term Investment Approach | Short-Term Trading Strategies |

|—————|————————————|———————————-|

| Time Horizon | Extended period | Shorter timeframes |

| Focus | Long-term growth potential | Short-term price fluctuations |

| Mindset | Patient | Vigilant and responsive |

| Risk Tolerance| Moderate | Higher |

[lyte id=’9zGeIsRFZGE’]