Investing in royalty income can be a lucrative and exciting way to diversify your investment portfolio. With the potential for passive income and long-term financial stability, royalty income offers investors a unique opportunity to earn money while supporting creative endeavors.

In this article, we will explore what royalty income is, how to earn it, its advantages and disadvantages, strategies for maximizing it, and real-life case studies of successful individuals who have generated substantial royalty income.

So let’s dive in and discover how you can start earning royalty income!

Introduction to Royalty Income

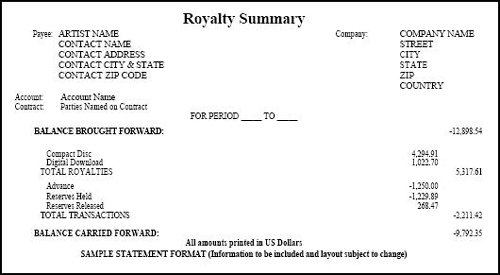

Royalty income refers to the compensation received for allowing others to use intellectual property or assets. This can include music royalties, book royalties, patent royalties, trademark royalties, and oil and gas royalties.

Creators earn passive income by granting others the right to use their works in exchange for a fee or percentage of revenue generated.

How to Earn Royalty Income

To earn royalty income, research and identify industries with potential opportunities like music, publishing, technology, and natural resources. Conduct thorough market research to analyze trends, demand, competition, and profitability. Invest in intellectual property through licensing agreements or partnerships.

Evaluate the potential profitability based on market demand, competition, and uniqueness of the intellectual property. By making informed investment decisions and leveraging intellectual assets, individuals can generate passive revenue streams from royalty income.

Advantages and Disadvantages of Royalty Income

Earning royalty income offers several advantages. Firstly, it provides a passive stream of revenue once the initial investment is made and the licensing agreement is established. This allows investors to enjoy consistent income without actively managing day-to-day operations.

Additionally, adding royalty income to an investment portfolio diversifies sources of revenue, reducing reliance on traditional investments like stocks or real estate. Moreover, royalty income has the potential for long-term financial stability due to its recurring nature.

However, there are challenges and risks associated with earning royalty income. Market fluctuations can impact demand for intellectual properties, while legal complexities require expertise in navigating licensing agreements and protecting copyrights and trademarks.

Furthermore, there is always a risk that the intellectual property may not generate expected revenue or face competition.

Strategies for Maximizing Royalty Income

To maximize royalty income, it’s crucial to diversify your sources, protect your intellectual property, and seek professional advice.

Diversification involves exploring multiple industries or types of intellectual properties. This spreads the risk and increases potential returns. Consider investing in patents from different sectors like technology, healthcare, or consumer goods, as well as trademarks and copyrights.

Protecting your intellectual property is vital for long-term value and profitability. Register patents, trademarks, or copyrights with relevant authorities to safeguard against infringement and unauthorized use. Regular monitoring and enforcement help maintain exclusivity.

Seeking professional advice is essential for navigating intellectual property law and investment. Experts offer guidance on maximizing income while minimizing risks. Their knowledge of industry trends and legal proceedings can help you make informed decisions.

By diversifying sources, protecting intellectual property, and seeking professional advice, you can maximize royalty income effectively.

Case Studies: Successful Examples of Royalty Income

The music industry and book publishing have showcased remarkable success stories when it comes to generating royalty income. Let’s delve into some notable examples:

-

The Power of Songwriting: Songwriters earn performance royalties from radio play and live performances, mechanical royalties from sales or streams, and synchronization royalties from movie, TV, commercial, or video game use.

-

Timeless Legacy: The Beatles’ song catalog continues to generate significant royalty income even decades after their initial releases. Taylor Swift, known for writing her own songs, has built a successful career with substantial royalty earnings.

-

Rewards for Authors: Authors earn a percentage of book sales revenue (typically 6% to 15%) as royalties. Adaptations into movies or TV shows can further boost their royalty income.

-

Unparalleled Literary Success: J.K. Rowling’s Harry Potter series catapulted her to immense wealth through book sales and subsequent movie adaptations.

In summary, these case studies exemplify how songwriters and authors can achieve financial success through their creative works. By understanding the various avenues for earning royalties and staying committed to their craft, individuals in these industries can maximize their potential for financial prosperity.

Tax Implications of Royalty Income

Earning royalty income can have significant tax implications. Depending on your jurisdiction, royalty income may be subject to income tax or capital gains tax. Consulting with a knowledgeable tax professional can help you navigate these obligations and optimize your financial situation.

Royalty income is typically classified as “earned income” and subject to regular income tax rates. However, in some cases, such as when royalties are received from the sale of intellectual property rights, it may be treated as a capital gain instead.

Tax laws regarding royalty income vary by country and even within different states or provinces. It’s important to work with a tax professional familiar with your jurisdiction’s regulations to ensure compliance and take advantage of any available deductions or exemptions.

Consider whether you receive royalties as an individual or through a business entity, as this can impact the tax treatment. Accurate record-keeping of earnings and expenses is crucial for proper reporting and potential audits.

To maximize your financial outcomes, consult with a qualified tax professional who understands royalty income and can provide personalized advice based on your specific circumstances.

Risks and Rewards in Investing in Royalties

Investing in royalties comes with both risks and rewards. Potential for substantial returns exists, but careful evaluation of each opportunity is crucial. Factors like market demand, competition, legal complexities, and investment risks must be considered before making decisions.

Thorough analysis helps determine profitability and identify potential hurdles. Understanding intellectual property rights and copyright laws is essential to avoid legal disputes. While there are risks involved, successful royalty investments can provide passive income streams that continue generating revenue over time.

| Factors to Consider |

|---|

| Market demand |

| Competition |

| Legal complexities |

| Investment risks |

Frequently Asked Questions about Royalty Income

Investing in royalties offers a way to diversify portfolios and generate passive income. Here are some common questions about royalty income:

Royalty income is payment received for the use of intellectual property, such as music, books, patents, or trademarks.

You can earn royalty income by licensing your intellectual property for use in various ways, such as through music streaming platforms, book sales, or patent licensing.

Earning royalty income provides passive income and diversification beyond traditional investments. It offers long-term financial stability and potential for growth.

Fluctuations in demand for the licensed property and legal complexities are key risks to evaluate when investing in royalties.

Thorough research, understanding market demand, analyzing historical data, and seeking professional advice can help maximize your royalty income potential.

[lyte id=’CqyjeEd54rQ’]