Investing in developing countries has become an increasingly popular strategy for investors looking to diversify their portfolios and capitalize on the growth potential of emerging economies. One avenue through which investors can gain exposure to these markets is through developing countries exchange-traded funds (ETFs).

In this article, we will explore the concept of ETFs, the benefits of investing in developing countries ETFs, factors to consider before investing, and strategies for managing risk. We will also delve into case studies of successful investments and provide insights into the best emerging markets ETFs.

Understanding the Concept of ETFs

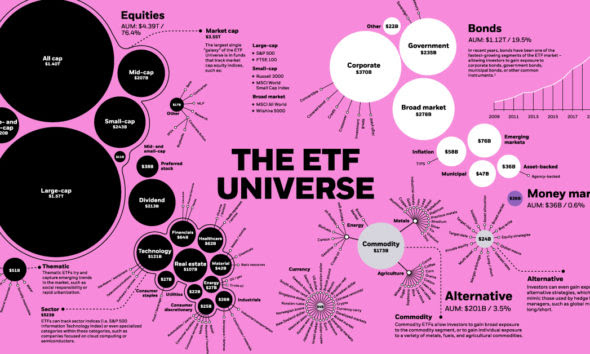

Exchange-traded funds (ETFs) are investment vehicles that trade on stock exchanges, similar to individual stocks. They track specific indexes or sectors, providing investors with diversified exposure to a range of securities.

Unlike mutual funds, ETF prices fluctuate throughout the trading day and can be bought and sold on exchanges at market prices. This makes them a popular choice for investors seeking diversification and flexibility in their investments.

Introduction to developing countries ETFs

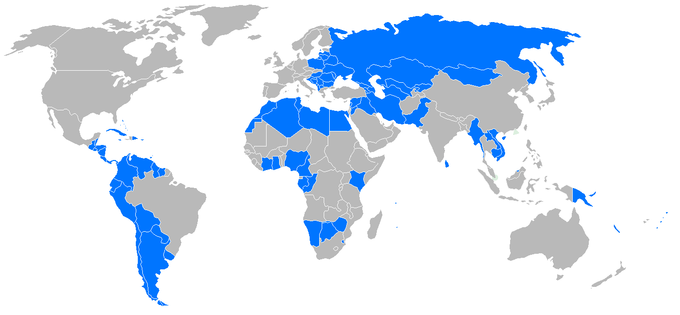

Developing countries, also known as emerging markets or frontier markets, offer unique investment opportunities. One popular way to access these markets is through exchange-traded funds (ETFs). These funds track the performance of specific indexes or baskets of assets, typically consisting of stocks from companies based in emerging market nations.

Investing in developing countries ETFs has several advantages. These economies often experience rapid growth due to factors such as urbanization, technological advancements, and favorable demographics. By including these funds in a portfolio, investors can diversify their holdings and potentially benefit from the growth potential of these markets.

Developing countries ETFs also provide accessibility and flexibility. With one transaction, investors can gain exposure to a broad range of companies across multiple sectors in a specific country or region. This saves time and effort compared to researching and purchasing individual stocks.

However, investing in developing countries ETFs comes with risks. Political instability, currency fluctuations, regulatory changes, and liquidity concerns are factors that should be carefully considered before entering these markets.

In summary, investing in developing countries ETFs allows investors to tap into the growth potential of emerging markets while diversifying their portfolios. However, it is important to conduct thorough research and exercise caution due to the associated risks.

Exploring the Benefits of Investing in Developing Countries ETFs

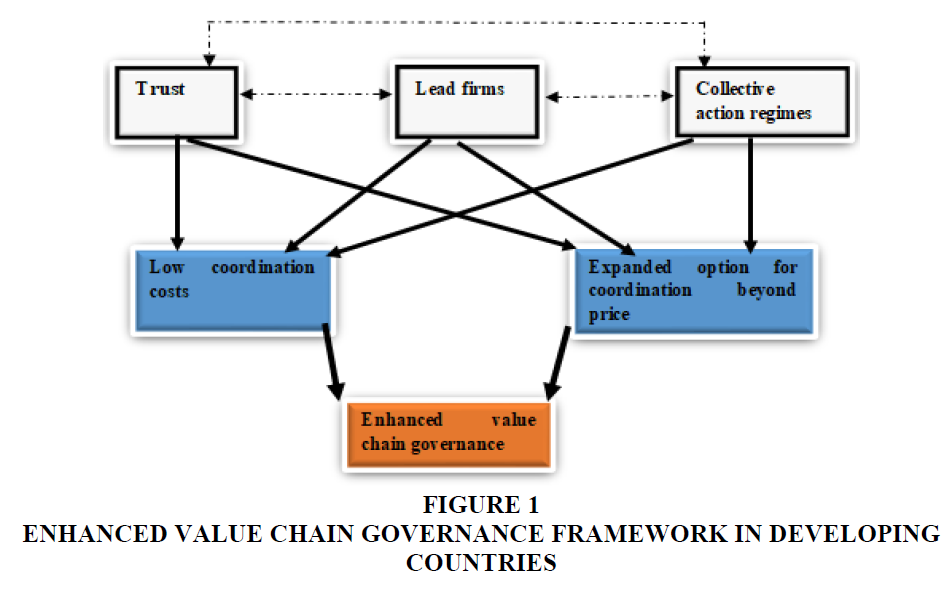

Investing in developing countries ETFs offers diversification and growth potential. These funds provide exposure to a diversified basket of securities across multiple markets and sectors, helping to mitigate risks associated with individual companies or industries.

Developing countries often experience rapid economic growth due to factors like demographics, resources, infrastructure, and consumer demand. By investing in these ETFs, investors can capitalize on this growth potential.

Additionally, these funds provide access to untapped markets and industries that may be challenging for individual investors to navigate directly. They allow investors to identify promising sectors within emerging economies and allocate capital accordingly.

Overall, investing in developing countries ETFs offers opportunities for diversification and exposure to high-growth markets.

Factors to Consider Before Investing in Developing Countries ETFs

Investing in developing countries ETFs can provide diversification and growth potential. However, it’s important to consider several factors before making such investments.

Political stability is crucial for investment success in any country, including developing ones. Assess the political environment of the target country to understand potential market volatility and hindered economic growth. Evaluate governance transparency and investor protection measures within the target countries.

Analyze GDP growth, inflation rates, and monetary policies for insights into a country’s economic health. Monitor exchange rates, trade balances, and fiscal deficits to understand macroeconomic conditions before deciding on investing.

By considering these factors, investors can make informed decisions when investing in developing countries ETFs while managing potential risks effectively.

Choosing the Right Developing Countries ETF for Your Portfolio

Investing in developing countries can be done through exchange-traded funds (ETFs) that offer diversification. There are two types of developing countries ETFs: broad-based and country-specific. Broad-based ETFs provide exposure to multiple economies, reducing risk.

Country-specific ETFs focus on individual countries or regions, offering potential growth but higher risks.

When selecting a suitable fund, consider the management strategy. Actively managed funds aim to outperform benchmarks using research-driven strategies, while passively managed funds replicate index performance without active stock selection.

Other factors to consider include fund size, liquidity, and expense ratios. Larger funds with higher liquidity have better trading opportunities and lower bid-ask spreads. Expense ratios impact returns, so evaluating fees is important.

Evaluating the fund’s performance track record and management expertise is also crucial. Look at historical returns, risk-adjusted performance, consistency in investment strategy, and the manager’s experience in developing countries’ markets.

Choosing the right developing countries ETF for your portfolio requires understanding different types of ETFs and considering factors like management strategy, fund size, liquidity, expense ratios, performance track record, and management expertise.

By carefully evaluating these factors, you can make an informed decision that aligns with your investment goals and risk tolerance.

Risk Management Strategies for Developing Countries ETF Investors

Investing in developing countries ETFs can be rewarding, but it also comes with risks. To manage these risks effectively, investors should employ two key strategies.

Investors can mitigate risks by diversifying their investments across various regions within developing countries. This helps minimize exposure to country-specific events and economic downturns. Sector diversification is also important, as it reduces concentration risk and captures growth opportunities in different industries.

Currency fluctuations can significantly impact investment returns. Investors should consider using currency-hedged ETFs to mitigate this risk. These funds minimize the impact of foreign currency movements on returns, providing a more stable investment profile.

By adopting these risk management strategies, investors can navigate the challenges of investing in developing countries ETFs and enhance their overall investment experience.

Understanding the Challenges and Volatility of Developing Countries ETFs

Developing countries ETFs come with unique challenges and volatility that investors should consider. These ETFs can experience market fluctuations due to geopolitical events, economic crises, or sudden policy changes. Global market conditions, such as interest rate hikes or trade disputes, can also affect developing economies.

Additionally, investors are increasingly focused on social and environmental factors when making investment decisions. Ethical practices and sustainable business models contribute to long-term value creation. It’s important to assess human rights concerns and labor practices within target countries for responsible investing.

Overall, understanding these challenges is crucial for informed investment decisions in developing countries ETFs.

Success Stories and Lessons Learned from Developing Countries ETFs

Investing in developing countries ETFs can offer unique growth opportunities. By examining success stories and learning from past experiences, investors gain insights into effective investment strategies. Highlighting specific ETFs that performed well provides concrete examples of successful approaches.

Analyzing past investments allows learning from both successes and failures. Critical analysis of potential risks and rewards helps make informed decisions. Managing expectations in volatile markets involves setting realistic goals and maintaining a long-term perspective.

Overall, exploring success stories and lessons learned informs wise investing in developing countries ETFs.

[lyte id=’Q1PMTMYhR_w’]