Covered calls are a popular strategy in the world of investing, allowing investors to potentially generate income from their existing stock positions. In this article, we will delve into the concept of covered calls and explore the benefits they offer to investors.

Definition of Covered Calls

Covered calls are an options strategy where investors sell call options on stocks they already own. By selling these options, investors collect upfront premium income but give up some potential upside on the underlying stock.

For example, if you own 100 shares of Company X at $50 per share, selling a call option with a $55 strike price grants someone else the right to buy your shares at that price within a specified time period. If the stock price remains below $55, you keep both your shares and the premium income.

However, if the stock price rises above $55 and the buyer exercises their option, you must sell your shares at that predetermined price. Covered calls can provide additional income and downside protection but require careful analysis and consideration of potential risks.

Benefits of Using Covered Calls in Investing

Covered calls provide several advantages for investors, making them an attractive strategy in certain market conditions. Firstly, selling call options generates additional income from existing stock holdings, particularly during low volatility or sideways trading.

Secondly, by selling call options against stocks, potential losses can be partially offset, thanks to the premium acting as a cushion. Lastly, while covered calls limit gains if stock prices rise significantly, they still allow participation in some upside potential while collecting premium income.

To identify suitable candidates for covered call strategies among thousands of stocks, screening tools play a crucial role by filtering based on specific criteria and parameters. These tools streamline the selection process and increase efficiency in implementing successful covered call strategies.

Introduction to Screening Tools

Screening tools are software programs or online platforms that help investors filter through vast amounts of financial data to identify stocks that meet specific criteria. These tools allow investors to set parameters based on their investment goals, risk tolerance, and desired outcomes.

By using screening tools, investors can save time by narrowing down potential stocks and focusing on analyzing a more manageable number of opportunities. These tools provide flexibility and customization options, enhance decision-making capabilities, and can be utilized for portfolio management purposes.

Overall, screening tools are indispensable assets for efficient and informed investing.

Why Screening Tools Are Essential for Investors

Screening tools are indispensable for investors as they offer several key benefits. Firstly, these tools automate the process of sifting through financial reports and company filings, saving valuable time and presenting relevant information in a concise format. This efficiency allows investors to make informed decisions more quickly.

Secondly, screening tools eliminate human bias by relying on predefined criteria set by the investor, ensuring objective analysis based on reliable data. Lastly, these tools help investors identify potential investment opportunities that meet their desired criteria, uncovering hidden gems that may otherwise be overlooked.

However, finding a reliable and free covered call screener can be challenging. In the next section, we will review three popular screeners and evaluate their features and limitations.

Free Covered Call Screeners: A Comprehensive Review

When it comes to free covered call screeners, there are several options available in the market. Let’s take a closer look at three popular screeners and evaluate their features as well as their limitations.

| Screener Name | Features | Limitations |

|---|---|---|

| Screener A | Advanced filtering options Real-time data updates User-friendly interface |

Limited coverage of smaller companies Basic technical analysis tools only |

| Screener B | Extensive coverage of various markets Customizable alerts and notifications Comprehensive financial metrics |

Steep learning curve for beginners Requires registration for full access |

| Screener C | Detailed analysis of options contracts Historical data comparison Interactive charting features |

Limited stock screening capabilities Slow loading times during peak hours |

By reviewing these screeners’ features and limitations, investors can make an informed decision about which tool best suits their needs.

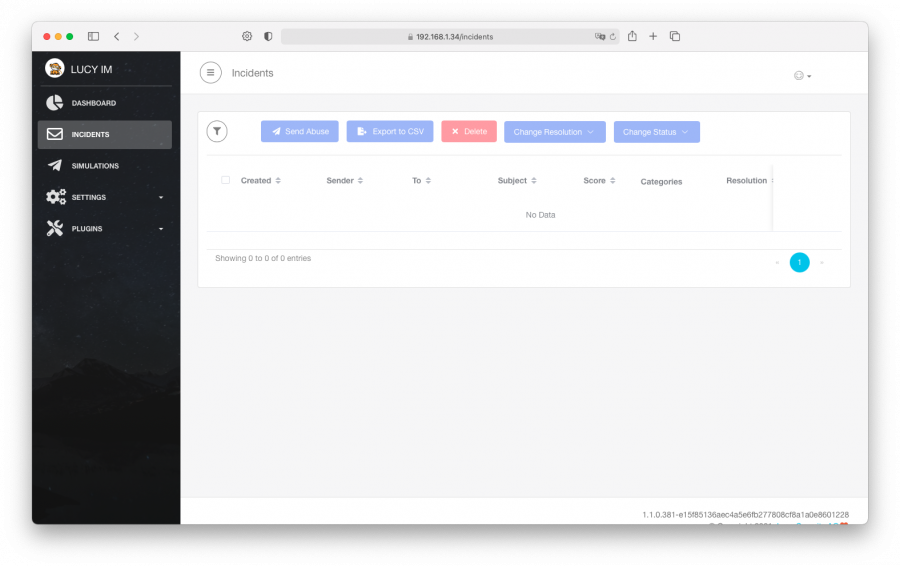

XYZ Screener

XYZ Screener is a popular free covered call screener that helps investors find suitable candidates for covered call strategies. It offers a user-friendly interface and customizable filters, allowing investors to easily input their desired parameters.

Real-time data on stocks, options prices, and premiums is provided, keeping investors updated with the latest market conditions. However, XYZ Screener has limited coverage of stocks traded worldwide and its analytics tools are relatively basic compared to paid alternatives.

Despite these limitations, it remains a valuable tool for investors seeking simplicity and convenience in their covered call screening process.

ABC Analyzer

ABC Analyzer is a powerful tool for investors seeking potential covered call opportunities. This free screener offers a range of features that provide valuable insights into the market, helping users make informed investment decisions.

One notable feature of ABC Analyzer is its extensive search capabilities. Investors can easily search for specific criteria, such as high implied volatility or low beta stocks. This allows them to narrow down their options and focus on the most promising opportunities.

Another useful feature is the historical data analysis provided by ABC Analyzer. By analyzing past price movements, users can identify patterns that may influence their investment strategies. This historical perspective can be invaluable in understanding market trends and making predictions about future performance.

In addition to these features, ABC Analyzer also offers watchlist functionality. Users can create personalized watchlists of potential covered call candidates, making it easy to monitor and track their progress over time. This helps investors stay organized and ensures they don’t miss out on any important opportunities.

While ABC Analyzer offers many advantages, it does have some limitations to consider. Compared to paid screeners, customization options are somewhat limited. This means that investors may not have as much flexibility in fine-tuning their search criteria. Additionally, the free version of ABC Analyzer has a slight delay in data updates.

While this may not be problematic for long-term investors, those who rely on up-to-the-minute information for time-sensitive trading decisions may find this delay inconvenient.

Overall, ABC Analyzer is a valuable tool for investors interested in covered call opportunities. Its extensive search capabilities, historical data analysis, and watchlist functionality make it an essential resource for staying informed and maximizing investment returns.

DEF Tracker

DEF Tracker is a free covered call screener that offers advanced analytics tools, customizable alerts, and a community forum for investors. With its comprehensive range of features, DEF Tracker assists users in analyzing historical performance, volatility, and other key metrics.

The customizable alerts keep users informed about potential opportunities based on specific criteria or market events. Additionally, the community forum allows for knowledge-sharing and discussion among like-minded individuals.

However, DEF Tracker may have a steeper learning curve for novice investors and limited customer support in its free version. Overall, DEF Tracker is a solid option for investors seeking a free covered call screener.

John’s Experience with Enhancing His Investment Strategy

John’s investment goals were the driving force behind his quest to enhance his investment strategy. Seeking to maximize profits while minimizing risks, he knew that a well-informed approach was essential. In his pursuit of profitable opportunities, John turned to a free covered call screener, which proved to be an invaluable tool.

With a clear understanding of his goals and risk tolerance, John utilized the covered call screener to identify potential trades that aligned with his investment strategy. This screening tool allowed him to filter through numerous options and focus on those that offered the best possibilities for generating income from his existing stock holdings.

The free covered call screener provided John with valuable insights into various aspects of each trade opportunity. It helped him assess factors such as volatility, time decay, and potential returns. Armed with this information, he could make informed decisions based on data-driven analysis rather than relying solely on intuition or guesswork.

By using the covered call screener, John gained a deeper understanding of how different stocks performed under varying market conditions. He discovered new opportunities that he may not have otherwise considered and refined his investment strategy accordingly.

This allowed him to better capitalize on market trends and optimize returns while effectively managing risk.

[lyte id=’se8Moh3OxiA’]