Investing is a world filled with opportunities and possibilities. From stocks and bonds to real estate and cryptocurrencies, there is no shortage of investment options available to those looking to grow their wealth. One commodity that has been gaining significant attention in recent years is copper.

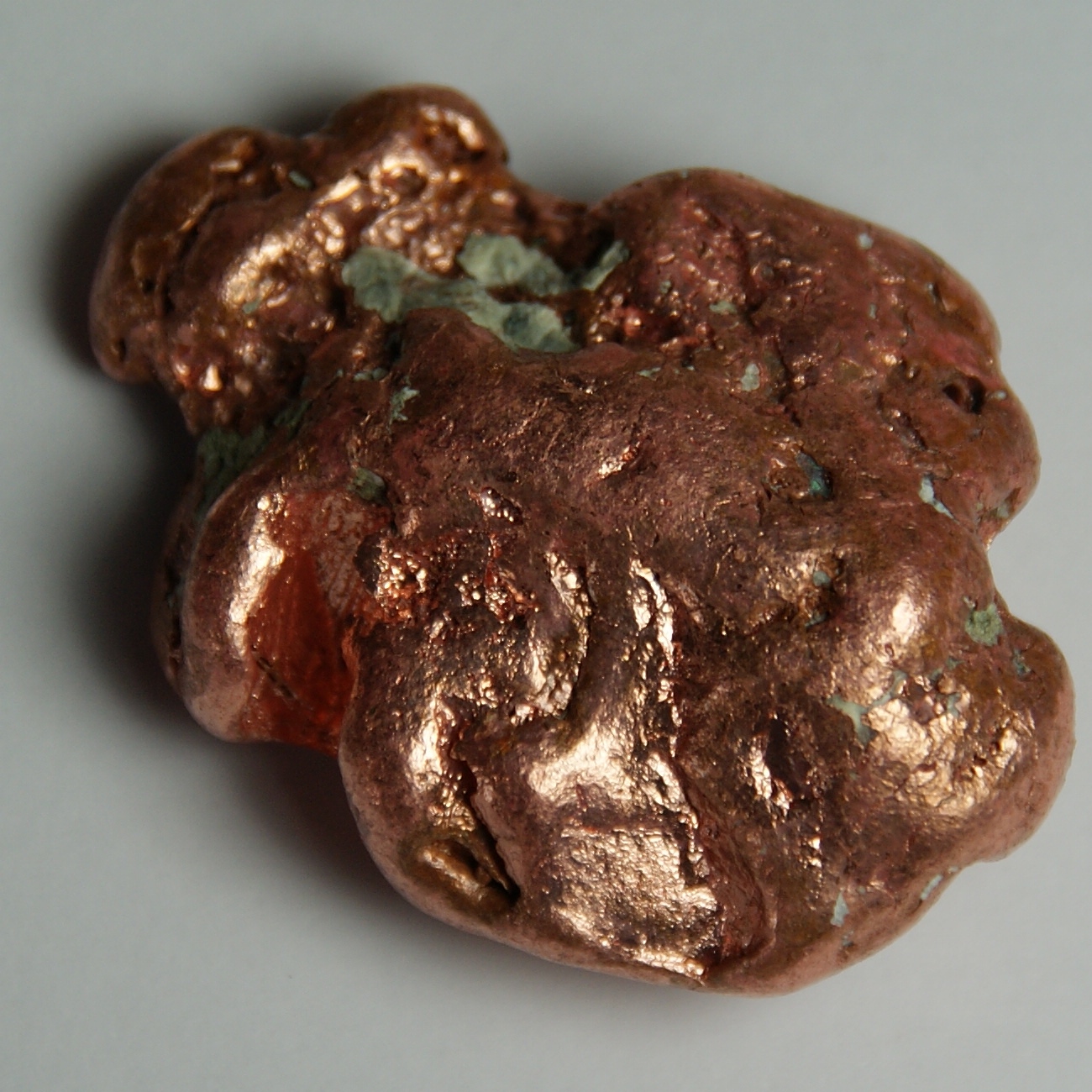

Copper, often referred to as “the metal with a PhD in economics,” plays a vital role in our modern society. Its conductivity, durability, and malleability make it an essential component in various industries. From construction and electrical wiring to transportation and renewable energy, copper is used extensively across the globe.

The increasing demand for copper has created exciting opportunities for investors. As the world continues to evolve, so does the need for this valuable metal. In this article, we will explore the rise of copper as a valuable commodity in investing and introduce you to an innovative approach – Copper Metal ETFs.

Introducing Copper Metal ETFs: An Innovative Approach to Investing

Copper Metal ETFs are revolutionizing investment opportunities by providing a convenient and flexible way for individuals to invest in copper. These specialized funds allow investors to participate in the price movements of copper without physically owning or storing the metal.

By offering exposure to a diversified portfolio of copper-related assets, such as mining companies and futures contracts, Copper Metal ETFs provide a unique opportunity for investors looking to diversify their portfolios and take advantage of potential growth opportunities.

With high liquidity and the ability to trade on stock exchanges like individual stocks, these innovative ETFs offer convenience and flexibility for those interested in navigating the copper market.

Benefits of Investing in Copper Metal ETFs

Investing in Copper Metal ETFs offers several key advantages. Firstly, these ETFs provide diversification and risk management by investing in a basket of copper-related assets, spreading the risk and potentially minimizing losses. Secondly, Copper Metal ETFs offer the potential for long-term growth as the demand for copper continues to rise.

Additionally, investing in Copper Metal ETFs allows investors to gain exposure to the copper market without physical ownership or trading futures contracts. Moreover, Copper Metal ETFs provide liquidity and flexibility, with easy entry and exit points for investors.

Lastly, professional management ensures optimized returns compared to passive investments.

| Benefits of Investing in Copper Metal ETFs |

|---|

| – Diversification and risk management |

| – Long-term growth potential |

| – Accessibility without physical ownership |

| – Liquidity and flexibility |

| – Professional management |

Choosing the Right Copper Metal ETF: Factors to Consider

When choosing a Copper Metal ETF for your investment portfolio, there are key factors to consider. Research different options from reputable providers with successful track records. Evaluate their investment strategies and objectives to ensure they align with your goals.

Pay attention to expense ratios, liquidity, and fund performance. Compare costs to minimize expenses. Consider liquidity for easy buying and selling of shares without impacting prices significantly. Analyze historical performance relative to benchmark indexes.

Choosing the right Copper Metal ETF requires thorough research, considering expense ratios, liquidity, and fund performance. Make an informed decision that aligns with your goals for success in the copper market.

Case Studies: Success Stories of Investors with Copper Metal ETFs

To gain insights into investing in Copper Metal ETFs, let’s examine success stories of investors who profited from this approach. John Smith, a seasoned investor, recognized copper’s potential early on and invested when prices were low due to oversupply concerns. As global demand increased, so did his investment value.

Jane Thompson also saw the growth potential in electric vehicles and made a well-timed investment in a Copper Metal ETF. These case studies highlight how strategic decisions and market understanding can lead to significant returns in copper investments.

Risks and Considerations when Investing in Copper Metal ETFs

Investing in Copper Metal ETFs comes with risks that should not be ignored. Market volatility, influenced by global economic conditions, geopolitical events, and supply-demand dynamics, can impact copper prices. Regulatory changes, storage costs, and contango or backwardation in futures markets are additional risks to consider.

Understanding these factors is crucial before committing capital to Copper Metal ETFs. Stay informed, conduct thorough research, and closely monitor market conditions to make well-informed investment decisions.

Expert Insights: Interviews with Industry Professionals on Copper Metal ETFs

To gain valuable insights on investing in Copper Metal ETFs, we interviewed experienced financial advisors specializing in commodities. Sarah Johnson, a renowned advisor, suggests that investing in Copper Metal ETFs can provide exposure to the metal without the complexities of physical ownership.

However, diversifying beyond copper-related assets is crucial to mitigate risk and ensure a well-rounded portfolio. Staying informed about market trends and developments in the copper sector is also essential for making informed investment decisions.

Overall, investing in Copper Metal ETFs offers convenience and potential returns but requires careful consideration and diversification.

| Pros | Cons |

|---|---|

| Convenient and accessible investment option | Need to diversify beyond copper-related assets |

| Potential for attractive returns | Market volatility can impact performance |

| Opportunity to gain exposure to a valuable metal | Need to stay informed about market trends |

Note: The table above provides a brief summary of the pros and cons associated with investing in Copper Metal ETFs*. *

Tips for Successful Investing with Copper Metal ETFs

To maximize investment success with copper metal ETFs, follow these tips:

-

Regularly monitor and rebalance your portfolio: Keep track of performance and adjust your investments to maintain an optimal asset allocation.

-

Diversify beyond copper metal ETFs: Don’t forget about other investment opportunities to mitigate risk.

-

Stay informed about the copper market: Follow reliable sources to gain insights into factors that influence prices.

-

Consider working with a financial advisor: Seek expertise in commodities trading for tailored guidance.

By implementing these strategies, you can enhance your chances of achieving optimal returns while effectively managing risks in the copper market.

Conclusion: Embrace the Opportunities – Invest Wisely with Copper Metal ETFs

[lyte id=’LpoT2gKJfXI’]