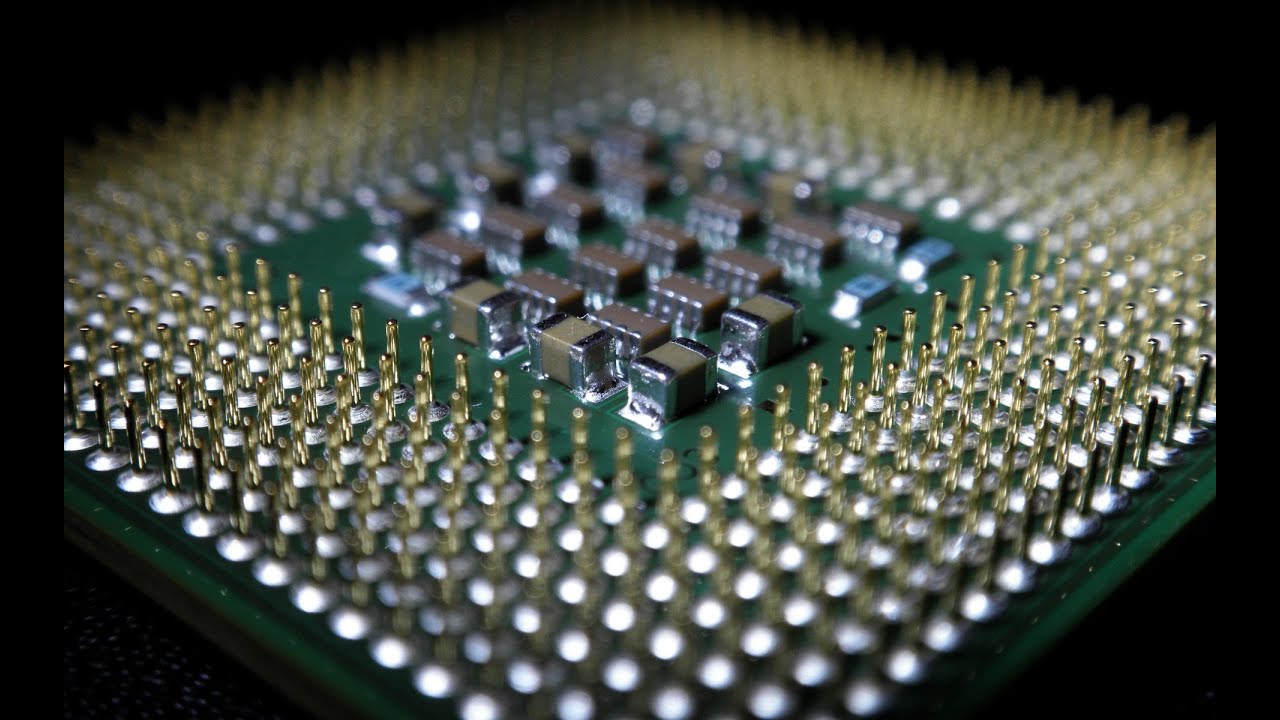

In today’s rapidly advancing technological landscape, microchips have become the backbone of countless industries. From smartphones and computers to cars and medical devices, these tiny semiconductors play a crucial role in powering our modern world.

As an investor with an interest in the field of investing and learning about investment strategies, understanding the potential of microchip stocks can prove to be a lucrative opportunity.

Investing in Microchip Stocks

The microchip industry is booming, driven by advancements in AI, cloud computing, 5G, and IoT. This presents a promising investment opportunity. Investing in microchip stocks offers advantages such as sustained demand and competitive advantages of leading companies. Additionally, it provides exposure to multiple industries reliant on microchips.

However, it’s important to consider market risks and stay informed. Overall, investing in microchip stocks can be a smart move for those seeking growth potential.

Best Microchip Stocks to Buy Right Now

Investing in the microchip industry offers lucrative opportunities, and here are three top-notch microchip stocks to consider:

Nvidia is renowned for its high-performance graphics processing units (GPUs) used in gaming, data centers, AI applications, and autonomous vehicles. With dominance in the gaming and AI sectors, strategic partnerships, and a focus on innovation, Nvidia is well-positioned for continued success.

As the world’s largest semiconductor foundry, TSMC manufactures chips for major tech companies. Its advanced fabrication processes enable it to produce cutting-edge chips with superior performance and energy efficiency.

Broadcom specializes in designing and manufacturing semiconductor solutions for wireless communication, networking, and storage devices.

With consistent revenue growth through strategic acquisitions and a strong balance sheet, Broadcom demonstrates stability and has a broad product portfolio to capitalize on emerging opportunities within the microchip industry.

Consider these microchip stocks as potential investments in this thriving industry that shows no signs of slowing down.

Recent Developments Shaping the Microchip Industry

The microchip industry is being shaped by recent technological advancements and global events. Emerging technologies like artificial intelligence, autonomous vehicles, virtual reality, and the Internet of Things are driving increased demand for microchips across various sectors. This growth potential presents attractive investment opportunities.

However, challenges such as trade tensions, supply chain disruptions, and government regulations can impact the profitability and performance of microchip companies. It is crucial for investors to monitor these developments closely to make informed decisions in this rapidly evolving industry.

Success Stories: Investors Who Profited from Microchip Stocks

Notable investors have achieved significant returns by investing in microchip stocks, offering valuable insights into effective investment strategies. Thorough research, long-term vision, and diversification are common themes among these successful investors.

Staying informed about industry trends is crucial for success in the microchip industry. Recognizing technological advancements and understanding market dynamics help investors identify emerging opportunities.

Thorough financial analysis is another key component of successful investment strategies in microchip stocks. Examining a company’s financial health and growth potential through metrics such as revenue growth and profitability ratios is essential.

A disciplined approach to buy/sell decisions is emphasized by profitable investors. Setting clear goals and following predetermined criteria, alongside implementing risk management techniques, helps protect profits and minimize losses.

Diversification is also important among these investors. Investing in multiple microchip companies across different sub-sectors spreads risk and enhances portfolio performance.

By adopting similar strategies tailored to their goals and risk tolerance, individuals can maximize their own investment returns in the microchip market.

Tips for Investing in Microchip Stocks

Investing in microchip stocks requires careful consideration. Before investing, evaluate the company’s financial health, market position, and competitive advantage. Stay updated on industry trends, technological advancements, and customer demand to identify promising opportunities.

Choose between long-term and short-term strategies based on your goals and risk tolerance.

| Factors to Consider |

|---|

| Financial health |

| Market position |

| Competitive advantage |

| Industry trends |

| Technological advancements |

| Customer demand |

| Long-term vs short-term strategies |

Conclusion

[lyte id=’m5I0rUhGJis’]