If you’re interested in investing and learning about the stock market, penny stocks can offer an exciting opportunity. These low-priced stocks have the potential for significant gains, but they also come with higher risks. In this article, we’ll take a closer look at penny stocks available on E*TRADE, one of the leading online trading platforms.

We’ll explore the appeal of investing in these stocks, highlight the features to consider when trading them, and provide insights into some of the best-performing penny stocks on E*TRADE. Additionally, we’ll discuss how to analyze financial data and industry trends to make informed investment decisions.

Lastly, we’ll address frequently asked questions about trading penny stocks on ETRADE and provide guidance on mitigating risks. By the end of this article, you’ll have a better understanding of the opportunities and risks associated with trading penny stocks on ETRADE.

Overview: E*TRADE Penny Stocks

Penny stocks have gained popularity among investors due to their appeal in terms of low prices and the potential for significant returns. These stocks, typically priced below $5 per share, offer an opportunity for investors with limited capital to diversify their portfolios by investing in multiple companies.

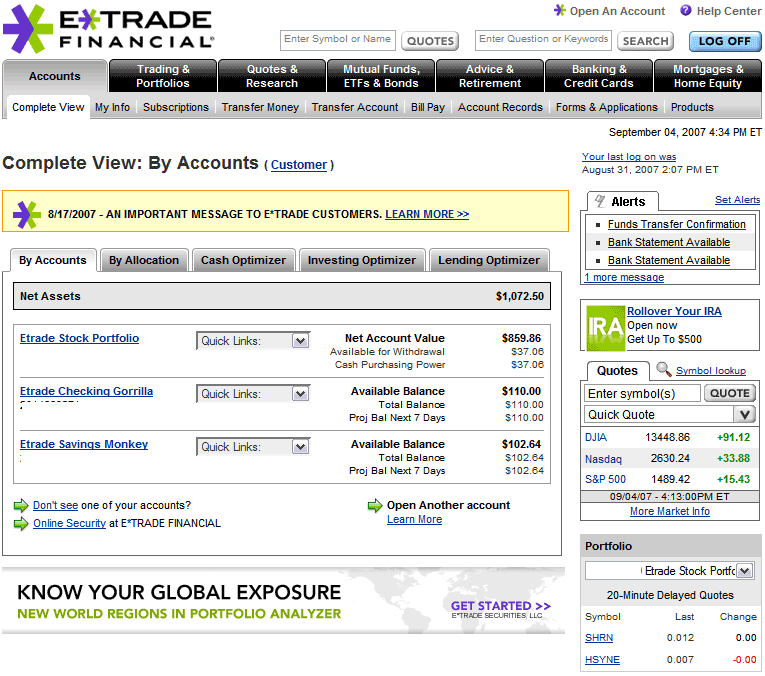

As a reliable and well-established online brokerage platform, ETRADE is an ideal choice for individuals interested in trading penny stocks. With its user-friendly interface and comprehensive research tools, ETRADE simplifies the process of finding and trading these low-priced securities.

E*TRADE offers a range of investment options, including penny stocks, giving investors the flexibility to explore different opportunities within this market. The platform provides users with access to extensive data and analysis, allowing them to make informed decisions when it comes to investing in penny stocks.

One advantage of trading penny stocks through E*TRADE is the ease of use provided by its intuitive interface. Whether you are a seasoned investor or new to the world of trading, navigating through the platform is straightforward and hassle-free.

The platform’s clean design ensures that essential information is easily accessible, enabling users to monitor their investments and execute trades efficiently.

Additionally, E*TRADE’s research tools serve as valuable resources for those interested in exploring penny stock opportunities. Investors can benefit from real-time market data, news updates, company profiles, and analyst reports – all conveniently available on the platform.

This wealth of information allows investors to conduct thorough due diligence before making any investment decisions.

In summary, ETRADE offers a robust platform for trading penny stocks*, catering to both experienced traders and newcomers alike. Its user-friendly interface and comprehensive research tools provide investors with the necessary means to navigate this niche market successfully.

By leveraging ETRADE’s resources and expertise, individuals can take advantage of the potential returns offered by penny stocks while managing risk effectively*.

Features to Look for in E*TRADE Penny Stocks

When considering penny stocks on E*TRADE, two important features to evaluate are liquidity and volume of trades, as well as volatility and potential price fluctuations.

Assessing the liquidity and volume of trades helps ensure easy entry and exit positions. Higher trading volumes provide better opportunities for buying and selling, indicating an active market for the stock. Consider average daily trading volume and bid-ask spreads to gauge liquidity.

Penny stocks are known for their volatility, which can lead to significant gains or losses. Look for stocks with a history of notable price fluctuations, as this indicates potential short-term profits. Research factors like company news releases and market trends that may impact price movements.

By considering these features when selecting penny stocks on E*TRADE, you can make more informed investment decisions while managing risks effectively.

Quick Look at the Best E*TRADE Penny Stocks

When evaluating penny stocks on ETRADE, consider factors such as revenue growth, profitability, industry trends, innovative products/services, strong management teams*, positive market sentiment, and successful regulatory changes.

While there is no definitive list of the best penny stocks on the platform, conducting thorough research can help identify potential winners. It’s important to exercise caution due to their volatility and lower liquidity compared to larger companies.

Take a Closer Look at E*TRADE Penny Stocks

When investing in penny stocks on ETRADE, it’s crucial to analyze financial data* and performance indicators. Evaluate metrics like revenue growth, profitability ratios, debt levels, and cash flow to gain insights into a company’s financial health. Additionally, consider industry trends and market conditions.

Identify emerging sectors with growth potential and stay informed about regulatory factors that may impact penny stocks. By thoroughly examining these aspects, investors can make well-informed decisions to maximize their potential returns while managing risks effectively.

Frequently Asked Questions about Trading Penny Stocks on E*TRADE

Trading penny stocks on E*TRADE comes with risks. These include high volatility, limited liquidity, potential for fraud, lack of information transparency, and susceptibility to market manipulation.

To mitigate these risks, diversify your portfolio, avoid hype-based investments, conduct thorough research, set realistic expectations, use stop-loss orders, and be cautious of scams. The Securities and Exchange Commission (SEC) imposes regulations on brokers and issuers dealing with penny stocks to protect investors from fraudulent activities.

Stay informed about these regulations and work with reputable brokers to trade penny stocks safely on E*TRADE.

Conclusion: Opportunities and Risks of Trading Penny Stocks on E*TRADE

Trading penny stocks on E*TRADE can offer investors the potential for high returns, but it is important to consider the associated risks. Volatility, limited liquidity, and potential fraud are factors that must be taken into account.

While penny stocks have the potential for significant growth, their low market capitalization makes them prone to price fluctuations. This volatility can lead to sudden gains or losses, necessitating careful monitoring.

Additionally, there is a risk of fraudulent practices in this market segment. Traders should conduct thorough research on companies before investing to avoid falling prey to false information or manipulation.

Before investing in penny stocks on ETRADE or any other platform, comprehensive research* is crucial. Evaluating a company’s financial health, industry trends, and regulatory factors helps traders make informed decisions and navigate this volatile market more confidently.

[lyte id=’WQDlkD9WAhI’]