Investing in today’s dynamic market requires access to accurate and timely information. For investors seeking an edge, Chaikin Analytics has emerged as a powerful tool that provides comprehensive data insights.

However, before diving into the world of Chaikin Analytics, it is essential to understand the true cost of investing and how it impacts your overall returns.

In this article, we will explore the features and benefits of Chaikin Analytics, assess its pricing structure, compare it with competing products, and highlight the value it brings to investors. By the end, you will have a clear understanding of whether Chaikin Analytics is worth the investment for achieving your financial goals.

Introducing Chaikin Analytics as a Powerful Tool for Investors

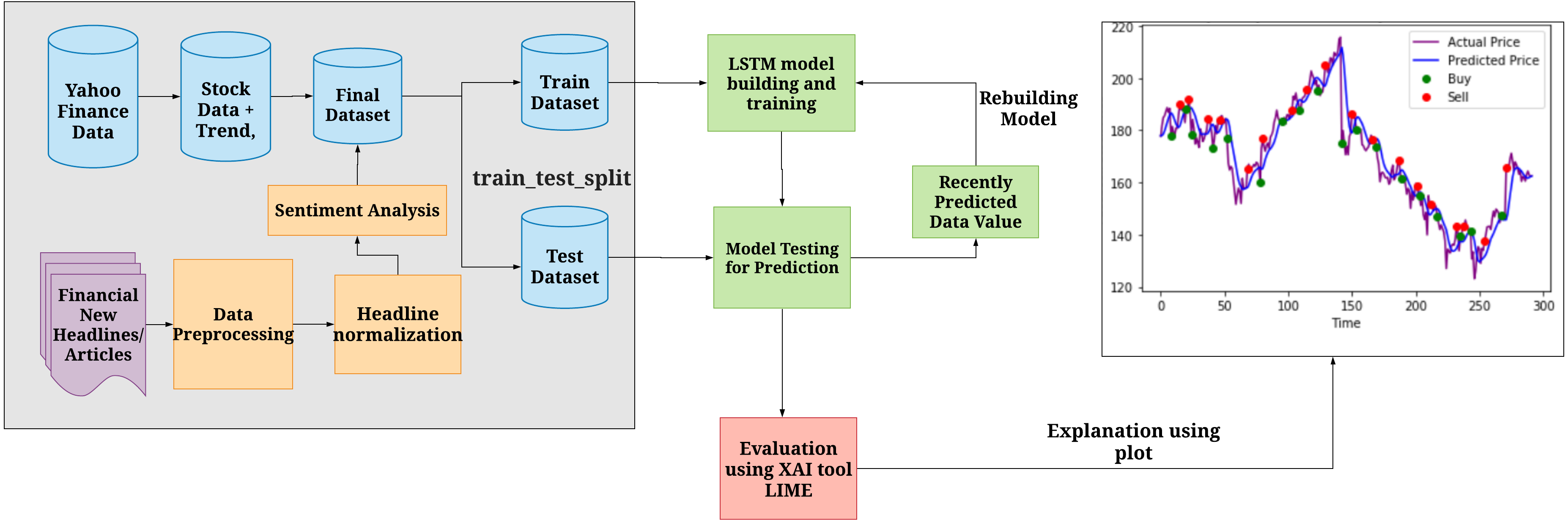

Chaikin Analytics is an advanced investment research platform that provides real-time data analysis and insights. Whether you’re new to investing or an experienced investor, this platform offers a wide range of features tailored to your specific needs.

With comprehensive tools and resources, Chaikin Analytics empowers users to make informed decisions based on accurate information.

What sets Chaikin Analytics apart is its ability to simplify complex financial data. It presents information in a visually appealing way, making it easy for users to understand and act upon. By leveraging various indicators and algorithms, the platform generates actionable insights that help investors navigate the market with confidence.

In summary, Chaikin Analytics is a powerful tool for investors in today’s market. Its real-time analysis capabilities combined with user-friendly features make it an invaluable resource for both beginners and seasoned investors.

By utilizing the insights provided by Chaikin Analytics, investors can make smarter decisions and increase their chances of success in the ever-changing world of investing.

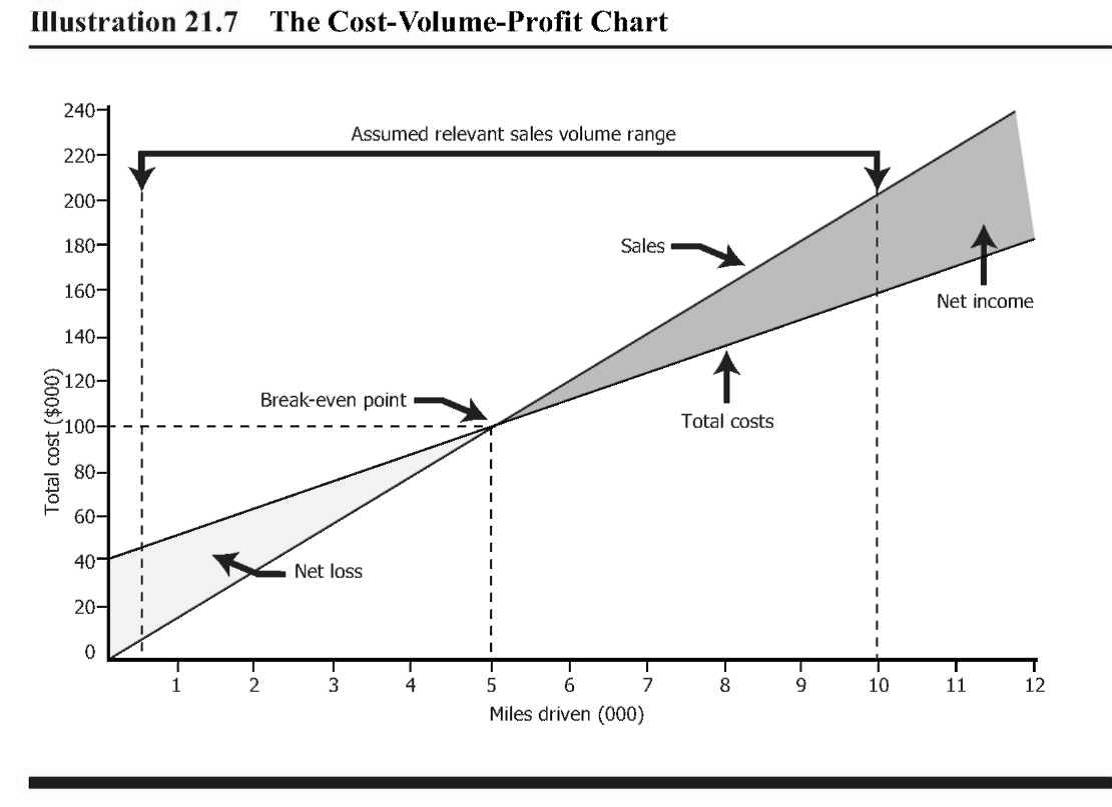

Understanding the Importance of Cost in Investing

Cost plays a crucial role in investing, directly impacting your overall returns. Every dollar spent on fees or subscription charges affects your profitability. Evaluating the pricing model of investment tools is essential before committing your hard-earned money.

Investing isn’t just about selecting stocks or diversifying portfolios; it’s also about being mindful of costs. Expenses can eat into profits and impact long-term financial goals. Understanding cost is paramount for both beginners and experienced investors.

Consider fees charged by brokers or advisors, including transaction fees, management fees, and performance-based fees. Analyze these fees across providers to ensure you’re getting the best value.

Evaluate subscription charges or membership fees for investment platforms and determine if they justify recurring expenses.

Trading commissions are another factor influencing costs. Compare commission fees per trade across brokers to minimize expenses.

Expense ratios matter when assessing mutual funds and ETFs. Lower ratios indicate lower management costs relative to peers, potentially enhancing long-term returns.

Understanding cost optimizes potential gains while aligning financial goals with cost-effective strategies. Be mindful of fees, charges, commissions, and expense ratios to make informed investment decisions that contribute positively to your journey.

About Chaikin Analytics: A Comprehensive Overview

Chaikin Analytics stands out in the financial markets with its advanced features and user-friendly interface. With a rich history and expertise in the industry, this platform provides comprehensive market analysis tools for informed decision-making.

One notable feature is the proprietary Chaikin Power Gauge Rating, combining fundamental and technical analysis to assess a stock’s potential. The intuitive interface allows users to navigate effortlessly, accessing the information they need quickly.

Chaikin Analytics offers an extensive library of educational resources, including video tutorials, webinars, and articles. Pricing options are flexible, catering to individual investors and professional traders with different needs.

In summary, Chaikin Analytics is a leading platform known for its advanced features, user-friendly interface, educational resources, and customizable pricing plans. It empowers investors by providing comprehensive insights and tools for making informed decisions in today’s complex markets.

Key Features of Chaikin Analytics: Empowering Investors with Data Insights

Chaikin Analytics offers powerful features that empower investors to make better decisions. With real-time data analysis, customized alerts, and portfolio management tools, this platform is designed to cater to the needs of active traders and long-term investors.

By providing valuable insights and advanced analytics capabilities, Chaikin Analytics equips users with the tools they need to navigate the stock market effectively. Its user-friendly interface ensures accessibility for both experienced investors and beginners alike.

Discover new opportunities and manage risk with the comprehensive features of Chaikin Analytics.

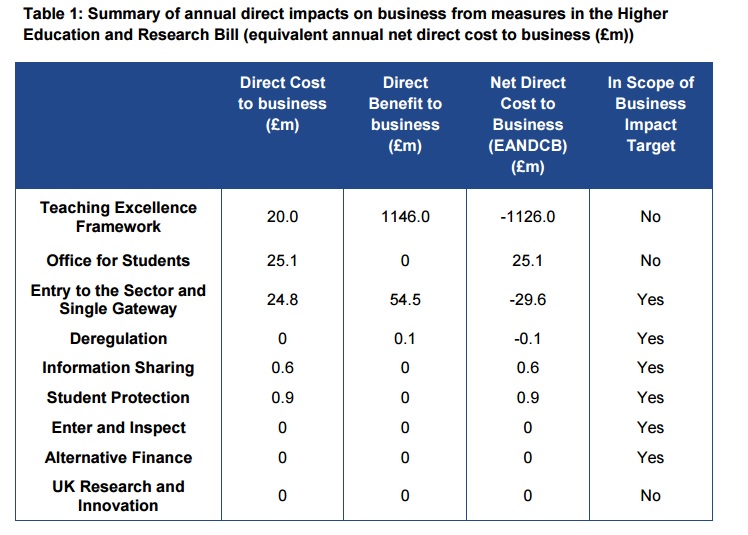

Assessing the Pricing Model: How Chaikin Analytics Charges its Users

Chaikin Analytics offers a subscription-based pricing structure that allows users to choose from different tiers based on their needs. By exploring the options and associated costs, investors can make an informed decision about the plan that suits them best.

The pricing model is designed to provide flexibility and value, ensuring that users have access to the tools and features they need without paying for unnecessary extras. Transparent information about costs and features empowers investors to evaluate each plan before making a decision.

With comprehensive features such as real-time market data, analytics tools, customizable watchlists, and portfolio tracking capabilities, Chaikin Analytics aims to enhance investors’ decision-making process in today’s complex financial markets.

Evaluating Performance: Comparing Chaikin Analytics to Competing Products

To truly understand the value of Chaikin Analytics, it is essential to compare it with other similar platforms in terms of price-performance ratio, features offered, benefits provided, and overall costs involved.

When evaluating financial analytics platforms, cost should not be the sole determining factor. It’s crucial to assess whether Chaikin Analytics offers the features you need and provides tangible benefits that justify its cost.

Chaikin Analytics stands out for its robust set of tools, including real-time stock analysis, customizable alerts, and portfolio tracking. By comparing these features with competitors, you can determine which platform best meets your requirements.

Consider the overall costs involved in using Chaikin Analytics compared to other platforms. This includes subscription fees and any additional charges for premium data or advanced features. Assessing these costs ensures you get optimal value for your investment.

By conducting a thorough evaluation and utilizing comparison tables, investors can confidently choose the financial analytics platform that enhances their decision-making process.

The Value of Accuracy: How Chaikin Analytics Helps Investors Save Money

Chaikin Analytics is a game-changer for investors looking to save money in the long run. Its accurate data insights help them avoid costly mistakes in stock selection, maximizing their returns. By capitalizing on market trends and minimizing expenses, investors can make smarter decisions and optimize their portfolios over time.

With Chaikin Analytics, accuracy becomes the key to financial success.

Tailored Solutions for Every Investor: Finding the Right Fit within Your Budget

Chaikin Analytics offers a range of subscription tiers designed to cater to the needs and budgets of all types of investors. From beginners to advanced traders and institutional investors, there is a tier suitable for every investor’s requirements.

The different tiers provide tailored experiences, ensuring that users have access to the right tools and features without being overwhelmed or limited.

Beginners can benefit from affordable options with essential tools and educational resources, while advanced traders can access comprehensive analytics, real-time data feeds, customizable screeners, and in-depth market insights. Institutional investors have access to institutional-grade analytics and advanced portfolio management tools.

By offering tailored solutions at different price points, Chaikin Analytics empowers investors to choose the right fit for their needs and budget. With these solutions, investors can confidently navigate the market and make informed investment decisions.

[lyte id=’1nsdI4wi5B0′]