Investing in royalties can be a lucrative and rewarding venture for those looking to diversify their investment portfolio. Royalty investments offer the potential for passive income, diversification benefits, and lower risk compared to traditional investments.

In this article, we will explore the different types of royalty investments available, the risks and challenges associated with them, successful case studies, and tips for selecting the best royalty investments.

Music Royalties

Investing in music royalties offers a lucrative opportunity for diversifying portfolios. Royalties from music sales, streaming platforms, and licensing agreements provide a steady income stream. Acquiring music catalogs or individual songs allows investors to earn a share of the generated royalties.

Streaming platforms and licensing agreements further enhance earning potential. However, it is important to understand the risks involved, such as fluctuating popularity and changes in technology or copyright laws. Thorough research is crucial before making any investment decisions.

Intellectual Property Royalties

Investing in intellectual property royalties offers a unique opportunity for generating passive income. Patents, copyrights, and trademarks can all be valuable assets that allow investors to earn royalties through licensing agreements.

By granting permission for others to utilize or sell their intellectual property, investors can receive a percentage of the sales or usage fees as royalty payments. Thorough market research is essential to identify profitable opportunities within specific industries and ensure the potential profitability of these investments.

Overall, delving into intellectual property royalties presents a promising avenue for long-term financial gains.

(Note: The paragraph has been shortened while maintaining the key points and main ideas.)

Mineral Rights Royalties

Investing in mineral rights allows individuals to earn royalties from oil, gas, or mining activities on a specific property. Evaluating factors such as resource estimates, production history, and market conditions is vital when considering mineral rights investments.

One crucial factor to consider is resource estimates. Understanding the potential quantity and quality of minerals on a property helps determine its value and earning potential. Assessing production history provides insights into past extraction success.

Monitoring market conditions and staying updated on industry trends ensures informed decision-making.

While mineral rights royalties offer attractive opportunities, it’s essential to acknowledge associated risks. Fluctuating commodity prices can impact royalty payments, and technical or legal issues may disrupt operations and payments.

In conclusion, investing in mineral rights royalties presents an intriguing option for generating income. Careful evaluation of key factors maximizes chances of success in this potentially rewarding field.

Risks and Challenges Associated with Royalty Investments

Factors to Consider Before Investing in Royalties

Investing in royalties requires careful consideration of various factors. Firstly, royalty investments may have limited liquidity compared to traditional stocks or bonds. This means it can be challenging to sell your assets quickly if needed.

Secondly, the income from royalties can fluctuate due to industry trends and external factors, making future earnings uncertain. Lastly, industries like music and natural resources can be highly volatile, impacting the stability of royalty investments. It is crucial to understand these potential risks before entering the world of royalties.

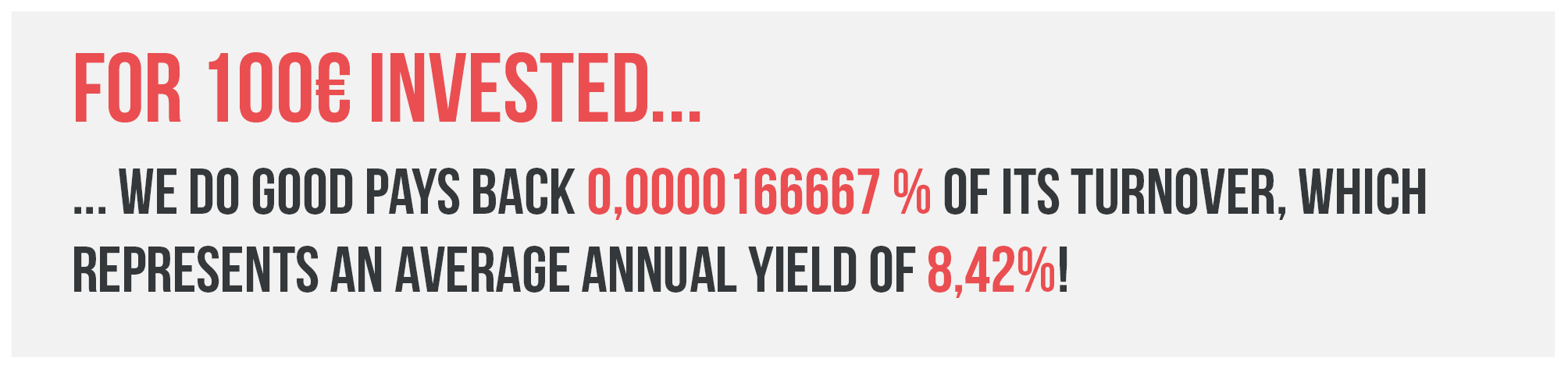

Evaluating the Potential Return on Investment (ROI) for Royalties

To assess the potential return on investment for royalties, consider analyzing historical performance, understanding contractual terms and revenue projections, and considering external factors that may impact returns.

By reviewing past performance of similar royalty investments, gaining insights into revenue projections and contractual terms, and staying aware of market competition, regulatory changes, and technological advancements, investors can make informed decisions to maximize their ROI.

Evaluating these factors ensures a comprehensive assessment of royalty investments’ profitability.

Examples of Successful Royalty Investments

Investors have found success in various types of royalty investments.

-

Music Catalog Acquisitions: Acquiring rights to popular music catalogs has proven lucrative. With the rise of digital platforms, music royalties offer a consistent stream of income.

-

Licensing Agreements: Companies securing licensing agreements with popular brands or intellectual properties generate revenue through merchandising, spin-offs, and marketing campaigns.

-

Mineral Rights Investments: Identifying promising mineral deposits and acquiring corresponding rights leads to substantial returns as global demand for natural resources grows.

When selecting royalty investments, thorough research and due diligence are essential. Assess historical performance, market trends, and future growth prospects to make informed decisions. Diversify your portfolio across different types of royalties to mitigate risks and maximize returns.

Researching Potential Opportunities

When it comes to exploring potential opportunities in the world of royalty investing, there are several avenues that investors can explore. By utilizing online platforms and marketplaces dedicated to connecting investors with royalty opportunities, individuals can gain access to a wealth of options.

These platforms serve as a hub for connecting investors with various industries, such as music, intellectual property, or mineral rights.

In addition to online platforms, seeking guidance from experienced investment advisors or brokers can be invaluable in identifying suitable royalty investment opportunities. These professionals possess the knowledge and expertise necessary to navigate the complex world of royalty investing.

They can offer insights into emerging trends, advise on potential risks, and provide recommendations based on their industry experience.

However, before diving into any investment opportunity, conducting thorough due diligence is crucial.

This involves researching the specific industry in which the royalties are derived from, analyzing financial statements related to the investment opportunity, understanding contractual terms associated with the royalties, and assessing any potential risks involved.

By thoroughly researching these aspects of a potential investment opportunity, investors can ensure that they are making informed decisions based on reliable information. This due diligence process helps mitigate risks and increases the likelihood of a successful return on investment.

To summarize:

- Utilize online platforms and marketplaces dedicated to connecting investors with royalty opportunities.

- Seek guidance from experienced investment advisors or brokers.

- Conduct thorough due diligence by researching the industry, analyzing financial statements, understanding contractual terms, and assessing associated risks.

With these steps in mind, investors can embark on their journey of exploring potential opportunities in the exciting world of royalty investing.

Managing and Monitoring Your Royalty Investments

Investing in royalties requires active management and continuous monitoring. Regularly review financial statements and reports provided by the investment issuer to stay updated on performance. Stay informed about distribution processes and payments to ensure timely and accurate income.

Adjust your investment strategy based on performance to maximize returns. Thorough research, due diligence, and a proactive approach are key to success in the ever-evolving world of royalty investments.

[lyte id=’gq_5dNpHELQ’]