Investing in royalty companies has become an increasingly popular strategy for those seeking to diversify their investment portfolios and tap into unique income streams. Whether you’re a seasoned investor or just starting out, understanding the world of royalty companies can offer you exciting opportunities.

In this article, we will explore the best royalty companies in the market, evaluate factors to consider when investing in them, analyze their benefits and risks, compare different types of royalty companies, delve into key financial metrics for assessment, examine successful case studies, and provide insights on how to invest in these companies and build a diversified portfolio.

So let’s dive in and unlock the hidden potential of investing in royalty companies.

Introduction to Royalty Companies

Royalty companies act as specialized financiers for industries such as mining, oil and gas exploration, and music production. They provide capital upfront in exchange for a percentage of revenue or profits generated by projects in these sectors. This allows investors to indirectly participate in industry success without taking on operational risks.

Royalty companies play a crucial role in supporting exploration, development, and creative endeavors while offering investors diversification and passive income opportunities.

Factors to Consider When Evaluating Royalty Companies

When evaluating royalty companies for investment, it is important to consider their track record and reputation within the industry, portfolio diversity and quality, management expertise, and royalty agreement terms. A company with a strong history of success and positive reviews is more likely to be a reliable investment option.

A well-diversified portfolio reduces risk, while experienced management can navigate challenges and drive growth. Understanding the terms of royalty agreements helps gauge profitability. Careful evaluation of these factors enables informed investment decisions aligned with individual goals.

Top Performing Royalty Companies in the Market

Within the realm of royalty companies, there are standout performers that consistently deliver impressive returns. Franco-Nevada Corporation, Wheaton Precious Metals Corp., and Streamline Royalty Ltd. have established themselves as industry leaders with robust portfolios and a proven track record of generating substantial returns for investors.

Franco-Nevada Corporation is a diversified company with streaming agreements across gold, silver, platinum group metals, and oil and gas assets. Their stable revenue stream makes them an attractive choice for investors seeking consistent returns.

Wheaton Precious Metals Corp. specializes in precious metals like gold and silver. They secure streaming agreements with major mining companies to benefit from production growth without operational risks, providing shareholders with reliable dividends.

Streamline Royalty Ltd., although relatively new, focuses on acquiring royalties in North American oil and gas properties. Their disciplined approach ensures strong cash flows and potential upside for investors.

These top performing royalty companies offer investors opportunities to participate in resource extraction profits without assuming operational risks. With their diverse portfolios and strategic partnerships, they continue to excel in the market. Consider these companies if you seek stable returns and potential growth in your investments.

Benefits of Investing in Royalty Companies

Investing in royalty companies offers attractive benefits for your investment portfolio. Firstly, they provide exposure to industries that may be hard to access directly, such as mining, oil and gas, music, entertainment, and intellectual property rights. This indirect participation allows you to potentially benefit from their success.

Royalty companies can enhance portfolio diversification as their revenue streams have low correlation with traditional assets like stocks and bonds. This stability can help navigate market volatility while aiming for consistent returns.

Compared to traditional businesses, royalty companies have lower operating costs. With minimal overhead expenses, they can allocate a larger portion of revenue towards profit margins or shareholder distribution. This potential for higher profits makes them an appealing investment option.

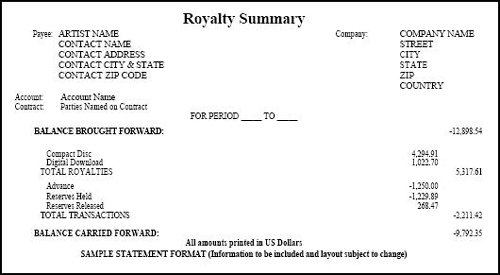

Investing in royalty companies also offers passive income opportunities. Through royalties received from license agreements or usage fees tied to intellectual property or natural resource extraction, these companies generate steady cash flow that can be distributed as regular dividend payments.

In summary, investing in royalty companies provides exposure to diverse industries, enhances portfolio diversification, offers potential for higher profits due to lower operating costs, and provides passive income opportunities through regular dividend payments.

Consider adding royalty companies to your investment strategy to potentially enhance returns while mitigating risk.

Risks Associated with Investing in Royalty Companies

Investing in royalty companies comes with risks that should be considered. One major risk is the dependence on the success of partner businesses and projects. If these projects fail or underperform, revenue for royalty companies can decline.

Fluctuations in commodity prices can also impact mining or energy projects, affecting royalty company earnings. Additionally, political and regulatory changes as well as economic downturns can pose challenges. Thorough research and analysis are crucial to mitigate these risks effectively in the realm of investing in royalty companies.

Comparison of Different Types of Royalty Companies

Royalty companies operate in various sectors such as oil and gas, mining, music, intellectual property, and technology. Each sector presents unique opportunities and challenges for investors. Oil and gas royalties offer potential long-term returns due to increasing global demand for energy resources.

Music royalties provide steady income streams from ongoing music consumption. Intellectual property licensing allows inventors to monetize their ideas while providing businesses with valuable rights. Technology advancements like renewable energy patents offer innovative solutions for investors interested in sustainability.

Understanding these differences helps investors tailor their portfolios based on risk appetite and market outlook.

Key Financial Metrics for Assessing Royalty Company Performance

When evaluating royalty companies, certain financial metrics provide valuable insights. These include free cash flow, revenue growth, return on investment capital (ROIC), and debt levels. Analyzing these metrics helps gauge a company’s financial health and potential for future success, allowing investors to make informed decisions.

Positive free cash flow ensures sufficient funds for obligations and growth. Steady or increasing revenue growth indicates income generation and future profitability. ROIC measures efficient capital utilization, while manageable debt levels indicate stability and borrowing capacity.

These metrics collectively inform investment decisions in the royalty company sector.

Case Studies of Successful Investments in Royalty Companies

Analyzing successful investments in royalty companies provides valuable lessons and inspiration for investors. For example, investing in a mining royalty company during a commodity upswing resulted in substantial returns. Understanding the factors that contributed to these successes can guide investment decisions and uncover new opportunities.

Royalty companies offer advantages such as passive participation and diversification across projects. By focusing on strong growth potential and considering market cycles, investors can maximize their returns. Thorough research and due diligence are essential for identifying management expertise, project quality, and contractual terms.

[lyte id=’6ghLZdbpBWM’]