Copper, often referred to as “Dr. Copper,” is a key metal that serves as a barometer for economic growth. Its applications span across various industries, making it an essential resource in our modern world.

As an investor, understanding the importance of copper and identifying the best copper royalty stocks can provide lucrative opportunities for growth.

In this article, we will delve into the world of copper investing and explore the top copper stocks to consider in 2023. But before we dive into specific companies, let’s first take a closer look at why copper plays such a vital role in our economy and the factors contributing to its market growth.

Overview of the Importance of Copper in Various Industries

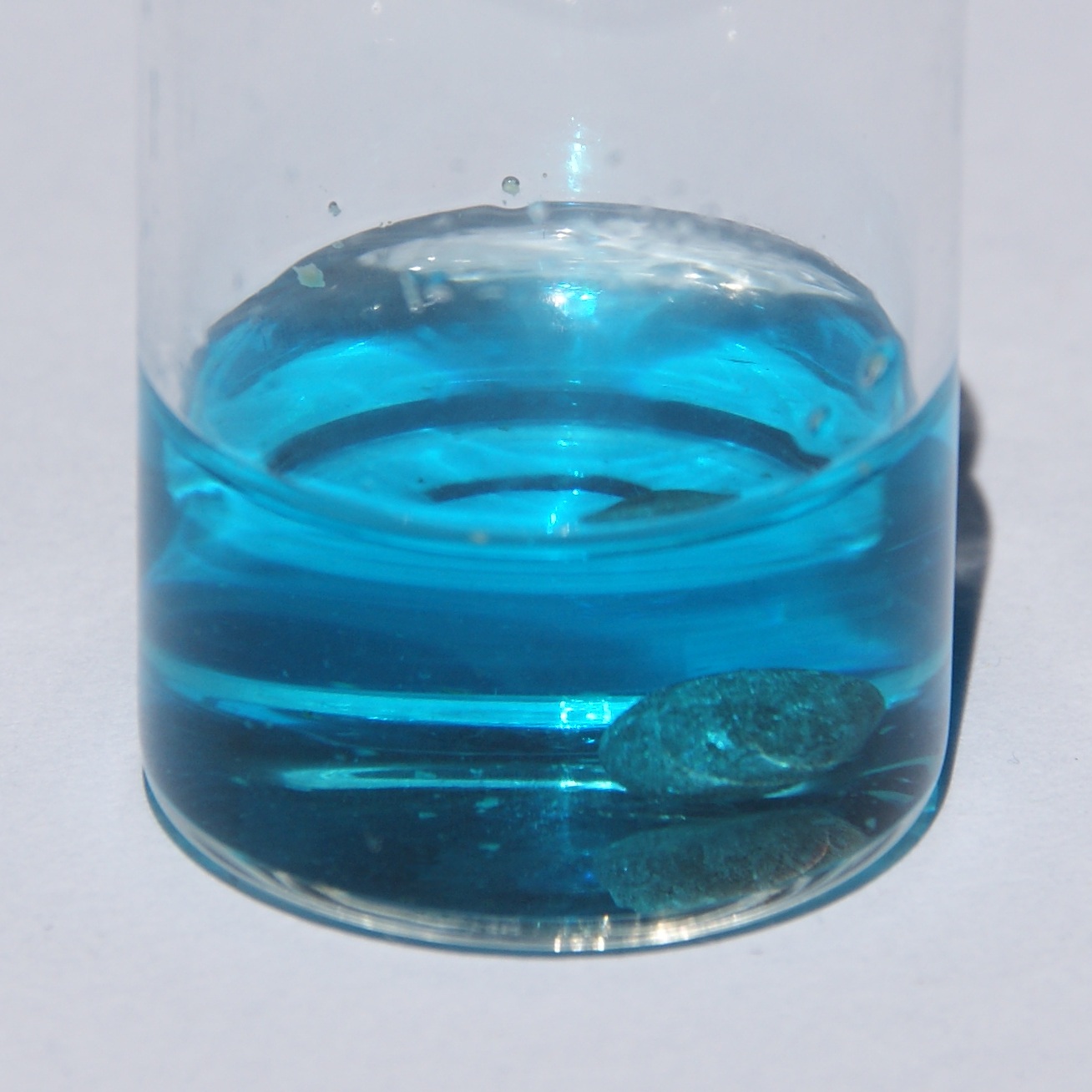

Copper, renowned for its exceptional conductivity and corrosion resistance properties, plays a crucial role in multiple industries across the globe. Its indispensability in electrical wiring and infrastructure projects stems from its ability to efficiently transmit electricity while withstanding environmental factors.

From power generation to telecommunications, transportation systems to renewable energy technologies, copper stands as an integral component that keeps our modern world running smoothly.

The construction industry heavily relies on copper due to its versatility and durability. It finds extensive use in plumbing systems, heating installations, roofing materials, and more. The automotive sector also recognizes the value of this versatile metal, employing it in wiring harnesses and electronic components.

The demand for copper has witnessed a substantial surge with the rise of electric vehicles (EVs) and renewable energy sources like wind and solar power. Copper’s superior conductivity compared to other metals makes it the ideal choice for these applications.

As society increasingly embraces sustainable solutions, the need for copper continues to grow exponentially.

Investors keen on capitalizing on this growing demand have identified significant growth potential in copper. With EVs gaining momentum in the automotive industry and renewable energy becoming a dominant force globally, there is an ever-increasing requirement for copper resources.

Factors Driving the Growth of the Copper Market

The copper market is experiencing significant growth due to several key factors. Economic expansion drives industrial activities and infrastructure development, increasing demand for copper-infused products. Urbanization leads to extensive construction projects reliant on copper wiring and piping systems.

Governments investing in renewable energy rely heavily on copper for efficient electricity transmission. The global shift towards electric vehicles increases demand for copper in their powertrain systems. Supply constraints, such as declining ore grades and stricter regulations, further drive up prices.

Investing in copper royalty stocks presents an exciting opportunity to tap into this growing demand for the essential metal.

BHP Group

BHP Group is a leading diversified resource company with a strong presence in the copper industry. With a rich history spanning over a century, BHP has established itself as a reliable market player.

The company’s focus on cost efficiency, sustainable practices, and technology adoption drives its financial performance and positions it for future growth.

BHP prioritizes cost efficiency, leveraging innovative technologies to optimize profitability while maintaining high-quality standards. It also emphasizes sustainable practices, implementing stringent environmental policies and investing in research for responsible resource extraction.

Additionally, BHP embraces technology adoption to enhance operational efficiency and safety.

In summary, BHP Group’s extensive experience and commitment to excellence make it exceptional in the copper industry. With its strong financial performance and dedication to cost efficiency, sustainability, and technology adoption, BHP is poised for continued growth.

Freeport-McMoRan

Freeport-McMoRan is a prominent player in the global copper industry, with extensive mining operations spanning multiple continents. Established as a leading copper producer, the company has solidified its position by consistently delivering impressive financial performance and projecting a positive outlook for the future.

Driven by higher copper prices and improved operational efficiencies, Freeport-McMoRan has achieved remarkable financial success. The company’s strategic investments in expansion projects have contributed significantly to its growth trajectory.

These investments have not only bolstered production capacity but also enhanced overall operational effectiveness.

With a strong focus on maximizing returns, Freeport-McMoRan has capitalized on favorable market conditions, resulting in increased revenue and profitability. By continuously optimizing its mining operations and implementing cost-saving measures, the company has effectively managed its expenses while maintaining high production volumes.

In addition to their core business of copper mining, Freeport-McMoRan has also diversified their portfolio to include other valuable commodities such as gold and molybdenum. This diversification strategy provides the company with additional revenue streams and helps mitigate risks associated with fluctuations in copper prices.

Furthermore, Freeport-McMoRan places great emphasis on sustainable practices throughout their operations. Their commitment to environmental stewardship and community engagement sets them apart from their competitors.

By integrating responsible mining practices into their operations, they strive to minimize negative impacts on the environment while creating long-term value for stakeholders.

Overall, Freeport-McMoRan’s strong financial performance, driven by higher copper prices and strategic investments in expansion projects, positions them as a key player in the global copper industry.

With a focus on sustainability and continuous improvement, the company is well-equipped to navigate future challenges while capitalizing on opportunities for growth.

| Industry | Copper |

| Company | Freeport-McMoRan |

| Operations | Global |

| Revenue | Impressive |

| Strategy | Expansion and Diversification |

| Sustainability | Environmental Stewardship, Community Engagement |

Teck Resources

Teck Resources is a Canadian mining company with diversified operations, including copper production. The company has a strong track record and is committed to sustainable mining practices.

Teck Resources has implemented cost-saving initiatives, improved production efficiencies, and advanced sustainability efforts, positioning itself for future growth in the copper market.

With its focus on responsible mining practices and community engagement, Teck Resources exemplifies the industry’s evolving landscape and demonstrates resilience in achieving long-term growth objectives.

Southern Copper

Southern Copper Corporation is a major global player in the copper industry, operating in Peru, Mexico, and Chile. The company’s recent expansions and strategic acquisitions have boosted its production capacity, positioning it favorably in the market.

Southern Copper’s commitment to sustainable practices aligns with growing investor interests and ensures minimal environmental impact. By actively engaging with local communities and prioritizing corporate social responsibility, the company aims to create positive change beyond financial success.

With a solid foundation built on operational excellence, Southern Copper is poised for continued growth and success in the dynamic copper market.

Rio Tinto

Rio Tinto is a major player in the global copper industry, with significant assets worldwide. The company’s strong financial performance and commitment to sustainable mining practices make it an attractive investment option within the sector.

By investing in Rio Tinto, individuals can benefit from its expertise, geographic diversification, and focus on responsible mining methods. The company’s solid reputation and dedication to sustainability position it favorably for investors seeking exposure to the potential growth of the copper market.

Benefits of Investing in Mining Stocks

Investing in mining stocks offers the potential for high returns during favorable market conditions. These stocks historically show significant gains during commodity price upswings and economic expansions.

Additionally, including mining stocks in your portfolio provides diversification by exposing you to different sectors and commodities beyond traditional investments like stocks or bonds. This helps spread risk and can offset losses in other sectors.

Furthermore, investing in mining stocks allows you to participate in global economic growth and infrastructure development, as well as benefit from long-term trends driven by population growth and urbanization. Overall, mining stocks offer attractive investment opportunities for those seeking potential high returns and diversification.

| Benefits of Investing in Mining Stocks |

|---|

| – Potential for High Returns |

| – Portfolio Diversification |

| – Participation in Global Growth |

| – Long-term Trends and Demand |

[lyte id=’_8zgn3qCv4Y’]

/Escondida-5b4b2f52c9e77c00371e0cf7.jpg)