Investing in the stock market offers diverse opportunities, including the arms manufacturers stocks sector. With ongoing conflicts and increased defense budgets worldwide, the demand for weapons and military technology remains high.

In this article, we will explore why investing in arms manufacturers stocks can be beneficial, discuss associated risks, highlight key industry players, examine factors affecting stock performance, and provide tips for investing in this sector.

Brief History of Arms Manufacturers and Their Role in Warfare

Arms manufacturers have a centuries-long history, providing nations with the necessary tools for protection and offense. The Industrial Revolution marked a turning point as technological advancements allowed for mass production of weapons on a larger scale.

From ancient times to modern warfare, these companies have played a crucial role in equipping armies with effective weaponry. Today, arms manufacturers continue to innovate in military technology, collaborating with militaries worldwide to develop cutting-edge weapons systems.

Despite controversies surrounding warfare, governments invest heavily in research and development programs to ensure military superiority.

Overview of the Current Global Arms Industry

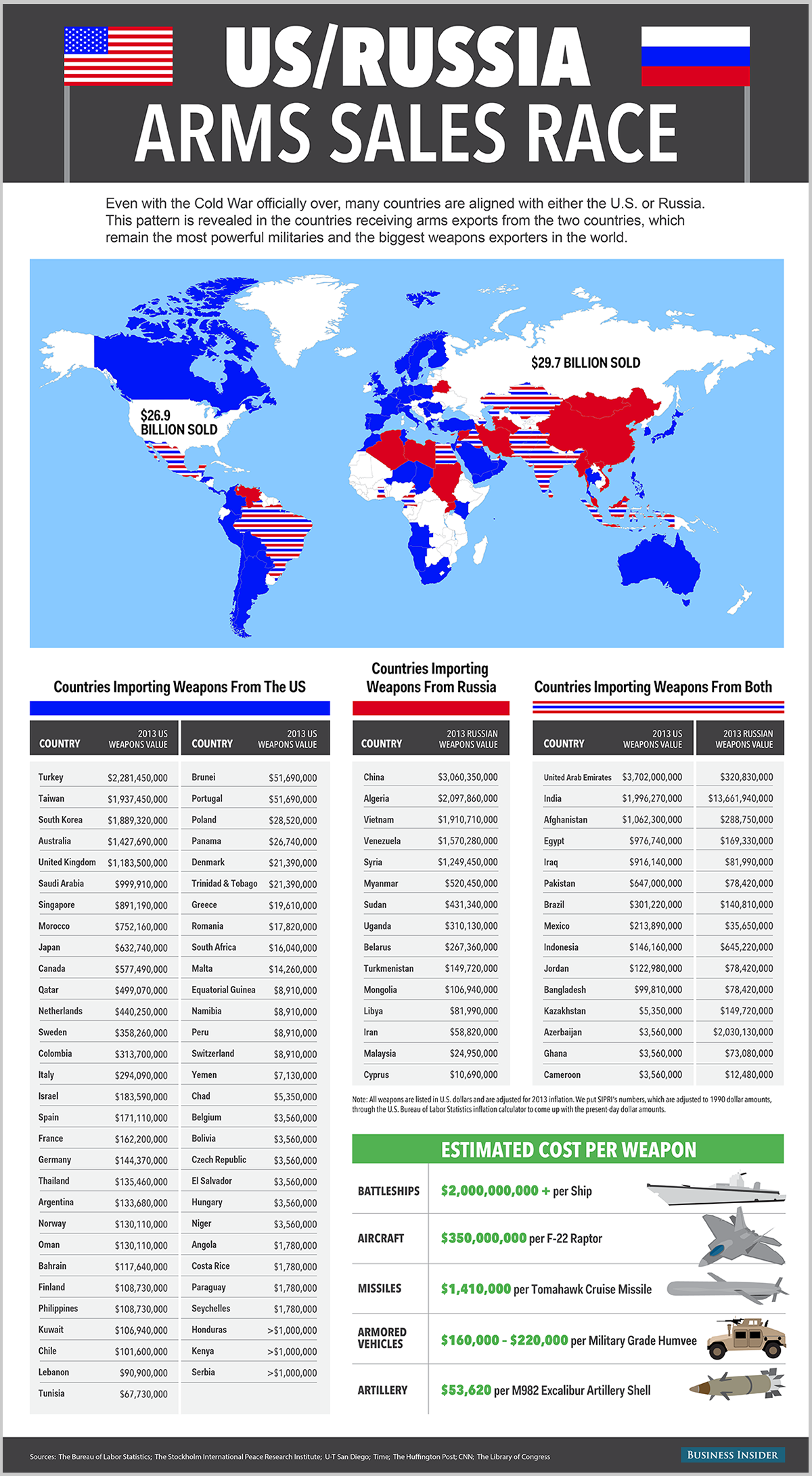

The global arms industry is booming as nations worldwide strive to enhance their military capabilities. Leading the pack are the United States, Russia, and China. This industry encompasses companies involved in designing and manufacturing cutting-edge weapons and defense equipment.

The constant pursuit of military supremacy and technological advancements drive its growth. Additionally, the arms industry contributes significantly to national economies through revenue generation and job creation. Overall, it plays a crucial role in shaping global security and economic landscapes.

Benefits of investing in this sector

Investing in the arms industry offers several advantages for individuals looking to diversify their portfolios and capitalize on a stable market. Key benefits include:

-

Consistent demand: As conflicts persist and defense spending remains a priority for nations, there is a steady demand for weapons and military technology. This ensures a reliable revenue stream for arms manufacturers.

-

Government contracts: Arms manufacturers often secure large government contracts due to their expertise and capabilities. These contracts provide stability and long-term revenue potential.

-

Strong financial performance: The arms industry has a history of strong financial performance, with companies reporting healthy profit margins and high returns on investment. This sector offers the potential for substantial returns.

Investing in the arms industry allows for diversification and can be influenced by geopolitical factors such as increased defense spending during periods of heightened tensions between nations. However, it is important to conduct thorough research and consider associated risks before making any financial decisions within this complex sector.

Ethical Considerations Surrounding Investing in Arms Manufacturers Stocks

The decision to invest in arms manufacturers stocks raises several ethical considerations that cannot be overlooked. The arms industry, while profitable for investors, is not without its controversies and public backlash. It is often associated with human rights abuses and contributing to global conflicts.

This association can attract criticism from certain segments of society, as individuals voice concerns over the moral implications of profiting from an industry that perpetuates violence.

Investors need to carefully consider the potential negative impact on society and human rights when contemplating investing in arms manufacturers stocks. There are legitimate ethical concerns about supporting a sector that directly contributes to violence and conflict around the world.

The consequences of such investments extend beyond financial gain and can have far-reaching implications for individuals, communities, and even entire nations affected by armed conflicts.

It is essential for investors to weigh these ethical considerations against their financial goals before making a decision. While some may argue that investing in arms manufacturers contributes to job creation and economic growth, others believe that any positive effects are outweighed by the harm caused by the weapons produced.

Understanding these opposing viewpoints is crucial for investors who wish to align their investment choices with their personal values.

Introduction to Major Arms Manufacturers Companies

The global arms manufacturing industry is dominated by major players known for their expertise in the defense sector. Among them, Lockheed Martin stands out as one of the largest defense contractors, offering a diverse range of aircraft, missiles, and advanced technology systems.

Boeing, renowned for its commercial aircraft, also plays a significant role in the defense industry by producing military aircraft, satellites, and weapons systems. Northrop Grumman specializes in aerospace and defense technology across air, land, sea, and space applications.

General Dynamics focuses on land and marine systems, producing armored vehicles, submarines, and other defense-related products. These companies shape military capabilities worldwide through innovation and technological advancements in their respective fields.

| Arms Manufacturer | Product Portfolio |

|---|---|

| Lockheed Martin | Aircraft, missiles, and advanced technology systems |

| Boeing | Military aircraft, satellites, and weapons systems |

| Northrop Grumman | Aerospace and defense technology for air, land, sea, and space applications |

| General Dynamics | Armored vehicles, submarines, and other defense-related products |

The table above summarizes the product portfolios offered by these major arms manufacturers. Their capabilities cater to various military requirements efficiently.

Global Conflicts and Geopolitical Tensions as Driving Forces Behind Stock Performance

Global conflicts and geopolitical tensions directly impact the demand for weapons and military technology, thus significantly influencing stock performance within the arms manufacturers sector. Investors should closely monitor these events as they can shape the demand for weapons in different regions.

For instance, escalating tensions often lead to increased defense spending, resulting in higher orders for arms manufacturers. Geopolitical tensions also create an arms race, offering lucrative opportunities for well-positioned companies.

The ripple effects of these tensions extend to industries supporting defense systems, such as aerospace and technology sectors. Overall, it is crucial for investors to stay informed about ongoing conflicts and geopolitical developments worldwide when making investment decisions in the arms manufacturing industry.

Defense Budgets

Defense budgets greatly influence the sales figures of arms manufacturers worldwide. Changes in these budgets can cause fluctuations in stock prices. When defense budgets increase, companies benefit from higher demand and potential revenue growth. Conversely, reductions in defense spending can lead to decreased orders and lower revenues.

Factors such as geopolitical situations, security threats, and economic conditions impact budget decisions. Additionally, defense budgets encompass investments in advanced technologies beyond traditional warfare expenses. Understanding these dynamics helps stakeholders navigate opportunities and risks in the arms manufacturing sector.

[lyte id=’fNRVvd_dPRs’]