Investing in the stock market can be a daunting task, especially for those new to the game. The sheer amount of information and analysis required to make informed decisions can overwhelm even the most seasoned investors.

However, with advancements in technology, specifically Artificial Intelligence (AI), a new breed of traders has emerged – AI traders.

In this article, we will delve into the world of AI trading and explore how it can revolutionize your investment journey. We will uncover the inner workings of AI bots, discuss their key attributes, and provide insights into setting up and activating a Trader AI system.

By the end of this article, you will have a clear understanding of how Trader AI can enhance your investment strategy.

Understanding Trader AI

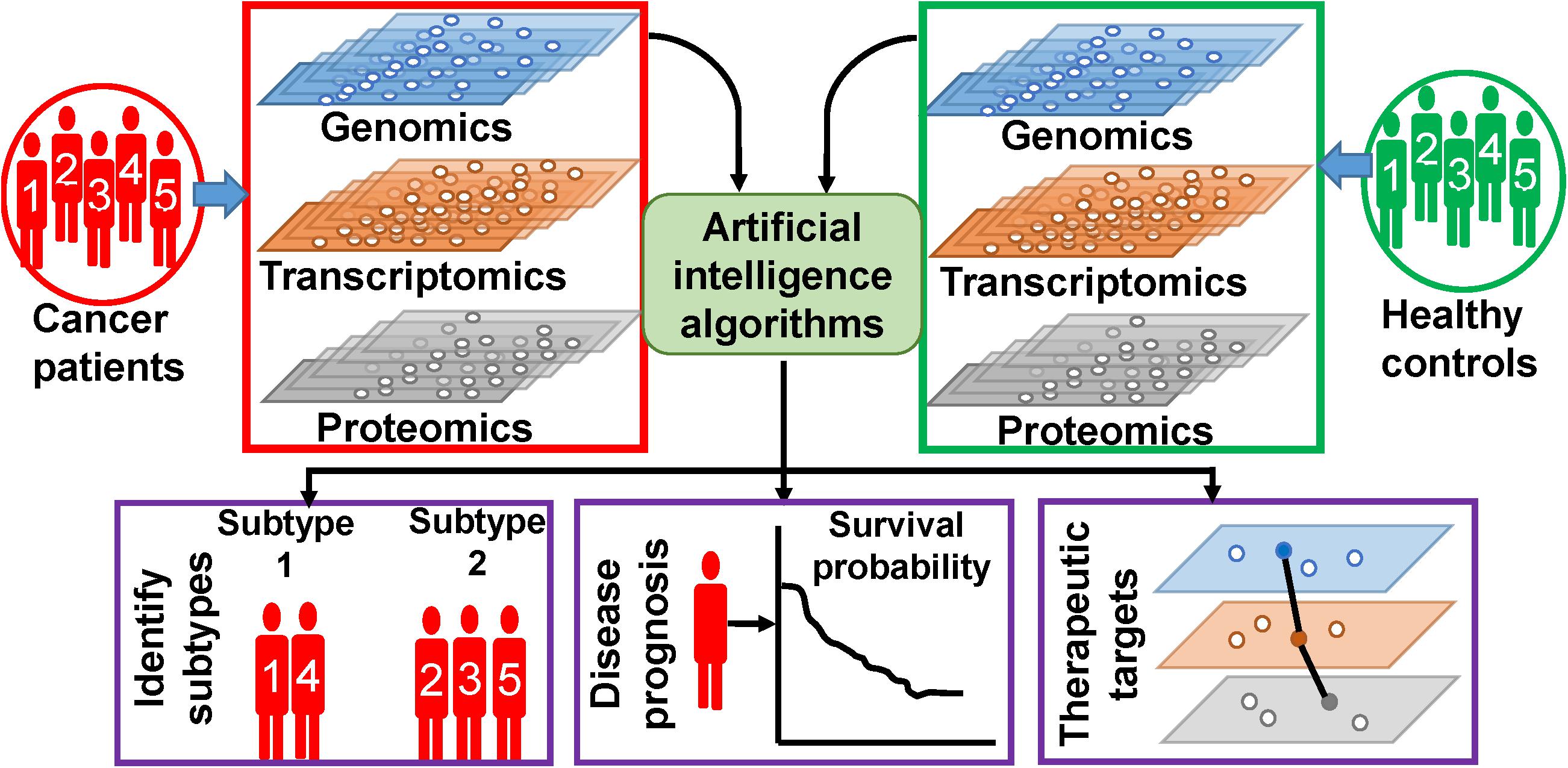

Trader AI, also known as automated or algorithmic trading, uses computer programs to execute trades based on pre-set instructions. These programs analyze vast amounts of data from various sources to identify patterns and make predictions about future price movements.

Trader AI offers several advantages, including speed, emotionless trading, 24/7 market monitoring, and backtesting capabilities. It allows for quick execution of trades, eliminates emotion-based decision-making, ensures round-the-clock market surveillance, and enables evaluation of performance using historical data.

Overall, understanding Trader AI can help investors optimize their trading strategies using advanced technology and data analysis.

Getting Started with Trader AI

Trader AI offers numerous benefits in investment strategies. It enhances efficiency by eliminating the need for manual analysis and trade execution, saving time and effort. With access to vast amounts of data, Trader AI enables data-driven decision making, leading to more informed investment choices.

Additionally, it ensures consistency and discipline by strictly adhering to predefined rules. To set up a Trader AI system:

- Research and choose a reputable automated trading system provider.

- Open an account with the chosen provider and follow their instructions for setting up your trading platform.

- Customize your trading parameters based on risk tolerance and investment preferences.

- Activate the bot to analyze market data and execute trades on your behalf.

By following these steps, you can harness the power of Trader AI in your investment journey, optimizing efficiency and potentially improving overall performance.

Pros and Cons of Trader AI

Trader AI, also known as automated trading, offers several advantages for investors. It provides speedy execution, allowing you to take advantage of short-term price movements. By removing emotional bias, it minimizes the impact of fear or greed on decision-making. Trader AI also enables diversification by analyzing multiple markets simultaneously.

However, there are considerations to keep in mind. Technical risks like system failures can lead to missed opportunities or unintended consequences. Market volatility may result in unexpected outcomes that don’t align with the bot’s algorithms.

Over-reliance on Trader AI without human oversight can lead to a loss of control over investment decisions.

In summary, while Trader AI offers benefits such as speedy execution and diversification, it is important to be aware of potential drawbacks like technical risks and market volatility. Balancing automation with human oversight is crucial for making informed investment decisions.

Case Studies: Real-Life Examples of Successful Trader AI Systems

In this section, we will explore real-life case studies highlighting the effectiveness of Trader AI systems in optimizing investments. One notable example is Renaissance Technologies, a hedge fund led by Jim Simons.

Through their sophisticated use of AI strategies and complex models that capture market inefficiencies, they have consistently achieved high returns. Their success is attributed to continuous refinement based on historical data analysis.

Jim Simons emphasizes adaptability and evolving trading strategies based on changing market conditions. This approach has allowed Renaissance Technologies to stay ahead of the competition and achieve extraordinary results.

These case studies showcase how advanced technology can revolutionize investment practices, unlocking new avenues for profitability and risk mitigation in the financial landscape.

Choosing the Right Trader AI: Factors to Consider When Selecting an Automated Trading System

When selecting an automated trading system, there are key factors to consider. First, evaluate the reputation and track record of the system provider. Look for consistent results and positive customer reviews. Second, understand the technology and algorithms used by the system. Robust models that analyze market data accurately are crucial.

Third, consider risk management features like stop-loss orders and customization options based on your risk tolerance and investment preferences. By carefully assessing these factors, you can find a Trader AI system that aligns with your goals and maximizes your trading success.

Tips for Maximizing Success with Trader AI: Best Practices for Investors

To maximize success with Trader AI systems, it is important to follow these best practices:

-

Conduct thorough research before selecting a Trader AI system: Ensure it aligns with your investment goals and risk appetite by considering factors such as historical performance, customer reviews, and industry reputation.

-

Start small and gradually increase investment as confidence grows: Begin with smaller investments to assess the system’s performance and gradually increase capital as trust builds.

-

Regularly monitor performance and make necessary adjustments: While Trader AI can operate autonomously, it is essential to monitor its effectiveness, make adjustments to trading parameters when needed, and stay informed about market conditions that may impact its performance.

By adhering to these best practices, investors can leverage the power of Trader AI systems effectively and increase their chances of success in today’s dynamic financial markets.

Addressing Concerns: Common Misconceptions and Risks Associated with Trader AI

Contrary to popular belief, Trader AI does not replace human investors but complements their decision-making processes. Human oversight remains critical in evaluating market conditions beyond algorithm analysis.

One misconception is that Trader AI will take over human jobs. However, it works alongside investors, providing data-driven insights to inform decisions. Traders can leverage advanced algorithms and machine learning for more informed choices.

Risks associated with Trader AI include system failures or glitches leading to missed opportunities or unintended consequences. Extreme market conditions or unforeseen events may result in outcomes that do not align with the bot’s algorithms.

To maximize success, traders must balance reliance on data-driven insights from Trader AI with human judgment and experience. By combining the strengths of both humans and machines, traders can navigate the investment industry more effectively.

The Future of Trader AI: Trends and Predictions for Automated Investing

Advancements in AI technology are revolutionizing investing, with Trader AI leading the way. Machine learning algorithms adapt to changing markets, while improved natural language processing analyzes news sentiment. As access to sophisticated trading systems grows, individual investors will embrace Trader AI.

This democratization of automated investing will increase adoption across all expertise levels, leveling the playing field and maximizing success potential while minimizing risks. The future holds great promise for Trader AI, empowering traders with valuable insights and shaping a more inclusive investment landscape.

[lyte id=’cDqknghLsWo’]