The world is undergoing a revolutionary shift towards electric vehicles (EVs), and this transformation is not only changing the way we commute but also presenting lucrative investment opportunities. If you’ve been keeping an eye on the market, you may have already noticed the immense potential of investing in EV stocks.

In this article, we will delve into the reasons why investing in EV stocks is a smart move and provide an in-depth analysis of the top 5 EV stocks to consider for your investment portfolio.

The EV Revolution: How Electric Vehicles are Changing the Game

Electric vehicles (EVs) have sparked a revolution in the automotive industry. With advancements in technology and environmental concerns, more consumers are embracing EVs as a sustainable alternative to gasoline-powered cars.

These vehicles offer superior performance, lower maintenance costs, and reduced carbon emissions, disrupting the traditional automotive industry. Government initiatives and supportive policies have further fueled the demand for EVs.

Investing in EV stocks provides an opportunity to be part of this transformative journey while potentially reaping substantial financial rewards. The growth potential within this sector promises a greener future for transportation worldwide.

Why Invest in EV Stocks?

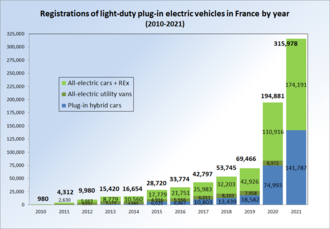

Investing in EV stocks offers several compelling reasons to consider adding them to your portfolio. The demand for electric vehicles is skyrocketing as countries strive for sustainability, presenting an opportunity for substantial returns.

The rapid expansion of the EV market means companies at the forefront have the potential for explosive growth and impressive financial gains. Additionally, investing in EV stocks aligns with a sustainable future by supporting companies that reduce greenhouse gas emissions and fight climate change.

Overall, investing in EV stocks combines financial potential with environmental impact, making it an enticing choice for investors.

Key Factors to Consider When Investing in EV Stocks

When investing in EV stocks, there are key factors to consider. Understanding market trends and forecasts helps identify growth potential. Analyzing the competitive landscape reveals companies with advantages like innovative technology or a robust charging infrastructure. Evaluating company financials ensures long-term viability.

Staying updated on government policies and regulations is crucial as they shape the industry’s trajectory. By considering these factors, investors can make informed decisions in this rapidly growing sector.

Top 5 EV Stocks to Buy: An In-depth Analysis

Investing in electric vehicle (EV) stocks is gaining popularity as the world embraces sustainable transportation. Let’s analyze the top 5 EV stocks for potential investment:

Tesla, a pioneer in the EV industry, dominates with groundbreaking innovations and visionary leadership. Its financial growth and future prospects make it an informed investment choice.

NIO, a Chinese EV manufacturer, stands out with cutting-edge technology and aggressive expansion plans. Its unique battery swap system adds intrigue to its investment potential.

GM’s commitment to electrification is evident through popular models like the Chevy Bolt EUV. With solid financials and strategic partnerships, GM has strong growth prospects in the EV market.

Ford’s investments in EVs showcase its dedication to sustainability. Models like the Mustang Mach-E and upcoming F-150 Lightning position Ford for growth in the electric vehicle sector.

As a leading Chinese manufacturer of automobiles and batteries, BYD offers diverse electric vehicles catering to various markets. Investors seeking exposure to China’s growing EV demand may find BYD appealing.

Thorough research is essential when investing in EV stocks. Consider factors like market dominance, financial performance, unique business models, and expansion plans before making informed decisions aligned with your goals. Stay updated with industry trends for optimal returns in this exciting sector.

Tips for Investing in EV Stocks

When investing in EV stocks, consider these key tips:

- Diversify your portfolio to mitigate risks: Spread your investments across multiple EV stocks to minimize losses if one company faces challenges.

- Stay updated with industry news and developments: Keep informed about technological advancements, regulatory changes, and company updates to make better investment decisions.

- Adopt long-term investment strategies: Ride out short-term volatility by taking a long-term approach and positioning yourself for maximum returns as the industry matures.

- Evaluate company fundamentals: Analyze financial stability, management competence, competitive positioning, and product roadmap when choosing which companies to invest in.

- Monitor global market trends: Understand varying levels of EV adoption and government support across different regions to identify emerging opportunities.

- Seek professional advice if needed: Consider consulting a financial advisor or investment consultant for personalized guidance.

Following these tips can enhance your strategy when investing in the dynamic world of EV stocks.

Conclusion: Capitalizing on the Electric Vehicle Revolution

[lyte id=’3tj8qNiJWWU’]