In the dynamic world of investing, a new breed of traders has emerged – the 10 Stock Trader. These individuals have gained popularity among investors for their unique approach to stock trading and their ability to consistently generate impressive returns.

In this article, we will explore the concept of the 10 Stock Trader, understand the basics of stock trading, uncover the secrets to becoming a successful 10 Stock Trader, discuss essential tools and resources for effective stock trading analysis, delve into the role of emotional intelligence in stock trading success, learn from successful 10 Stock Traders through case studies, identify common mistakes to avoid as a beginner, provide practical tips for aspiring 10 Stock Traders, and highlight valuable resources for learning and further development.

By the end of this article, you will be empowered to begin your journey as a 10 Stock Trader.

The Rise of the 10 Stock Trader

The emergence of the “10 Stock Trader” has revolutionized investment strategies. These traders focus on carefully selecting and trading only ten stocks at a time, instead of spreading their investments across hundreds or thousands. This approach simplifies decision-making, allowing for thorough research and analysis on each company.

By maintaining a concentrated portfolio, these traders can identify high-potential opportunities more accurately and make informed investment decisions. The 10 Stock Trader strategy also offers better risk management, agility in executing trades, and maximizes returns.

This shift towards focused and informed decision-making is transforming the world of stock trading.

Understanding the Basics of Stock Trading

Before delving into stock trading, it’s important to grasp the fundamentals. The stock market is a platform where investors buy and sell shares of publicly traded companies. Traders aim to profit by purchasing shares at a lower price and selling them at a higher price.

Success in stock trading hinges on knowledge and research. Staying informed about market trends, economic indicators, company financials, and industry news helps make informed investment decisions. Thorough research identifies undervalued stocks with growth potential or companies facing challenges.

Being aware of current events impacting investments is crucial. Market shifts can result from government policies, global conditions, technological advancements, or unexpected events like natural disasters. Gathering relevant information allows traders to anticipate risks and opportunities.

Understanding financial statements and analyzing company performance is essential. Examining balance sheets, income statements, cash flow statements provides insights into a company’s financial health and profitability. Data-driven decisions are preferred over speculation or intuition.

Lastly, effective risk management strategies are vital. Traders must understand their risk tolerance levels and employ measures to protect capital. Diversification across sectors or asset classes reduces risk.

Secrets to Becoming a Successful 10 Stock Trader

To become a successful 10 stock trader, there are a few secrets you should know. First, develop a strong investment strategy by identifying your financial goals and risk tolerance. Choose an approach that aligns with your goals, like value or growth investing.

Second, build a diversified portfolio by spreading investments across different asset classes and sectors within stocks. This helps mitigate risk and protect against market volatility. Stay informed about market trends and developments, and maintain a long-term perspective for steady wealth accumulation.

By following these secrets, you can increase your chances of success in stock trading.

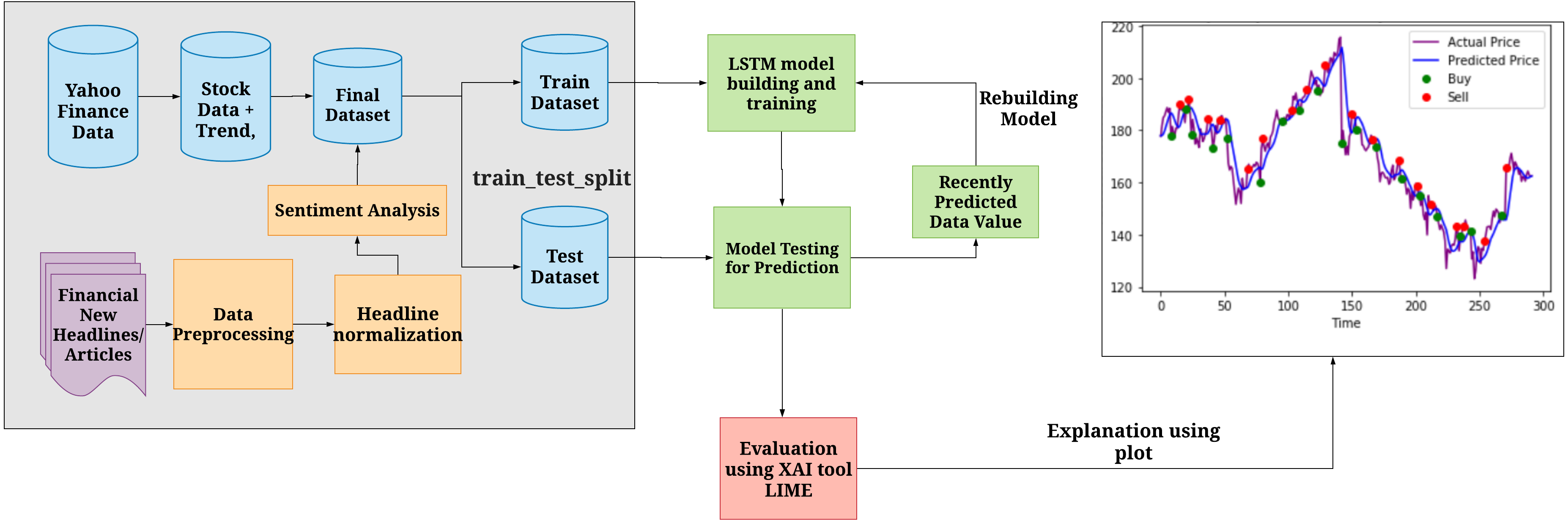

Tools and Resources for Effective Stock Trading Analysis

To succeed in stock trading, having the right tools is crucial. Online brokerage platforms provide real-time market data and intuitive trading interfaces. Financial news websites and apps keep traders updated with market developments. Fundamental analysis tools evaluate a company’s financial health and growth potential.

Technical analysis software identifies price patterns. Education resources offer insights into trading strategies and risk management. By utilizing these tools, traders can make informed decisions and improve their chances of success in stock trading.

The Role of Emotional Intelligence in Stock Trading Success

Emotional intelligence plays a vital role in stock trading success. Emotions like fear and greed can cloud judgment, leading to impulsive decisions and poor investment outcomes. Recognizing these emotional triggers is crucial to avoid irrational choices driven by short-term fluctuations.

Successful traders manage their emotions during market volatility by sticking to predetermined strategies and avoiding knee-jerk reactions. Techniques like setting stop-loss orders or limiting exposure to volatile stocks help control emotional responses during turbulent times.

By developing emotional intelligence, traders gain an edge in the market. Understanding how emotions influence decision-making allows for more rational choices aligned with long-term goals. Combining technical analysis with emotional intelligence enables traders to navigate the unpredictable nature of the stock market successfully.

Learning from Successful 10 Stock Traders

To succeed in stock trading, learning from successful individuals is crucial. John Smith, a prominent figure in 10 stock trading, has consistently outperformed the market for over two decades. His success stems from thorough research and analysis when selecting his ten stocks.

John’s disciplined approach to risk management and emotional intelligence also contribute to his achievements. By emulating his strategies, aspiring traders can increase their chances of success in this dynamic field.

Common Mistakes to Avoid as a Beginner

As a beginner in stock trading, it’s important to be aware of common mistakes that can hinder your progress. Chasing hot stocks based on rumors or tips often leads to poor investment decisions. Lack of discipline, such as failing to stick to predetermined strategies or letting emotions drive your actions, can also sabotage long-term success.

To avoid these pitfalls, establish clear investment goals and stick to them. Develop a well-defined trading plan with strict entry and exit criteria for maintaining discipline. Continuously educate yourself about market dynamics and learn from experienced traders’ insights to avoid costly mistakes.

Practical Tips for Aspiring 10 Stock Traders

To succeed in the stock market, aspiring traders must follow practical tips that can help them navigate the complexities of investing. Here are key strategies to consider:

-

Set realistic expectations: Understand that investing involves risks and focus on long-term growth rather than short-term gains.

-

Establish an effective risk management plan: Diversify your portfolio, set stop-loss orders to limit losses, and apply position sizing techniques to protect capital while maximizing profit potential.

-

Understand tax implications: Different investments have varying tax treatments, so consult with a tax professional to optimize compliance and tax efficiency.

-

Stay updated with market trends: Follow reputable financial publications and attend educational seminars or webinars to gain insights into market dynamics and investment strategies.

-

Continuously learn about investment strategies: Explore different asset classes, analyze company fundamentals, study financial statements, and understand technical analysis tools to make informed decisions.

-

Develop emotional intelligence: Maintain discipline and emotional control by avoiding impulsive decisions driven by fear or greed, allowing you to stay focused on your trading strategy.

By following these practical tips, aspiring traders can increase their chances of success in the stock market.

[lyte id=’gXzJm85mtns’]